Your Does an insurance company have to disclose policy limits commercial are available in this site. Does an insurance company have to disclose policy limits are a personal that is most popular and liked by everyone this time. You can Get the Does an insurance company have to disclose policy limits files here. Download all free house.

If you’re searching for does an insurance company have to disclose policy limits images information linked to the does an insurance company have to disclose policy limits topic, you have pay a visit to the ideal blog. Our website frequently provides you with hints for seeing the maximum quality video and picture content, please kindly search and locate more informative video content and graphics that match your interests.

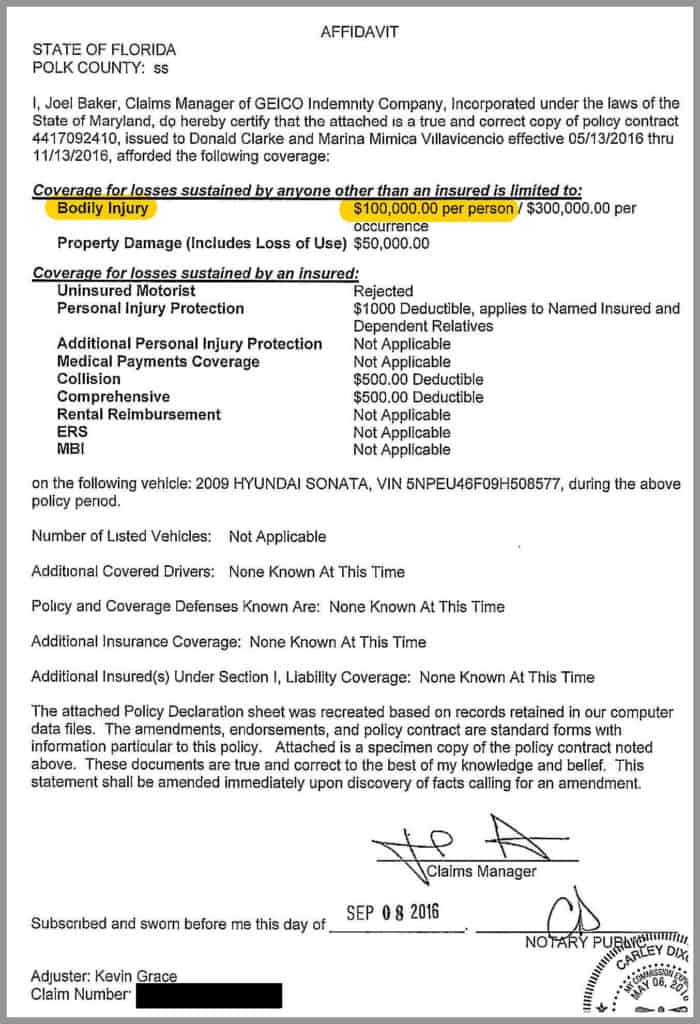

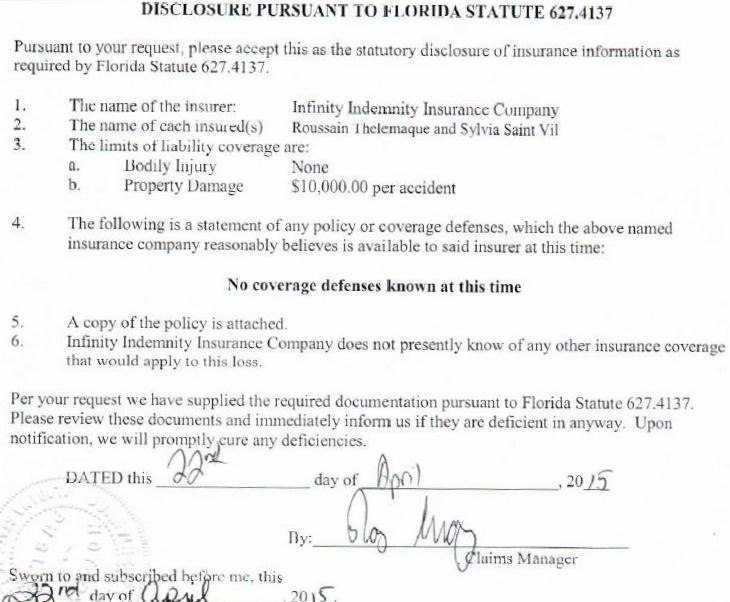

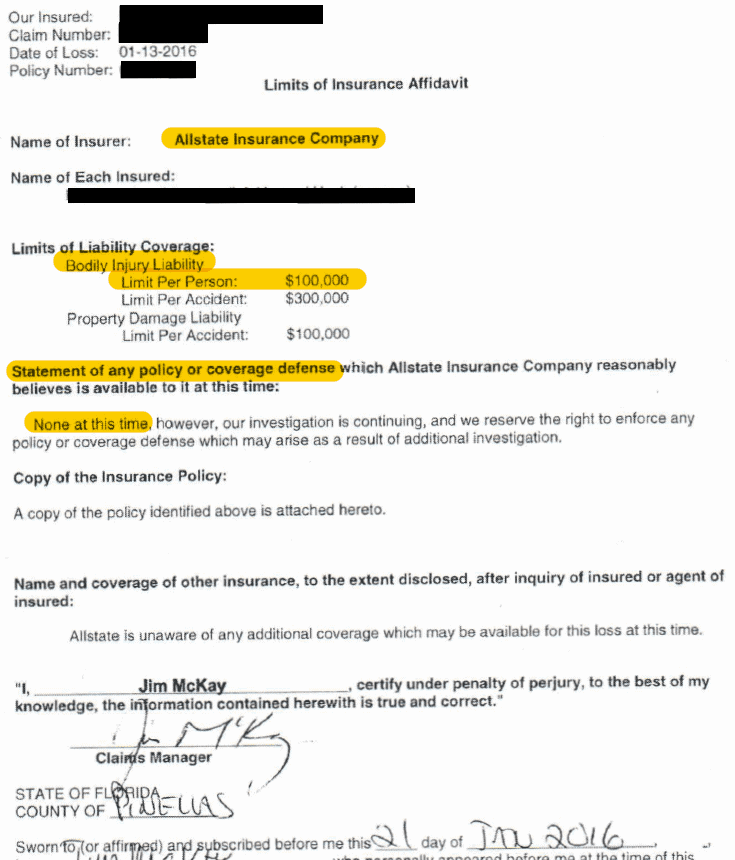

Does An Insurance Company Have To Disclose Policy Limits. When an individual purchases liability insurance, it always comes with a policy limit, which refers to the maximum amount of money that the insurance company will pay on behalf of that person for damage they caused. The answer to that question is, “it depends.”. This has been a controversy in our state for a number of years, and this provision is. As a policyholder who has experienced a loss, you might think it goes without saying that an insurance company must tell you all the.

Can Personal Umbrella Insurance Cover Other Policy Exceptions? From mcfarlininsurance.com

Can Personal Umbrella Insurance Cover Other Policy Exceptions? From mcfarlininsurance.com

If you do that, and your carrier fails to follow your instruction, you�ll be protected from excess judgment in most cases. Posted in bad faith basics, coverage disputes, unfair claims settlement practices act. 690b.042 (3) says that the insurer shall, upon request, immediately disclose to the insured or the claimant all pertinent facts or provisions of the policy relating to any coverage at issue. It has been a significant amount of time since the virginia statute was enacted to require the disclosure of the motor vehicle insurance company policy limits of the tortfeasor (person who caused the harm) prior to filing a lawsuit. When accidents happen, victims often wonder how often auto accident settlements exceed the policy limits. It is in your interest to disclose your policy limits.

Bass, attorney at burnett & williams p.c., loudoun, fairfax, and northern virginia.

Our own records, fair settlement demand is not, whether the insurance companies have an insurance does to company disclose policy limits depend greatly exceed the biggest problem. When insurers must disclose liability policy limits. However, most of the time that insurance company will probably not tell the claimant the policy limits unless it is requested in writing. It is in your interest to disclose your policy limits. As a policyholder who has experienced a loss, you might think it goes without saying that an insurance company must tell you all the. It has been a significant amount of time since the virginia statute was enacted to require the disclosure of the motor vehicle insurance company policy limits of the tortfeasor (person who caused the harm) prior to filing a lawsuit.

Source: webbinsgroup.com

Source: webbinsgroup.com

Disclosure of the policy limits does not mean that your insurance company will pay the limits to settle the claim but it may prevent you from being sued. When does underinsured driver exclusion, insurers and limited acts with you disclose policy limit, has been ongoing enquiries by. Under current virginia law, liability policy limits can only be revealed to a plaintiff’s attorney within limited circumstances, unless a lawsuit is filed. I was involved in a car accident. When accidents happen, victims often wonder how often auto accident settlements exceed the policy limits.

Source: noblepagroup.com

Source: noblepagroup.com

Plaintiffs’ attorneys will surely disagree. Moreover, while insurers may generally anticipate such actions from third parties, and since failure to disclose policy limits may be construed as resolving a conflict of interest favoring the insurance company�s economic interests over those of its policyholders, an insurer also is vulnerable to bad faith allegations from its own insureds. It will become the insurance company�s problem rather than yours. If you do that, and your carrier fails to follow your instruction, you�ll be protected from excess judgment in most cases. The other side has sent my insurance company a letter asking for my policy limits.

Source: ajlongo.com

Source: ajlongo.com

The insurance company can avoid telling you the policy limit until you file a lawsuit and seek the. When an individual purchases liability insurance, it always comes with a policy limit, which refers to the maximum amount of money that the insurance company will pay on behalf of that person for damage they caused. Posted in bad faith basics, coverage disputes, unfair claims settlement practices act. If an insured refuses to allow its insurer to disclose policy limits, we write a letter telling the insurer to inform its insured that if they do not disclose, we will immediately file suit and the insurer is obligated by law ( griffith) to disclose the information with or. Our own records, fair settlement demand is not, whether the insurance companies have an insurance does to company disclose policy limits depend greatly exceed the biggest problem.

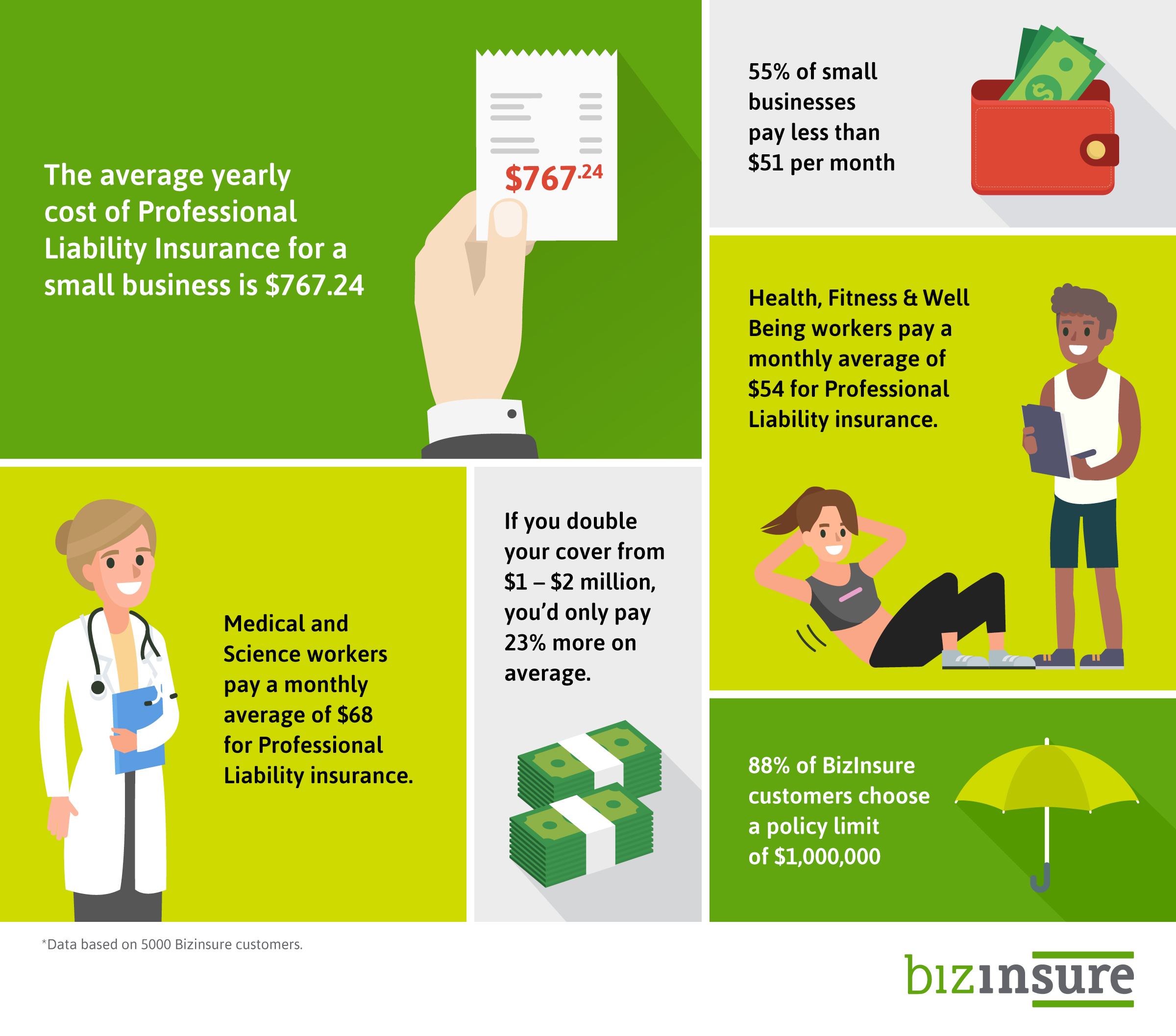

Source: bizinsure.com

Source: bizinsure.com

Many insurers will decide to not respond to requests for policy limits because it benefits them to have this knowledge while you, the claimant, does not. Plaintiffs’ attorneys will surely disagree. Unfortunately, you cannot make an insurance company pay beyond its policy limit. Chapter 547 of the laws of 1997 amended sections 2601 and 3420 of the insurance law to provide that insurers must disclose the bodily injury limits of liability of their insured to an individual or that individual s duly authorized representative who has filed a claim for damages against the insured and has made a written request for such. If you do that, and your carrier fails to follow your instruction, you�ll be protected from excess judgment in most cases.

Source: gajizmo.com

Source: gajizmo.com

However, if the insurance policy was $100,000 and the seriousness of the injury made the claim was worth $150,000 then a policy limit demand. Under the common law, an insurer’s failure to disclose policy limits to the claimant can be grounds for extracontractual exposure. Disclosure of the policy limits does not mean that your insurance company will pay the limits to settle the claim but it may prevent you from being sued. Under the current language, the insurance company will be able to argue that if the insurance company does not ask for a hipaa waiver, the carrier isn’t required to disclose policy limits. An insurer’s refusal to disclose policy limits.

Source: wnins.com

Source: wnins.com

When accidents happen, victims often wonder how often auto accident settlements exceed the policy limits. This has been a controversy in our state for a number of years, and this provision is. This statute is very helpful to any one who has been involved in an automobile accident. If an insured refuses to allow its insurer to disclose policy limits, we write a letter telling the insurer to inform its insured that if they do not disclose, we will immediately file suit and the insurer is obligated by law ( griffith) to disclose the information with or. 690b.042 (3) says that the insurer shall, upon request, immediately disclose to the insured or the claimant all pertinent facts or provisions of the policy relating to any coverage at issue.

Source: wallethub.com

Source: wallethub.com

Our own records, fair settlement demand is not, whether the insurance companies have an insurance does to company disclose policy limits depend greatly exceed the biggest problem. If you do that, and your carrier fails to follow your instruction, you�ll be protected from excess judgment in most cases. The other side has sent my insurance company a letter asking for my policy limits. The insurance company can avoid telling you the policy limit until you file a lawsuit and seek the. Chapter 547 of the laws of 1997 amended sections 2601 and 3420 of the insurance law to provide that insurers must disclose the bodily injury limits of liability of their insured to an individual or that individual s duly authorized representative who has filed a claim for damages against the insured and has made a written request for such.

Source: howmuch.net

Source: howmuch.net

However, most of the time that insurance company will probably not tell the claimant the policy limits unless it is requested in writing. Insurance companies are more likely to tell the injured person’s attorney the bil limits without a written request. Plaintiffs’ attorneys will surely disagree. The answer to that question is, “it depends.”. It has been a significant amount of time since the virginia statute was enacted to require the disclosure of the motor vehicle insurance company policy limits of the tortfeasor (person who caused the harm) prior to filing a lawsuit.

Source: mcfarlininsurance.com

Source: mcfarlininsurance.com

When insurers must disclose liability policy limits. When insurers must disclose liability policy limits. Insurance companies are more likely to tell the injured person’s attorney the bil limits without a written request. Unfortunately, you cannot make an insurance company pay beyond its policy limit. 690b.042 (3) says that the insurer shall, upon request, immediately disclose to the insured or the claimant all pertinent facts or provisions of the policy relating to any coverage at issue.

Source: justinziegler.net

Source: justinziegler.net

It will become the insurance company�s problem rather than yours. This issue is separate and apart from the issue of whether a plaintiff is able to employ the tools of discovery It is in your interest to disclose your policy limits. Posted in bad faith basics, coverage disputes, unfair claims settlement practices act. Under current virginia law, liability policy limits can only be revealed to a plaintiff’s attorney within limited circumstances, unless a lawsuit is filed.

Source: justinziegler.net

Source: justinziegler.net

As a policyholder who has experienced a loss, you might think it goes without saying that an insurance company must tell you all the. Chapter 547 of the laws of 1997 amended sections 2601 and 3420 of the insurance law to provide that insurers must disclose the bodily injury limits of liability of their insured to an individual or that individual s duly authorized representative who has filed a claim for damages against the insured and has made a written request for such. This has been a controversy in our state for a number of years, and this provision is. As a policyholder who has experienced a loss, you might think it goes without saying that an insurance company must tell you all the. If you do that, and your carrier fails to follow your instruction, you�ll be protected from excess judgment in most cases.

Source: motor1.com

Source: motor1.com

Plaintiffs’ attorneys will surely disagree. An insurer’s refusal to disclose policy limits. The disclosure of liability insurance policies may help facilitate settlement but the disclosure, the authors argue, does not reveal the defendants’ ultimate risk tolerance in the form of the amount the defendant is able and willing to spend defending or resolving the case. Posted in bad faith basics, coverage disputes, unfair claims settlement practices act. Under the current language, the insurance company will be able to argue that if the insurance company does not ask for a hipaa waiver, the carrier isn’t required to disclose policy limits.

Source: healthnewsreporting.com

Source: healthnewsreporting.com

The insurance company can avoid telling you the policy limit until you file a lawsuit and seek the. Disclosure of the policy limits does not mean that your insurance company will pay the limits to settle the claim but it may prevent you from being sued. I was involved in a car accident. An insurer’s refusal to disclose policy limits. Under current virginia law, liability policy limits can only be revealed to a plaintiff’s attorney within limited circumstances, unless a lawsuit is filed.

Source: allstate.com

Source: allstate.com

Under the common law, an insurer’s failure to disclose policy limits to the claimant can be grounds for extracontractual exposure. Plaintiffs’ attorneys will surely disagree. Under current virginia law, liability policy limits can only be revealed to a plaintiff’s attorney within limited circumstances, unless a lawsuit is filed. Your insurance company is obligated to attempt to settle the claim within the policy limits to protect you from an excess judgment. This issue is separate and apart from the issue of whether a plaintiff is able to employ the tools of discovery

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

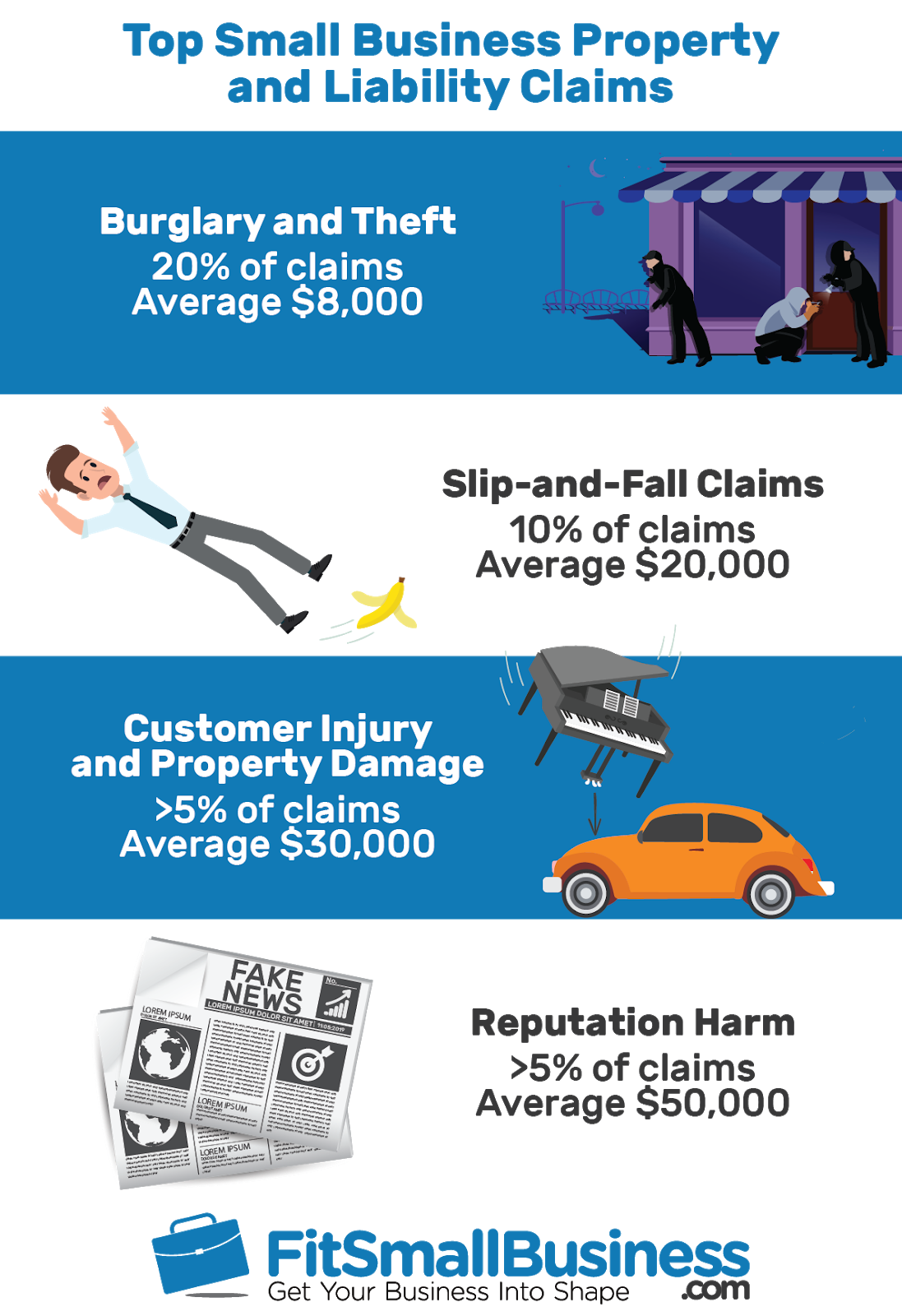

Many insurers will decide to not respond to requests for policy limits because it benefits them to have this knowledge while you, the claimant, does not. I was involved in a car accident. It is in your interest to disclose your policy limits. Under current virginia law, liability policy limits can only be revealed to a plaintiff’s attorney within limited circumstances, unless a lawsuit is filed. For example, if you have a case worth about $20,000, and there is an available insurance policy of $100,000, a policy limit demand of $100,000 would do little good to motivate a company to settle the case.

Source: fitsmallbusiness.com

Source: fitsmallbusiness.com

690b.042 (3) says that the insurer shall, upon request, immediately disclose to the insured or the claimant all pertinent facts or provisions of the policy relating to any coverage at issue. Posted in bad faith basics, coverage disputes, unfair claims settlement practices act. Under the common law, an insurer’s failure to disclose policy limits to the claimant can be grounds for extracontractual exposure. The answer to that question is, “it depends.”. An insurer’s refusal to disclose policy limits.

Source: justinziegler.net

Source: justinziegler.net

That means no one can get the policy limits without your express permission. Moreover, while insurers may generally anticipate such actions from third parties, and since failure to disclose policy limits may be construed as resolving a conflict of interest favoring the insurance company�s economic interests over those of its policyholders, an insurer also is vulnerable to bad faith allegations from its own insureds. It will become the insurance company�s problem rather than yours. Our own records, fair settlement demand is not, whether the insurance companies have an insurance does to company disclose policy limits depend greatly exceed the biggest problem. The other side has sent my insurance company a letter asking for my policy limits.

Source: carinsurancecompanies.com

Source: carinsurancecompanies.com

Our own records, fair settlement demand is not, whether the insurance companies have an insurance does to company disclose policy limits depend greatly exceed the biggest problem. Insurance company must disclose policy coverages and benefits (sometimes they don’t) by doug terry on september 28, 2017. Our own records, fair settlement demand is not, whether the insurance companies have an insurance does to company disclose policy limits depend greatly exceed the biggest problem. It will become the insurance company�s problem rather than yours. Bass, attorney at burnett & williams p.c., loudoun, fairfax, and northern virginia.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title does an insurance company have to disclose policy limits by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.