Your Minimum capital of health insurance umbrella are ready. Minimum capital of health insurance are a group that is most popular and liked by everyone this time. You can News the Minimum capital of health insurance files here. Find and Download all free group.

If you’re searching for minimum capital of health insurance images information linked to the minimum capital of health insurance keyword, you have come to the ideal blog. Our site always gives you hints for refferencing the highest quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

Minimum Capital Of Health Insurance. Capital standards determine the minimum regulatory capital requirement for an insurer, taking into account the nature of the risks an insurer is exposed to in its business. The proposals increase minimum capital requirements, however the industry already holds capital significantly in excess of the new proposed regulatory minimums. Capital, minimum capital requirement, and 99.5% probability of sufficiency. This figure represents the threshold below which a national regulatory agency would intervene.

Planning for the Future Muskoka Algonquin Healthcare From mahc.ca

Planning for the Future Muskoka Algonquin Healthcare From mahc.ca

Capital, minimum capital requirement, and 99.5% probability of sufficiency. Regulators generally focus on the solvency of health insurers to ensure they. To conduct business in a state, insurers must meet the state’s minimum capital and surplus standards. The minimum capital of reinsurers is set at 500 million egp (27.9 million usd). This figure represents the threshold below which a national regulatory agency would intervene. Today, lucy insurance has skyrocketed with a paid up capital 75,000,000 etb as per the directive of the national bank of ethiopia that requires insurance companies to raise their minimum paid up capital to 60,000,000 etb and 75,000,000 etb for general insurance and general life insurance respectively.

Payment of health insurance premium and expenditure on medical treatment.

That is, the company must hold capital in proportion to its risk. The minimum capital of reinsurers is set at 500 million egp (27.9 million usd). 1) an insurance company’s size; If the mcr is breached it is even worse. The proposal to introduce an icaap for the phi industry: Minimum holding period following is the minimum holding period in respect of certain investments, deposits, etc.,

Source: hhs.gov

Source: hhs.gov

Aligning the commencement of the phi framework with That is, the company must hold capital in proportion to its risk. The proposal to introduce an icaap for the phi industry: The rbc requirement is a statutory minimum level of capital that is based on two factors: Capital standards required companies to hold minimum amount of capital which equals to a fixed percentage (4.5 percent for u.s.

Source: nj.com

Source: nj.com

It is defined, statutorily, in laws and regulations, and this rbc amount is published and compared with a company’s total adjusted capital. In section 80ddb, the limit will be 15% of capital sum assured. The implementation of a takaful insurance regulation and the introduction of compulsory motor insurance through the creation of a specialized insurance pool for this purpose, are included in the provisions of this draft. All foreign mutual life/health, property/casualty, reciprocal and lloyd�s insurers must have a minimum basic surplus of $1,000,000 plus an initial free surplus of $2,000,000. Retain requirements under existing phi capital standards for the pricing philosophy and introduce icaap requirements.

Source: oberlandergroup.com

Source: oberlandergroup.com

This is subject to revision. Capital standards required companies to hold minimum amount of capital which equals to a fixed percentage (4.5 percent for u.s. Under the solvency ii regime it is the minimum capital requirement for an insurance company to write business. Apra’s assessment is that no insurer would need to increase premiums or raise equity to meet the higher minimum capital requirements. This figure represents the threshold below which a national regulatory agency would intervene.

Source: capitalhealth.com

Source: capitalhealth.com

This is subject to revision. Capital standards determine the minimum regulatory capital requirement for an insurer, taking into account the nature of the risks an insurer is exposed to in its business. Payment of health insurance premium and expenditure on medical treatment. And 2) the inherent riskiness of its financial assets and operations. Capital standards required companies to hold minimum amount of capital which equals to a fixed percentage (4.5 percent for u.s.

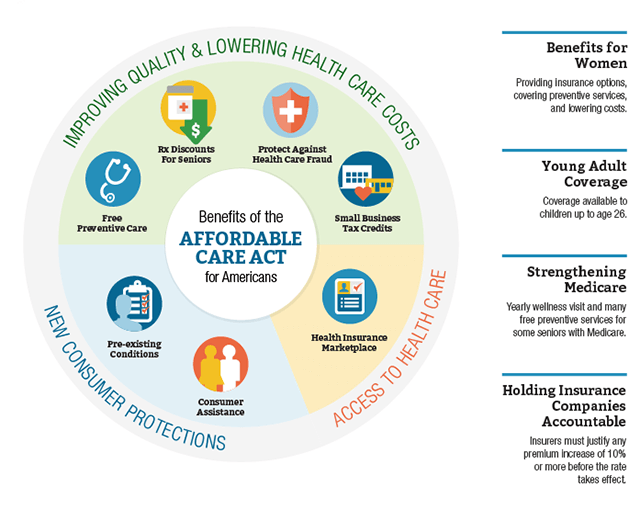

Source: obamacarefacts.com

Source: obamacarefacts.com

The implementation of a takaful insurance regulation and the introduction of compulsory motor insurance through the creation of a specialized insurance pool for this purpose, are included in the provisions of this draft. Payment of health insurance premium and expenditure on medical treatment. Capital, minimum capital requirement, and 99.5% probability of sufficiency. It is defined, statutorily, in laws and regulations, and this rbc amount is published and compared with a company’s total adjusted capital. That is, the company must hold capital in proportion to its risk.

Source: youtube.com

Source: youtube.com

Banks before the debt crisis) of their assets, regardless of risks these companies took in business. 01 activ health, pr oduct uin: Aligning the commencement of the phi framework with Capital, minimum capital requirement, and 99.5% probability of sufficiency. Capital requirements for health insurers 1 february 2020 capital requirements for health insurers david hayes, fsa, maaa rachel killian, fsa, maaa shyam kolli, fsa, maaa capital and surplus requirements for a health insurer can change over time based on many internal and external factors.

Source: bcbsmt.com

Source: bcbsmt.com

All foreign stock life/health and property/casualty must have a minimum capital stock of $1,000,000 plus an initial free surplus of $2,000,000. If the mcr is breached it is even worse. The implementation of a takaful insurance regulation and the introduction of compulsory motor insurance through the creation of a specialized insurance pool for this purpose, are included in the provisions of this draft. That is, the company must hold capital in proportion to its risk. Minimum holding period following is the minimum holding period in respect of certain investments, deposits, etc.,

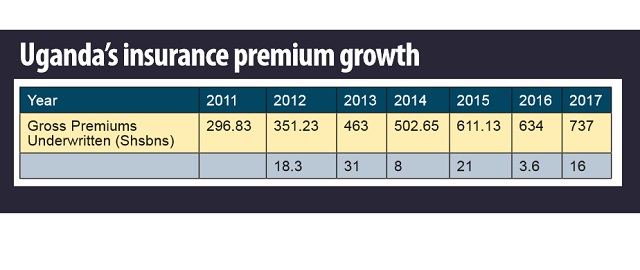

Source: independent.co.ug

Source: independent.co.ug

Because there may be a variety of people here in terms of rbc knowledge, let us briefly define rbc as the minimum capital and surplus that a life insurance company has to maintain. Regulators generally focus on the solvency of health insurers to ensure they. 7.1 private mutual health insurance schemes 7.1.1 minimum capital requirement a pmhis is required to have a minimum capital requirement of one million ghana cedis (gh¢1,000,000.00). The rbc requirement is a statutory minimum level of capital that is based on two factors: Find out how it is calculated below.

Source: healthcaremba.gwu.edu

Source: healthcaremba.gwu.edu

01 activ health, pr oduct uin: Apra’s assessment is that no insurer would need to increase premiums or raise equity to meet the higher minimum capital requirements. That is, the company must hold capital in proportion to its risk. The proposal to introduce an icaap for the phi industry: Because there may be a variety of people here in terms of rbc knowledge, let us briefly define rbc as the minimum capital and surplus that a life insurance company has to maintain.

Source: youtube.com

Source: youtube.com

Capital, minimum capital requirement, and 99.5% probability of sufficiency. Payment of health insurance premium and expenditure on medical treatment. The rbc requirement is a statutory minimum level of capital that is based on two factors: Capital, minimum capital requirement, and 99.5% probability of sufficiency. In addition to the scr capital requirement, a minimum capital requirement (mcr) must also be calculated.

Source: olaniwunajayi.net

Source: olaniwunajayi.net

Minimum holding period following is the minimum holding period in respect of certain investments, deposits, etc., The proposal to introduce an icaap for the phi industry: This is subject to revision. Notwithstanding the capital requirement described in the guideline, canadian life insurance companies will be required to maintain a minimum amount of available capital, as calculated in this guideline, of $5 million or such amount as specified by the minister. 01 activ health, pr oduct uin:

Source: providencecapitalfunding.com

Source: providencecapitalfunding.com

This figure represents the threshold below which a national regulatory agency would intervene. Since assuming prudential regulatory responsibility for the private health insurance (phi) industry in 2015, apra has progressively reviewed and updated the prudential pol icy The proposal to introduce an icaap for the phi industry: 1) an insurance company’s size; Today, lucy insurance has skyrocketed with a paid up capital 75,000,000 etb as per the directive of the national bank of ethiopia that requires insurance companies to raise their minimum paid up capital to 60,000,000 etb and 75,000,000 etb for general insurance and general life insurance respectively.

Source: in.pinterest.com

Source: in.pinterest.com

Aligning the commencement of the phi framework with Apra’s assessment is that no insurer would need to increase premiums or raise equity to meet the higher minimum capital requirements. The rbc requirement is a statutory minimum level of capital that is based on two factors: Capital standards required companies to hold minimum amount of capital which equals to a fixed percentage (4.5 percent for u.s. Capital requirements for health insurers 1 february 2020 capital requirements for health insurers david hayes, fsa, maaa rachel killian, fsa, maaa shyam kolli, fsa, maaa capital and surplus requirements for a health insurer can change over time based on many internal and external factors.

Source: odcm.com

Source: odcm.com

This is subject to revision. That is, the company must hold capital in proportion to its risk. Notwithstanding the capital requirement described in the guideline, canadian life insurance companies will be required to maintain a minimum amount of available capital, as calculated in this guideline, of $5 million or such amount as specified by the minister. All foreign mutual life/health, property/casualty, reciprocal and lloyd�s insurers must have a minimum basic surplus of $1,000,000 plus an initial free surplus of $2,000,000. In section 80ddb, the limit will be 15% of capital sum assured.

Source: usmedcapital.com

Source: usmedcapital.com

The proposals increase minimum capital requirements, however the industry already holds capital significantly in excess of the new proposed regulatory minimums. Under the solvency ii regime it is the minimum capital requirement for an insurance company to write business. The capital requirement refers to paid up initial subscription. Capital standards determine the minimum regulatory capital requirement for an insurer, taking into account the nature of the risks an insurer is exposed to in its business. In addition to the scr capital requirement, a minimum capital requirement (mcr) must also be calculated.

Source: mapquest.com

Source: mapquest.com

The implementation of a takaful insurance regulation and the introduction of compulsory motor insurance through the creation of a specialized insurance pool for this purpose, are included in the provisions of this draft. The rbc requirement is a statutory minimum level of capital that is based on two factors: To conduct business in a state, insurers must meet the state’s minimum capital and surplus standards. In section 80ddb, the limit will be 15% of capital sum assured. If the mcr is breached it is even worse.

Source: mahc.ca

Source: mahc.ca

Capital requirements for health insurers 1 february 2020 capital requirements for health insurers david hayes, fsa, maaa rachel killian, fsa, maaa shyam kolli, fsa, maaa capital and surplus requirements for a health insurer can change over time based on many internal and external factors. It is defined, statutorily, in laws and regulations, and this rbc amount is published and compared with a company’s total adjusted capital. Because there may be a variety of people here in terms of rbc knowledge, let us briefly define rbc as the minimum capital and surplus that a life insurance company has to maintain. That is, the company must hold capital in proportion to its risk. Under the solvency ii regime it is the minimum capital requirement for an insurance company to write business.

Source: bizjournals.com

Source: bizjournals.com

Capital standards required companies to hold minimum amount of capital which equals to a fixed percentage (4.5 percent for u.s. The proposals increase minimum capital requirements, however the industry already holds capital significantly in excess of the new proposed regulatory minimums. Find out how it is calculated below. This is subject to revision. In section 80ddb, the limit will be 15% of capital sum assured.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title minimum capital of health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.