Your What is ancillary insurance policy are available. What is ancillary insurance are a commercial that is most popular and liked by everyone now. You can News the What is ancillary insurance files here. Get all royalty-free car.

If you’re searching for what is ancillary insurance pictures information linked to the what is ancillary insurance keyword, you have visit the ideal blog. Our site frequently gives you suggestions for refferencing the highest quality video and image content, please kindly search and locate more enlightening video content and graphics that fit your interests.

What Is Ancillary Insurance. (a) the principal professional activity of that natural or. You might be wondering what it has to do with insurance, how it is relevant, or why it matters to you. Ancillary services are medical services provided in a hospital while a patient is an inpatient, but paid by medicare part b (outpatient care) when the part a (hospitalization) claim is denied because medicare believes that it was unreasonable or unnecessary for the person to be admitted as an inpatient. These employee benefits are becoming more and more crucial as they offer coverages that go well beyond that of typical healthcare plans, and often cover more extensive medical expenses.

Why All Insurance Agents Should Sell Ancillary Products From agent-link.net

Why All Insurance Agents Should Sell Ancillary Products From agent-link.net

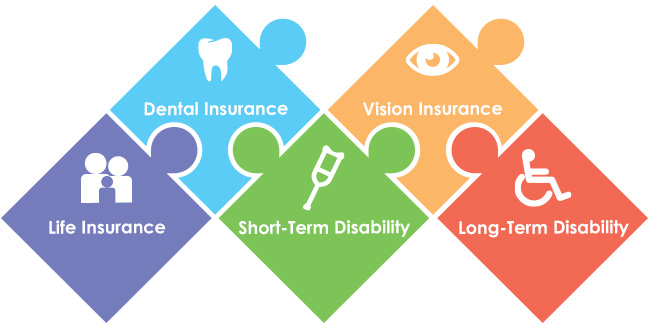

Ancillary insurance is health insurance that supplements standard health insurance. Learn more about ancillary insurance. How much should you be spending on ancillary insurance policies? Ancillary benefits are additions to a health insurance provided by an employer to his or her employees. In a healthcare context, ancillary insurance refers to any insurance specifically for medical care. Our ancillary insurance definition is any insurance product that is beyond the scope of traditional health insurance or is not included in your healthcare plan.

Everything from your weight to your gender matters when determining your health insurance costs, and ancillary products like vision coverage and life insurance vary drastically.

The term “ancillary” means “providing additional help or support,” and that’s just what ancillary health insurance does. It depends on a lot of factors. You might be wondering what it has to do with insurance, how it is relevant, or why it matters to you. The short answer is, it depends. Ancillary insurance products are an auxiliary type of health insurance. A great way to attract and retain talent is.

Source: pinterest.com

Source: pinterest.com

Ancillary health insurance ancillary benefits are a secondary type of health insurance coverage. (a) the principal professional activity of that natural or. For example, dental insurance can help cover routine checkups, cleanings, fillings, root canals, or other procedures if they are not covered under the primary plan. This coverage also refers to benefits that are used to supplement group health insurance. Our ancillary insurance definition is any insurance product that is beyond the scope of traditional health insurance or is not included in your healthcare plan.

Source: justuandmehere.blogspot.com

Source: justuandmehere.blogspot.com

More and more companies are creating customer solutions that combine some of the best ancillary insurance products such as accident, cancer, hospital, and critical illness plans. Insurance policies are a natural fit as an ancillary product for various purchases since they can be bundled with a variety of different goods or services. For example, dental insurance can help cover routine checkups, cleanings, fillings, root canals, or other procedures if they are not covered under the primary plan. If the word ancillary is foreign to you, then you’re not alone. What is ancillary products insurance?

Source: azmedicarebroker.com

Source: azmedicarebroker.com

How much should you be spending on ancillary insurance policies? A great way to attract and retain talent is. Everything from your weight to your gender matters when determining your health insurance costs, and ancillary products like vision coverage and life insurance vary drastically. Why is ancillary insurance important? Employees still need oral and vision care.

Source: newrochellechamber.org

Source: newrochellechamber.org

Ancillary insurance is supplemental health coverage that may provide you with additional benefits and protection not offered by your primary plan. Ancillary insurance is health insurance that supplements standard health insurance. Even the best health insurance companies don’t cover all of the costs associated with healthcare needs, which makes additional insurance a valuable addition to almost any type of coverage. For example, dental insurance can help cover routine checkups, cleanings, fillings, root canals, or other procedures if they are not covered under the primary plan. Employees still need oral and vision care.

Source: agent-link.net

Source: agent-link.net

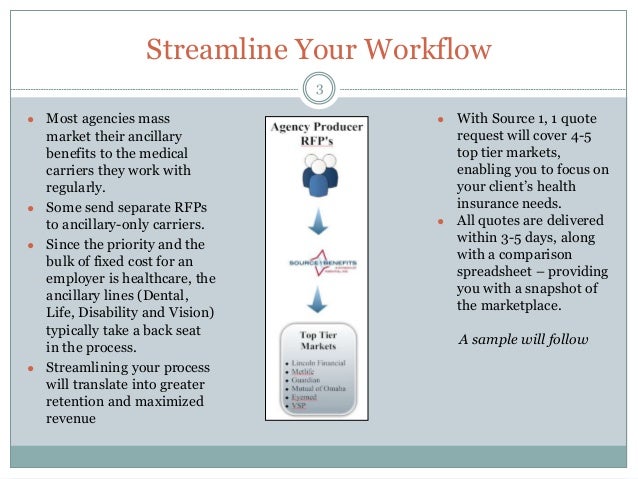

From an employer perspective, it doesn’t cost anything to offer this insurance and can help build stronger internal teams. Supplemental insurance is a type of secondary health insurance coverage that fills in some of the gaps in health care needs left by health insurance plans. You might be wondering what it has to do with insurance, how it is relevant, or why it matters to you. When regular health insurance does not include most living, medicals, and hazard costs, auxiliary products insurance, on the other hand, can help lessen the financial impediment of the insured. How much should you be spending on ancillary insurance policies?

Source: youtube.com

Source: youtube.com

With so many different terms, acronyms and plans it can sound like a different language. Learn more about ancillary insurance. Some examples of ancillary products in this category include warranties, free replacement on items if they break, or even guarantees of functionality or performance that would compensate the owner upon loss. A great way to attract and retain talent is. (a) the principal professional activity of that natural or.

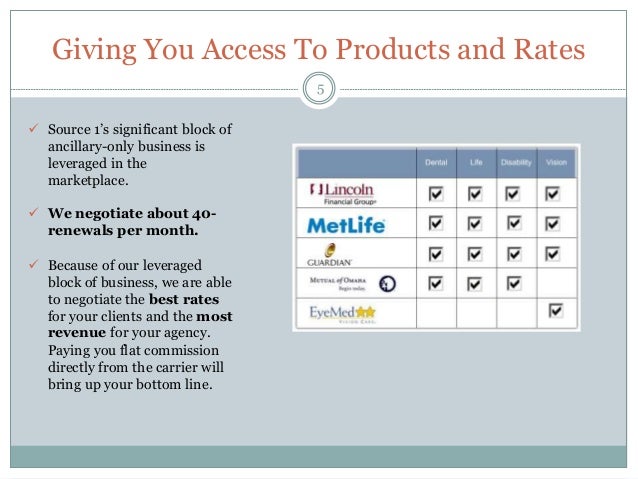

Source: slideshare.net

Source: slideshare.net

(a) the principal professional activity of that natural or. Insurance policies are a natural fit as an ancillary product for various purchases since they can be bundled with a variety of different goods or services. You may have seen this term while looking for group insurance. The term “ancillary” means “providing additional help or support,” and that’s just what ancillary health insurance does. These employee benefits are becoming more and more crucial as they offer coverages that go well beyond that of typical healthcare plans, and often cover more extensive medical expenses.

Source: nisbenefits.com

Source: nisbenefits.com

This coverage also refers to benefits that are used to supplement group health insurance. You may have seen this term while looking for group insurance. Everything from your weight to your gender matters when determining your health insurance costs, and ancillary products like vision coverage and life insurance vary drastically. Vision care, dental care, and life insurance. (a) its principal activity consists of:

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

The term “ancillary” means “providing additional help or support,” and that’s just what ancillary health insurance does. How much should you be spending on ancillary insurance policies? Also called voluntary benefits, this form of insurance is offered through ancillary insurance providers and is paid for 100% by the employee. The term “ancillary” means “providing additional help or support,” and that’s just what ancillary health insurance does. Some examples of ancillary products in this category include warranties, free replacement on items if they break, or even guarantees of functionality or performance that would compensate the owner upon loss.

Source: inproagent.com

(a) its principal activity consists of: In a healthcare context, ancillary insurance refers to any insurance specifically for medical care. With so many different terms, acronyms and plans it can sound like a different language. Ancillary insurance is a secondary form of healthcare, which supplements the everyday benefits packages that are typically offered. More and more companies are creating customer solutions that combine some of the best ancillary insurance products such as accident, cancer, hospital, and critical illness plans.

Source: redbirdagents.com

Source: redbirdagents.com

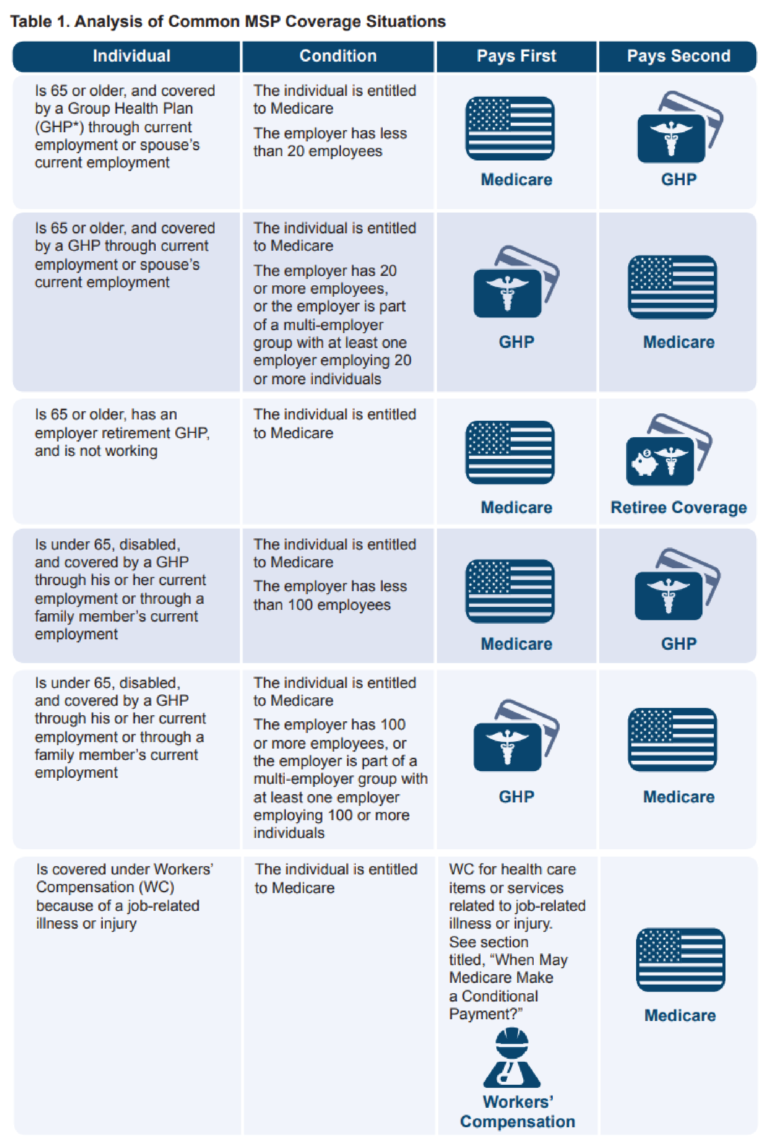

In a healthcare context, ancillary insurance refers to any insurance specifically for medical care. The employer can subsidize this. Ancillary services are medical services provided in a hospital while a patient is an inpatient, but paid by medicare part b (outpatient care) when the part a (hospitalization) claim is denied because medicare believes that it was unreasonable or unnecessary for the person to be admitted as an inpatient. From an employer perspective, it doesn’t cost anything to offer this insurance and can help build stronger internal teams. Supplemental insurance is a type of secondary health insurance coverage that fills in some of the gaps in health care needs left by health insurance plans.

Source: yialv.com

Source: yialv.com

Ancillary health insurance is a secondary type of coverage used to supplement your traditional health insurance. Insurance is a vast field. Often referred to as “ancillary benefits,” ancillary insurance can include coverage for miscellaneous medical. The term “ancillary” means “providing additional help or support,” and that’s just what ancillary health insurance does. Ancillary health insurance ancillary benefits are a secondary type of health insurance coverage.

Source: ametros.com

Source: ametros.com

Ancillary insurance is health insurance that supplements standard health insurance. Vision care, dental care, and life insurance. It depends on a lot of factors. These additions to the health plan are often the following: How much should you be spending on ancillary insurance policies?

Source: slideshare.net

Source: slideshare.net

Ancillary benefits are additions to a health insurance provided by an employer to his or her employees. Ancillary services are medical services provided in a hospital while a patient is an inpatient, but paid by medicare part b (outpatient care) when the part a (hospitalization) claim is denied because medicare believes that it was unreasonable or unnecessary for the person to be admitted as an inpatient. Ancillary insurance is a secondary form of healthcare, which supplements the everyday benefits packages that are typically offered. Our ancillary insurance definition is any insurance product that is beyond the scope of traditional health insurance or is not included in your healthcare plan. This coverage also refers to benefits that are used to supplement group health insurance.

Source: pinterest.com

Source: pinterest.com

In a healthcare context, ancillary insurance refers to any insurance specifically for medical care. For example, dental insurance can help cover routine checkups, cleanings, fillings, root canals, or other procedures if they are not covered under the primary plan. The short answer is, it depends. Ancillary private health insurance can help you cover the healthcare needs that your medicare insurance does. Often referred to as “ancillary benefits,” ancillary insurance can include coverage for miscellaneous medical.

Source: zipari.com

Source: zipari.com

Ancillary insurance products are an auxiliary type of health insurance. Ancillary health insurance is a secondary type of coverage used to supplement your traditional health insurance. (a) its principal activity consists of: What is ancillary products insurance? If the word ancillary is foreign to you, then you’re not alone.

Source: youtube.com

Source: youtube.com

Even the best health insurance companies don’t cover all of the costs associated with healthcare needs, which makes additional insurance a valuable addition to almost any type of coverage. Ancillary health insurance is a secondary type of coverage used to supplement your traditional health insurance. These additions to the health plan are often the following: Ancillary insurance products are an auxiliary type of health insurance. Ancillary insurance sales continue to grow as both great products for cross selling as well as a primary selling strategy.

Source: medicareplanfinder.com

Source: medicareplanfinder.com

Insurance policies are a natural fit as an ancillary product for various purchases since they can be bundled with a variety of different goods or services. Any natural or legal person, other than a credit institution or an investment firm who, for remuneration, takes up or pursues the activity of insurance distribution on an ancillary basis, provided that all the following conditions are met: Vision care, dental care, and life insurance. What is ancillary products insurance? Ancillary benefits might be more useful to you than you realize.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what is ancillary insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.