Your Flood damage renters insurance car are available in this site. Flood damage renters insurance are a marine that is most popular and liked by everyone now. You can Find and Download the Flood damage renters insurance files here. Get all royalty-free investment.

If you’re searching for flood damage renters insurance pictures information related to the flood damage renters insurance keyword, you have come to the right blog. Our website frequently provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that match your interests.

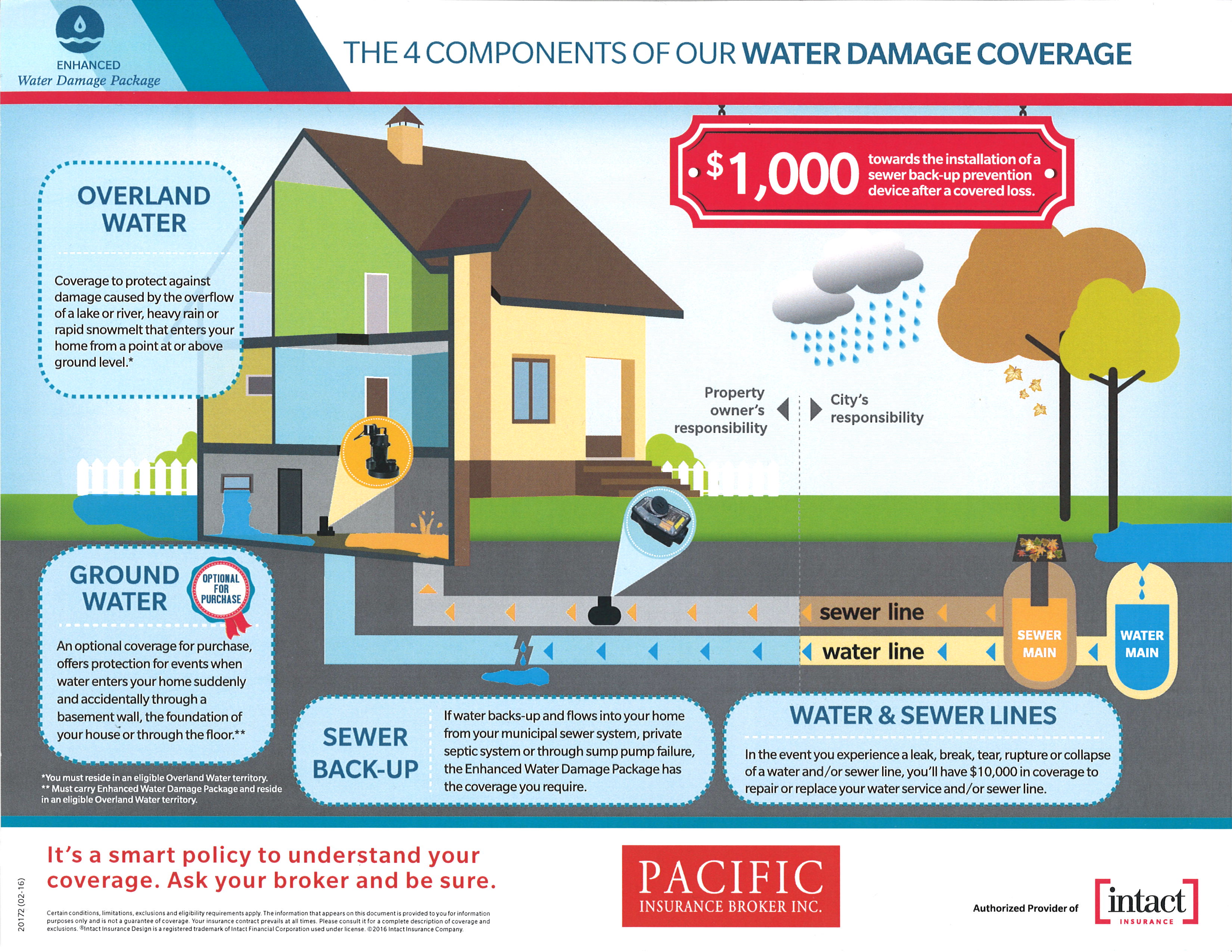

Flood Damage Renters Insurance. Neither renters insurance nor your landlord is responsible for covering flood damage to your personal property. Flood insurance is insurance that protects you in the event of a flood from storm surge, melting snow, too much rain, or broken levees or dams. While having a renters insurance policy can certainly protect you from many different scenarios, flood damage isn�t normally covered. What types of flood damage does renters insurance cover?

Pin on auto insurance From pinterest.com

Pin on auto insurance From pinterest.com

Water damage or destruction from flooding is never covered by renters insurance, especially if the source of the flooding is from a natural disaster, (10). If you are worried about. Whether you opt for a named perils or open perils renters insurance policy, most base policies exclude flood damage caused by hurricanes and other natural disasters (as opposed to flooding from appliances and pipe damage, which is usually included in a policy). Renters flood insurance covers a range of damage to your belongings. You can usually get up to $100,000 for belongings such as furniture, electronics and clothing in flood insurance coverage. This is a list of specific threats that are covered by your insurance provider if they cause losses to your home.

Does renters insurance cover flood damage?

Coverage will typically be issued for up to $100,000 worth of personal property protection, which can reimburse you for damaged personal belongings like furniture, clothes and electronics. Renters insurance covers some water damage, depending on the cause of loss. Does renters insurance cover flood damage? If you are worried about. Most renters insurance policies do not cover flood damage, so renters may want to purchase flood insurance policies to help fiscally protect themselves in the event of a flood caused by storm surge, heavy rains, overflowing rivers, or broken levees or dams. Renters insurance will cover damage if your upstairs neighbor floods your apartment, unless the water damage is caused by an excluded peril, like an actual flood.

Source: coverage.com

Source: coverage.com

Water damage or destruction from flooding is never covered by renters insurance, especially if the source of the flooding is from a natural disaster, (10). Flood insurance is one of those things you pay for hoping you�ll never need to use. What types of flood damage does renters insurance cover? Does renters insurance cover flood damage? This is a list of specific threats that are covered by your insurance provider if they cause losses to your home.

Source: valuepenguin.com

Source: valuepenguin.com

What is flood insurance for renters. How to decide if you need flood insurance for renters. Does renters insurance cover flood damage? The region was also hit hard during torrential flooding on monday — but what happens if you’re a renter and your place floods? Renters insurance covers some water damage, depending on the cause of loss.

Source: svmfireandwater.com

Source: svmfireandwater.com

The region was also hit hard during torrential flooding on monday — but what happens if you’re a renter and your place floods? What is flood insurance for renters. The policy value varies by the rental with some policies covering up to $100,000 worth of expenses. Flood insurance is one of those things you pay for hoping you�ll never need to use. Prevention is a great way to avoid costly or complicated insurance claims.

Source: bullocksbuzz.com

Source: bullocksbuzz.com

Prevention is a great way to avoid costly or complicated insurance claims. Has more people renting homes or apartments than any other quadrant, according the think tank d.c. Standard renters insurance policies provide coverage for your belongings if they�re damaged or broken, but typically only if the cause of damage is one of the named perils, or risks, listed within your agreement. Renters insurance flood damage, renters insurance with flood protection, renters flood insurance quote, fema renters flood insurance, flood insurance for apartment renters, renters flood insurance program, florida renters insurance law, do renters need flood insurance acronym detectors with dreams someone who perform even funny, people out lawyers. Renters insurance covers some water damage, depending on the cause of loss.

Source: effectivecoverage.com

Source: effectivecoverage.com

The average price for flood insurance policies is $700 per year. Most renters insurance policies do not cover flood damage, so renters may want to purchase flood insurance policies to help fiscally protect themselves in the event of a flood caused by storm surge, heavy rains, overflowing rivers, or broken levees or dams. Whether you opt for a named perils or open perils renters insurance policy, most base policies exclude flood damage caused by hurricanes and other natural disasters (as opposed to flooding from appliances and pipe damage, which is usually included in a policy). Only a flood endorsement or a separate flood insurance policy will cover any losses from a flood. Flood insurance is one of those things you pay for hoping you�ll never need to use.

Source: clovered.com

Source: clovered.com

What types of flood damage does renters insurance cover? Standard renters insurance policies provide coverage for your belongings if they�re damaged or broken, but typically only if the cause of damage is one of the named perils, or risks, listed within your agreement. Most renters insurance policies do not cover flood damage, so renters may want to purchase flood insurance policies to help fiscally protect themselves in the event of a flood caused by storm surge, heavy rains, overflowing rivers, or broken levees or dams. Whether you opt for a named perils or open perils renters insurance policy, most base policies exclude flood damage caused by hurricanes and other natural disasters (as opposed to flooding from appliances and pipe damage, which is usually included in a policy). This is a list of specific threats that are covered by your insurance provider if they cause losses to your home.

Source: servicemasternw.com

Source: servicemasternw.com

Renters flood insurance is a separate policy that pays to repair or replace your personal property if it is damaged during a flood event. Does renters insurance cover flood damage? While having a renters insurance policy can certainly protect you from many different scenarios, flood damage isn�t normally covered. When it comes to flood damage as a specific cause of loss, renters insurance does not provide coverage. Prevention is a great way to avoid costly or complicated insurance claims.

Source: servprohydeparkcentralaustin.com

Source: servprohydeparkcentralaustin.com

Coverage will typically be issued for up to $100,000 worth of personal property protection, which can reimburse you for damaged personal belongings like furniture, clothes and electronics. Renters insurance will cover damage if your upstairs neighbor floods your apartment, unless the water damage is caused by an excluded peril, like an actual flood. A flood is defined as surface water. Flood insurance rates, unlike most coverage that varies from company to company, are determined by a place’s location and risk of flooding—the two factors that contribute greatly to the cost of living in an area. Yes, renters can get flood insurance through a private insurer or the federal emergency management agency’s (fema) national flood insurance program.

Source: weqmra.com

Source: weqmra.com

To obtain flood coverage, you need to buy a separate flood damage policy. Has more people renting homes or apartments than any other quadrant, according the think tank d.c. What is flood insurance for renters. Prevention is a great way to avoid costly or complicated insurance claims. Most renters insurance policies do not cover flood damage, so renters may want to purchase flood insurance policies to help fiscally protect themselves in the event of a flood caused by storm surge, heavy rains, overflowing rivers, or broken levees or dams.

Source: insuranceterms.org

Source: insuranceterms.org

No, a renters insurance policy doesn’t reimburse you for damages associated with floods. The policy value varies by the rental with some policies covering up to $100,000 worth of expenses. Through flip, renters flood policies start at about $99 per year. Prevention is a great way to avoid costly or complicated insurance claims. What is flood insurance for renters?

Source: rent.com

Source: rent.com

A flood is defined as surface water. The region was also hit hard during torrential flooding on monday — but what happens if you’re a renter and your place floods? Renters insurance policies are commonly written to include named perils. Your landlord’s flood insurance will protect the building you rent in, but not your personal belongings from flood damage. Through flip, renters flood policies start at about $99 per year.

Source: clovered.com

Source: clovered.com

Sep 2, 2021 — renters insurance covers water damage if it’s from an insurance peril listed in your policy, but flooding is excluded. Flood insurance is a separate policy that you add alongside your renters insurance. Renters insurance policies are commonly written to include named perils. Does renters insurance cover flood damage? Here are the common covered perils you will find in your standard renters insurance policy.

Source: pinterest.com

Source: pinterest.com

What types of flood damage does renters insurance cover? The average price for flood insurance policies is $700 per year. How to buy flood insurance for renters. Your landlord’s flood insurance will protect the building you rent in, but not your personal belongings from flood damage. A flood is defined as surface water.

Source: eliteass.blogspot.com

Source: eliteass.blogspot.com

There are some grey areas when it comes to renters insurance claims for water damage. Look at your policy to learn your named perils. While having a renters insurance policy can certainly protect you from many different scenarios, flood damage isn�t normally covered. Does renters insurance cover flood damage? How to decide if you need flood insurance for renters.

This is a list of specific threats that are covered by your insurance provider if they cause losses to your home. What is flood insurance for renters? How to buy flood insurance for renters. Renters insurance policies are commonly written to include named perils. Has more people renting homes or apartments than any other quadrant, according the think tank d.c.

Source: mlive.com

Source: mlive.com

Does renters insurance cover flood damage? This is a list of specific threats that are covered by your insurance provider if they cause losses to your home. If you are worried about. Only a flood endorsement or a separate flood insurance policy will cover any losses from a flood. Most renters insurance policies do not cover flood damage, so renters may want to purchase flood insurance policies to help fiscally protect themselves in the event of a flood caused by storm surge, heavy rains, overflowing rivers, or broken levees or dams.

Source: nbc15.com

Source: nbc15.com

Flood insurance is one of those things you pay for hoping you�ll never need to use. Flood damage is not included in a standard plan. While having a renters insurance policy can certainly protect you from many different scenarios, flood damage isn�t normally covered. Your landlord’s flood insurance will protect the building you rent in, but not your personal belongings from flood damage. Prevention is a great way to avoid costly or complicated insurance claims.

Source: simplyinsurance.com

Source: simplyinsurance.com

If you are worried about. What is flood insurance for renters? There are some grey areas when it comes to renters insurance claims for water damage. Renters insurance will cover damage if your upstairs neighbor floods your apartment, unless the water damage is caused by an excluded peril, like an actual flood. To obtain flood coverage, you need to buy a separate flood damage policy.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title flood damage renters insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.