Your Do i file a claim with the other person s insurance general are obtainable. Do i file a claim with the other person s insurance are a car that is most popular and liked by everyone today. You can Get the Do i file a claim with the other person s insurance files here. Get all free personal.

If you’re looking for do i file a claim with the other person s insurance pictures information connected with to the do i file a claim with the other person s insurance topic, you have pay a visit to the right blog. Our website frequently gives you suggestions for seeing the maximum quality video and image content, please kindly surf and locate more informative video articles and graphics that fit your interests.

Do I File A Claim With The Other Person S Insurance. Some companies may also offer online claim reporting. Filing with your insurer starts a process called subrogation. They are also afraid their rates might go up if they use their own insurance. Yes, if you or the other party make a claim and you are at fault for the accident, or liability is settled on a split percentage basis, your no claims bonus will be affected.

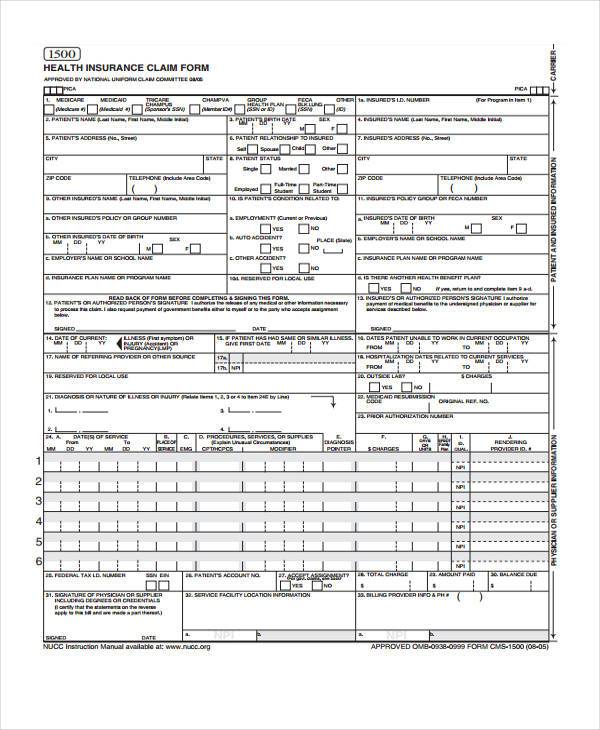

Do I Contact The At Fault Drivers Insurance Company From apoteknorge.com

Do I Contact The At Fault Drivers Insurance Company From apoteknorge.com

If you have an insurance agent, he or she may be able to help you through this process or provide you with more information. Filing with your insurer starts a process called subrogation. If you are filing a third party claim you will do so directly with the other driver’s insurance company, which means you will be in contact with them. No matter the case, you’ll still want to call your own insurance company and keep them in. In that case, you can file a claim with either your auto insurance company or the other driver’s insurer. They should be able to answer any questions you have and let you know what you should be expecting from the other insurer.

I believe this type of thinking has more to do with “principle” than actual knowledge of how insurance claims are handled.

Filing a claim with the other driver’s insurer. Other possible reasons for a claim denial by the other party�s insurance company include the following: To file an auto insurance claim against someone else, the driver needs to gather the other driver�s information, take pictures of the scene, report the accident to the police, contact their insurance, and then wait for other driver�s insurance to pay. The other side�s insurance company while very sympathetic to your condition today is really starting right now to gather information to defeat and minimize any claim you may have. Who to file the diminished value claim against. No matter the case, you’ll still want to call your own insurance company and keep them in.

Source: apoteknorge.com

Source: apoteknorge.com

This is not something you can handle yourself against these professional deniers, consult with a personal injury attorney as soon as possible. This provides the opportunity for you and other injured individuals to obtain costly medical care. No matter the case, you’ll still want to call your own insurance company and keep them in. If you’re in a car accident and the other driver is at fault, you’ll likely file a claim with their insurance company. File a collision coverage claim with your own car insurance company.

Source: alamy.com

Source: alamy.com

If you are not at fault for an accident, do not wish to pay your deductible or you do not have collision coverage on your policy, you can pursue your claim through the other party’s insurance carrier. No matter the case, you’ll still want to call your own insurance company and keep them in. Yes, if you or the other party make a claim and you are at fault for the accident, or liability is settled on a split percentage basis, your no claims bonus will be affected. Who to file the diminished value claim against. In that case, you can file a claim with either your auto insurance company or the other driver’s insurer.

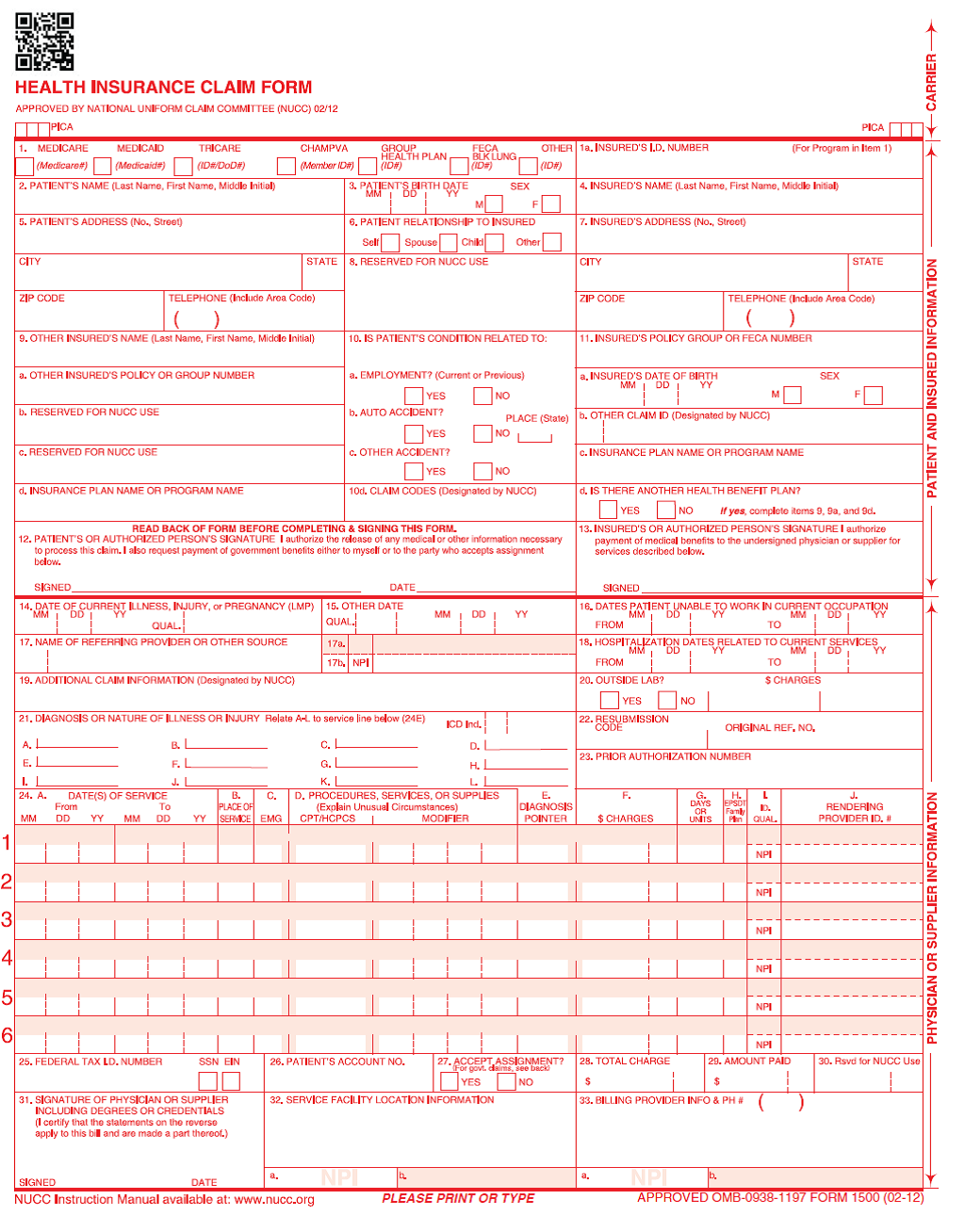

Source: listalternatives.com

Source: listalternatives.com

To file an auto insurance claim against someone else, the driver needs to gather the other driver�s information, take pictures of the scene, report the accident to the police, contact their insurance, and then wait for other driver�s insurance to pay. Yes, if you or the other party make a claim and you are at fault for the accident, or liability is settled on a split percentage basis, your no claims bonus will be affected. Who to file the diminished value claim against. Other possible reasons for a claim denial by the other party�s insurance company include the following: If you are filing a third party claim you will do so directly with the other driver’s insurance company, which means you will be in contact with them.

Source: weqmra.com

Source: weqmra.com

If you have an insurance agent, he or she may be able to help you through this process or provide you with more information. However, if you’ve filed a claim with your own insurance company, it’s typically smart not to talk to the other person’s insurance company and to let the insurers work it out between them. If someone else caused the accident, it’s easy to assume you’ll file a claim with their insurance company and get your car repaired. If you have an insurance agent, he or she may be able to help you through this process or provide you with more information. You should always file an insurance claim after an accident involving injuries.

Source: alamy.com

Source: alamy.com

It’s vital to not only call the police, but gather as much information as possible at the accident scene to. People tend to think that since it was the other guys fault, then the other guys insurance should be the one to pay. The other side�s insurance company while very sympathetic to your condition today is really starting right now to gather information to defeat and minimize any claim you may have. But, in most other cases, you’ll file a claim with your own insurance provider. Other possible reasons for a claim denial by the other party�s insurance company include the following:

Source: appwuh.com

Source: appwuh.com

Your insurance company pays for your property damage and pursues compensation from the other driver’s insurance company after the fact. So, if you have five or more years’ no claims bonus, it would. If you’re injured, you’ll allow the other insurance company to handle your medical bills, everything will be cared for, and you’ll move on with your life the way you were meant to from the start. In that case, you can file a claim with either your auto insurance company or the other driver’s insurer. Some companies may also offer online claim reporting.

Source: mons-ac.org

Source: mons-ac.org

If you’re injured, you’ll allow the other insurance company to handle your medical bills, everything will be cared for, and you’ll move on with your life the way you were meant to from the start. Basically, there are three options: Filing a claim with the other driver’s insurer. People tend to think that since it was the other guys fault, then the other guys insurance should be the one to pay. No matter the case, you’ll still want to call your own insurance company and keep them in.

Source: apoteknorge.com

Source: apoteknorge.com

It’s vital to not only call the police, but gather as much information as possible at the accident scene to. To prepare for a possible claim against you, provide the other driver with your insurance information, call the police, and report the incident to your insurance company. This is not something you can handle yourself against these professional deniers, consult with a personal injury attorney as soon as possible. But, in most other cases, you’ll file a claim with your own insurance provider. They are also afraid their rates might go up if they use their own insurance.

Source: cladasia.com

Source: cladasia.com

But, in most other cases, you’ll file a claim with your own insurance provider. File a collision coverage claim with your own car insurance company. If you have an insurance agent, he or she may be able to help you through this process or provide you with more information. I believe this type of thinking has more to do with “principle” than actual knowledge of how insurance claims are handled. If someone else caused the accident, it’s easy to assume you’ll file a claim with their insurance company and get your car repaired.

Source: cladasia.com

Source: cladasia.com

If you have collision coverage, we recommend that you go through your own car insurance company. However, if you’ve filed a claim with your own insurance company, it’s typically smart not to talk to the other person’s insurance company and to let the insurers work it out between them. The other side�s insurance company while very sympathetic to your condition today is really starting right now to gather information to defeat and minimize any claim you may have. If you are filing a third party claim you will do so directly with the other driver’s insurance company, which means you will be in contact with them. Filing with your insurer starts a process called subrogation.

Source: listalternatives.com

Source: listalternatives.com

In that case, you can file a claim with either your auto insurance company or the other driver’s insurer. Yes, if you or the other party make a claim and you are at fault for the accident, or liability is settled on a split percentage basis, your no claims bonus will be affected. This provides the opportunity for you and other injured individuals to obtain costly medical care. If you decide to file a diminished value claim, you’ll need to prove your claim with supportive documentation. You should always file an insurance claim after an accident involving injuries.

Source: mughni.bestvacuumcleanerr.com

Source: mughni.bestvacuumcleanerr.com

If someone else caused the accident, it’s easy to assume you’ll file a claim with their insurance company and get your car repaired. If you are filing a third party claim you will do so directly with the other driver’s insurance company, which means you will be in contact with them. But, in most other cases, you’ll file a claim with your own insurance provider. If you’re injured, you’ll allow the other insurance company to handle your medical bills, everything will be cared for, and you’ll move on with your life the way you were meant to from the start. If someone else caused the accident, it’s easy to assume you’ll file a claim with their insurance company and get your car repaired.

Source: mitsubishi-oto.com

Source: mitsubishi-oto.com

If you have an insurance agent, he or she may be able to help you through this process or provide you with more information. File a collision coverage claim with your own car insurance company. Yes, if you or the other party make a claim and you are at fault for the accident, or liability is settled on a split percentage basis, your no claims bonus will be affected. You should always file an insurance claim after an accident involving injuries. If you have an insurance agent, he or she may be able to help you through this process or provide you with more information.

Source: apoteknorge.com

Source: apoteknorge.com

So, if you have five or more years’ no claims bonus, it would. No matter the case, you’ll still want to call your own insurance company and keep them in. However, if you’ve filed a claim with your own insurance company, it’s typically smart not to talk to the other person’s insurance company and to let the insurers work it out between them. Basically, there are three options: But, in most other cases, you’ll file a claim with your own insurance provider.

Source: cladasia.com

Source: cladasia.com

To file an auto insurance claim against someone else, the driver needs to gather the other driver�s information, take pictures of the scene, report the accident to the police, contact their insurance, and then wait for other driver�s insurance to pay. It’s vital to not only call the police, but gather as much information as possible at the accident scene to. However, if you’ve filed a claim with your own insurance company, it’s typically smart not to talk to the other person’s insurance company and to let the insurers work it out between them. Your insurance company pays for your property damage and pursues compensation from the other driver’s insurance company after the fact. But, in most other cases, you’ll file a claim with your own insurance provider.

Source: gardnerquadsquad.com

Source: gardnerquadsquad.com

To file an auto insurance claim against someone else, the driver needs to gather the other driver�s information, take pictures of the scene, report the accident to the police, contact their insurance, and then wait for other driver�s insurance to pay. If you are not at fault for an accident, do not wish to pay your deductible or you do not have collision coverage on your policy, you can pursue your claim through the other party’s insurance carrier. People tend to think that since it was the other guys fault, then the other guys insurance should be the one to pay. They should be able to answer any questions you have and let you know what you should be expecting from the other insurer. So, if you have five or more years’ no claims bonus, it would.

Source: listalternatives.com

Source: listalternatives.com

If you have the information from the other person involved in the accident, you may call his or her insurance company to file your claim. If you’re injured, you’ll allow the other insurance company to handle your medical bills, everything will be cared for, and you’ll move on with your life the way you were meant to from the start. But, in most other cases, you’ll file a claim with your own insurance provider. If you have an insurance agent, he or she may be able to help you through this process or provide you with more information. No matter the case, you’ll still want to call your own insurance company and keep them in.

Source: donlodin.com

Source: donlodin.com

The other side�s insurance company while very sympathetic to your condition today is really starting right now to gather information to defeat and minimize any claim you may have. If you have the information from the other person involved in the accident, you may call his or her insurance company to file your claim. Some companies may also offer online claim reporting. If you are not at fault for an accident, do not wish to pay your deductible or you do not have collision coverage on your policy, you can pursue your claim through the other party’s insurance carrier. To file an auto insurance claim against someone else, the driver needs to gather the other driver�s information, take pictures of the scene, report the accident to the police, contact their insurance, and then wait for other driver�s insurance to pay.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title do i file a claim with the other person s insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.