Your Health insurance mergers 2017 personal are obtainable. Health insurance mergers 2017 are a car that is most popular and liked by everyone now. You can News the Health insurance mergers 2017 files here. News all free group.

If you’re looking for health insurance mergers 2017 pictures information related to the health insurance mergers 2017 keyword, you have come to the right blog. Our website always gives you suggestions for seeing the highest quality video and image content, please kindly hunt and locate more informative video articles and images that fit your interests.

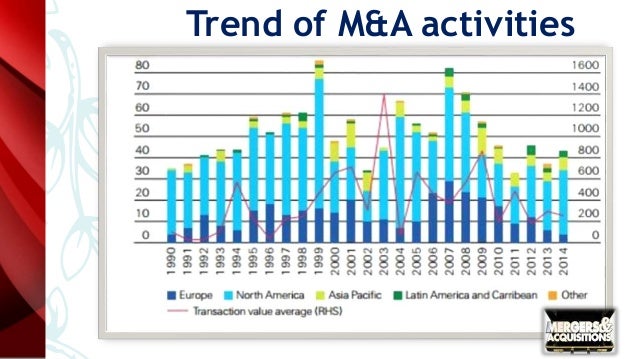

Health Insurance Mergers 2017. Healthcare mergers and acquisitions have been on tear in the past few years, as the savings tied economies of scale become even more important as margins tighten. April 13, 2017 by jesse migneault. On july 3, 2015, health insurance giant and third largest health insurance company by revenue, aetna, announced that it entered into an agreement to acquire the fifth largest health insurance M&a activity continued to thrive among insurers and providers in 2019.

Healthcare megamergers dominate 2017 Health care From pinterest.com

Healthcare megamergers dominate 2017 Health care From pinterest.com

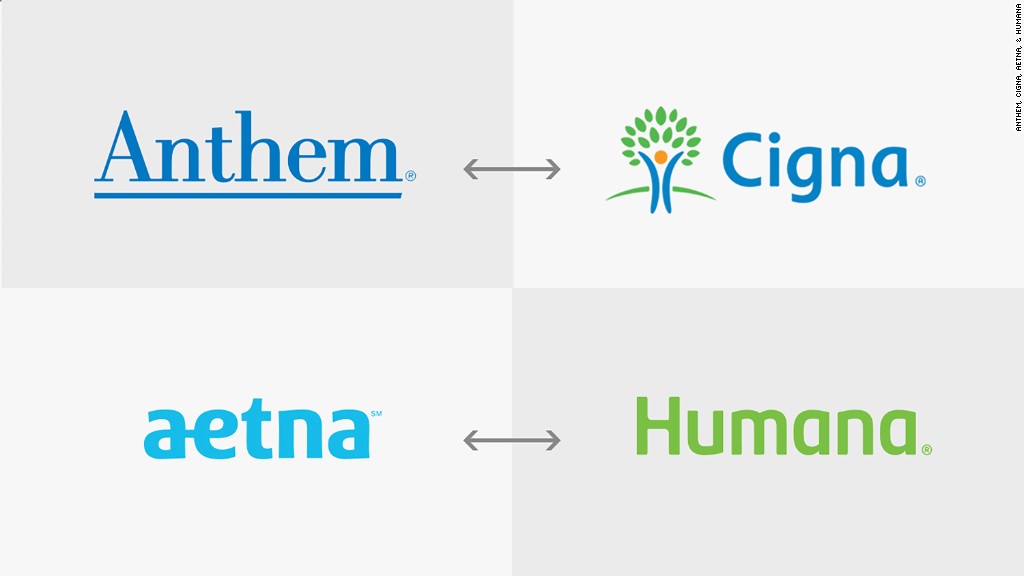

While hospitals are merging and systems continue to snatch up ambulatory centers, physician practices and in some cases clinics, technology and service vendors to. Healthcare systems have set revolutionary merger records in previous years. Department of justice, antitrust division ryan kantor slides: Healthcare mergers and acquisitions have been on tear in the past few years, as the savings tied economies of scale become even more important as margins tighten. In 2017, two mega mergers in health insurance were blocked by the american authorities. Nera�s health economists have been retained to evaluate the likely competitive effects of a variety of proposed mergers and acquisitions in the health care field such as hospitals and health insurers.

Nera�s health economists have been retained to evaluate the likely competitive effects of a variety of proposed mergers and acquisitions in the health care field such as hospitals and health insurers.

In 2017, two mega mergers in health insurance were blocked by the american authorities. As was the case in 2018, the healthcare industry saw several megamergers occur in 2019. Cvs and aetna with the $69 billion merger still in the process, we. Healthcare systems have set revolutionary merger records in previous years. On july 3, 2015, health insurance giant and third largest health insurance company by revenue, aetna, announced that it entered into an agreement to acquire the fifth largest health insurance Moves to block health insurance mergers.

Source: pinterest.com

Source: pinterest.com

As was the case in 2018, the healthcare industry saw several megamergers occur in 2019. April 13, 2017 by jesse migneault. A federal judge in washington dc recently blocked a potential $48 billion health insurance merger between cigna and anthem, according to a department of. Specific transactions are detailed, and trends are analyzed across all sectors. A merger of this size would seem to portend an anticompetitive increase in market power, and many stakeholders came out against the deal.

Source: finance.yahoo.com

February 09, 2017 by jacqueline lapointe. Both consummated and proposed consolidation of health insurers should raise serious antitrust concerns. A merger of this size would seem to portend an anticompetitive increase in market power, and many stakeholders came out against the deal. On july 3, 2015, health insurance giant and third largest health insurance company by revenue, aetna, announced that it entered into an agreement to acquire the fifth largest health insurance Anthem is the blue cross and blue shield association licensee in fourteen states and, after united healthcare, the nation’s second largest insurer by enrollments.

Source: wolfstreet.com

Source: wolfstreet.com

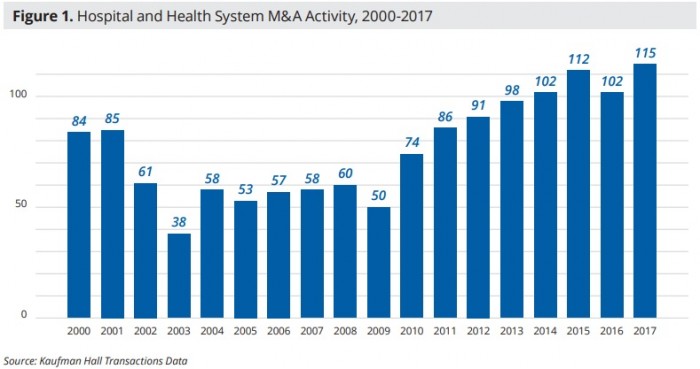

The conning study, “global insurer mergers & acquisitions in 2017: In 2017, these institutions were at the forefront of m&a activity with more than 115 deals. M&a activity continued to thrive among insurers and providers in 2019. As was the case in 2018, the healthcare industry saw several megamergers occur in 2019. Specific transactions are detailed, and trends are analyzed across all sectors.

Source: oxfordeagle.com

Source: oxfordeagle.com

The conning study, “global insurer mergers & acquisitions in 2017: The justice department went to court thursday seeking to block two mergers involving four. A federal judge in washington dc recently blocked a potential $48 billion health insurance merger between cigna and anthem, according to a department of. As was the case in 2018, the healthcare industry saw several megamergers occur in 2019. Specific transactions are detailed, and trends are analyzed across all sectors.

Source: slideshare.net

Source: slideshare.net

In 2017, these institutions were at the forefront of m&a activity with more than 115 deals. A federal judge has blocked the merger of two major health insurance companies, anthem and cigna, after the justice department concluded that the deal would reduce competition. A merger of this size would seem to portend an anticompetitive increase in market power, and many stakeholders came out against the deal. A federal judge in washington dc recently blocked a potential $48 billion health insurance merger between cigna and anthem, according to a department of. In 2017, two mega mergers in health insurance were blocked by the american authorities.

Source: downwithtyranny.blogspot.com

Source: downwithtyranny.blogspot.com

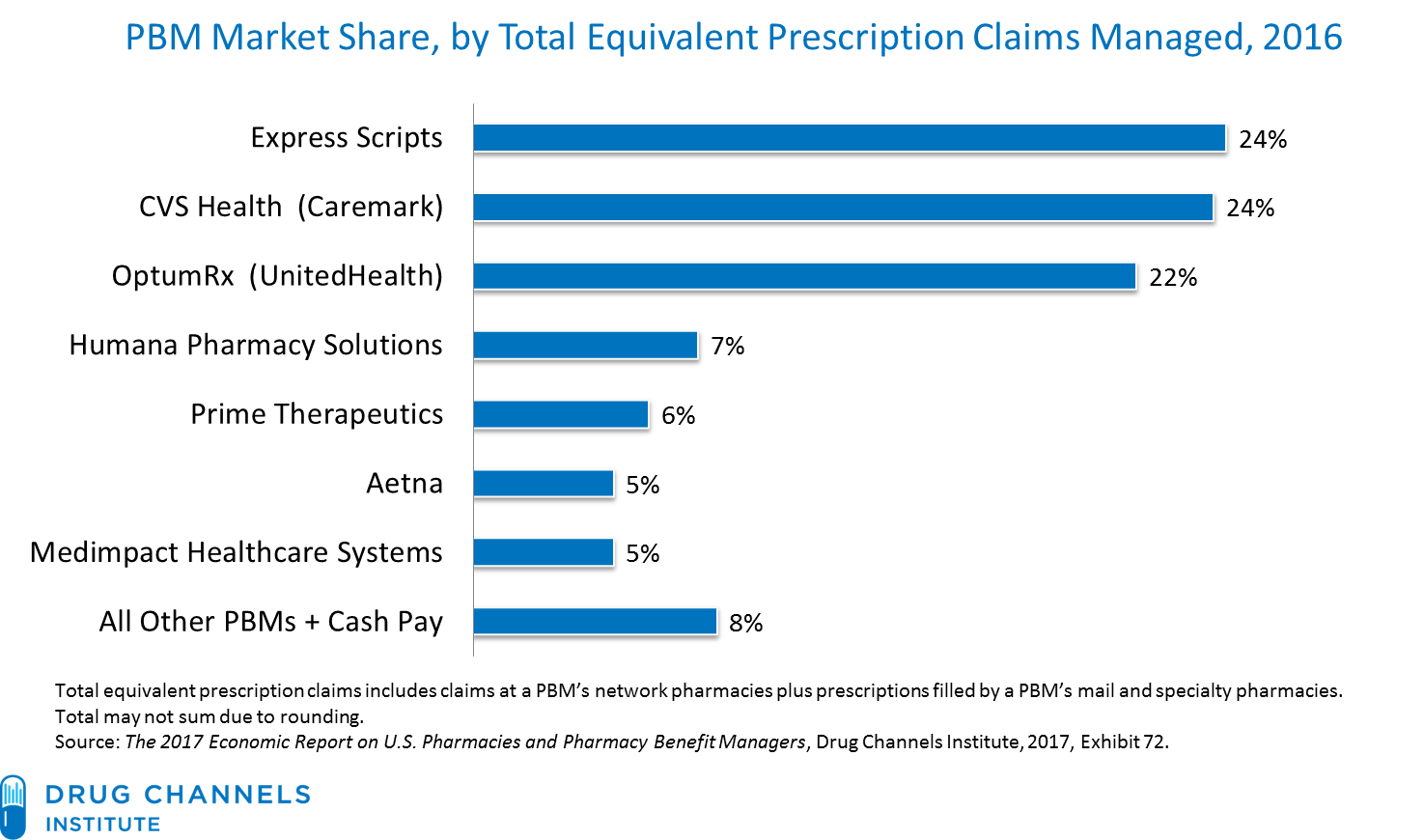

The american department of justice (doj) has disapproved of the takeover of humana by aetna for 33 billion usd and cigna by anthem for the sums of 50 billion usd. Over the past several years, nera has analyzed over 75 hospital mergers and provided strategic advice on choosing merger partners in many more. Both consummated and proposed consolidation of health insurers should raise serious antitrust concerns. The merger also causes other health insurance companies to step up their game. On july 3, 2015, health insurance giant and third largest health insurance company by revenue, aetna, announced that it entered into an agreement to acquire the fifth largest health insurance

Source: jnjbeck.blogspot.com

Source: jnjbeck.blogspot.com

Repositioning to face the future” tracks and analyzes both u.s. Moves to block health insurance mergers. In january and february of 2017, the u.s. A merger of this size would seem to portend an anticompetitive increase in market power, and many stakeholders came out against the deal. Cigna is the fourth largest insurer.

Source: competitionpolicyinternational.com

Source: competitionpolicyinternational.com

M&a activity continued to thrive among insurers and providers in 2019. The conning study, “global insurer mergers & acquisitions in 2017: Cigna is the fourth largest insurer. While hospitals are merging and systems continue to snatch up ambulatory centers, physician practices and in some cases clinics, technology and service vendors to. A federal judge in washington dc recently blocked a potential $48 billion health insurance merger between cigna and anthem, according to a department of.

Source: money.cnn.com

Source: money.cnn.com

M&a activity continued to thrive among insurers and providers in 2019. A merger of this size would seem to portend an anticompetitive increase in market power, and many stakeholders came out against the deal. Anthem is the blue cross and blue shield association licensee in fourteen states and, after united healthcare, the nation’s second largest insurer by enrollments. And (2) aetna with humana. High concentration levels in health insurance markets are largely the result of consolidation (i.e., mergers and acquisitions), which can lead to the exercise of market power and, in turn, harm to consumers and providers of care.

Source: slideshare.net

Source: slideshare.net

In 2017, two mega mergers in health insurance were blocked by the american authorities. April 13, 2017 by jesse migneault. A federal judge has blocked the merger of two major health insurance companies, anthem and cigna, after the justice department concluded that the deal would reduce competition. In 2017, these institutions were at the forefront of m&a activity with more than 115 deals. Repositioning to face the future” tracks and analyzes both u.s.

Source: economist.com

Source: economist.com

Cvs and aetna with the $69 billion merger still in the process, we. As was the case in 2018, the healthcare industry saw several megamergers occur in 2019. M&a activity continued to thrive among insurers and providers in 2019. While hospitals are merging and systems continue to snatch up ambulatory centers, physician practices and in some cases clinics, technology and service vendors to. Healthcare mergers and acquisitions have been on tear in the past few years, as the savings tied economies of scale become even more important as margins tighten.

Source: health-access.org

Source: health-access.org

On july 3, 2015, health insurance giant and third largest health insurance company by revenue, aetna, announced that it entered into an agreement to acquire the fifth largest health insurance A merger of this size would seem to portend an anticompetitive increase in market power, and many stakeholders came out against the deal. Lien* introduction 2015 marked the beginning of a long battle for two major health insurance companies. In 2017, these institutions were at the forefront of m&a activity with more than 115 deals. High concentration levels in health insurance markets are largely the result of consolidation (i.e., mergers and acquisitions), which can lead to the exercise of market power and, in turn, harm to consumers and providers of care.

Source: vdocuments.site

Source: vdocuments.site

February 09, 2017 by jacqueline lapointe. Repositioning to face the future” tracks and analyzes both u.s. April 13, 2017 by jesse migneault. The justice department went to court thursday seeking to block two mergers involving four. Department of justice, antitrust division ryan kantor slides:

Source: massdevice.com

Source: massdevice.com

While hospitals are merging and systems continue to snatch up ambulatory centers, physician practices and in some cases clinics, technology and service vendors to. M&a activity continued to thrive among insurers and providers in 2019. Cvs and aetna with the $69 billion merger still in the process, we. And (2) aetna with humana. In january and february of 2017, the u.s.

Source: drugchannels.net

Source: drugchannels.net

Moves to block health insurance mergers. On july 3, 2015, health insurance giant and third largest health insurance company by revenue, aetna, announced that it entered into an agreement to acquire the fifth largest health insurance Lien* introduction 2015 marked the beginning of a long battle for two major health insurance companies. The merger also causes other health insurance companies to step up their game. A merger of this size would seem to portend an anticompetitive increase in market power, and many stakeholders came out against the deal.

Source: finance.yahoo.com

In 2017, two mega mergers in health insurance were blocked by the american authorities. Cigna is the fourth largest insurer. February 09, 2017 by jacqueline lapointe. And (2) aetna with humana. The merger also causes other health insurance companies to step up their game.

Source: pinterest.com

Source: pinterest.com

April 13, 2017 by jesse migneault. Cvs and aetna with the $69 billion merger still in the process, we. Repositioning to face the future” tracks and analyzes both u.s. Both consummated and proposed consolidation of health insurers should raise serious antitrust concerns. High concentration levels in health insurance markets are largely the result of consolidation (i.e., mergers and acquisitions), which can lead to the exercise of market power and, in turn, harm to consumers and providers of care.

Source: revcycleintelligence.com

Source: revcycleintelligence.com

A merger of this size would seem to portend an anticompetitive increase in market power, and many stakeholders came out against the deal. Healthcare mergers and acquisitions have been on tear in the past few years, as the savings tied economies of scale become even more important as margins tighten. In 2017, these institutions were at the forefront of m&a activity with more than 115 deals. Cvs and aetna with the $69 billion merger still in the process, we. The affordable care act has been a divisive.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title health insurance mergers 2017 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.