Your Characteristics of non insurable risk investment are ready. Characteristics of non insurable risk are a banner that is most popular and liked by everyone today. You can News the Characteristics of non insurable risk files here. Get all royalty-free business.

If you’re looking for characteristics of non insurable risk images information linked to the characteristics of non insurable risk topic, you have pay a visit to the ideal site. Our website always gives you suggestions for downloading the maximum quality video and image content, please kindly search and locate more informative video articles and images that fit your interests.

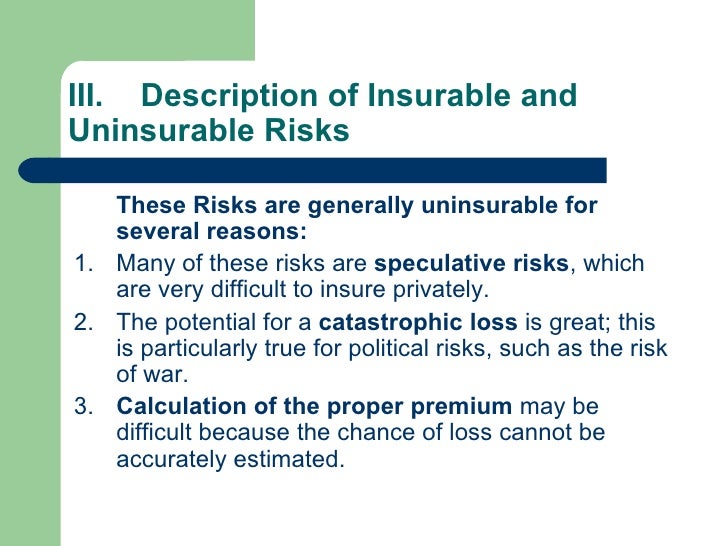

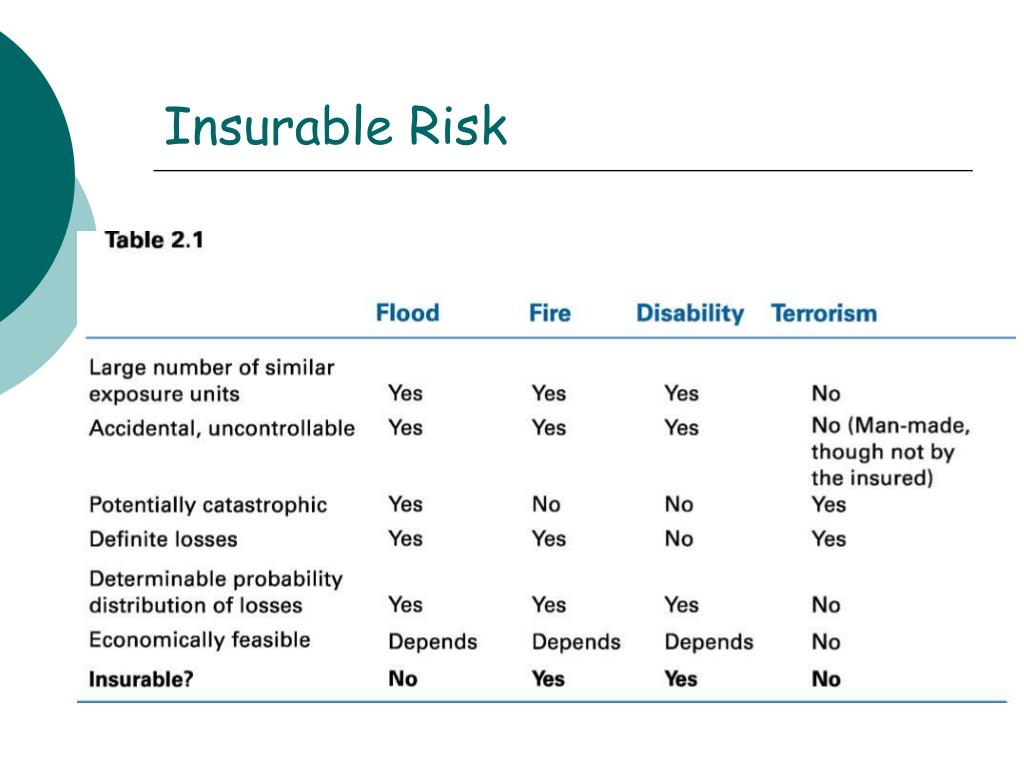

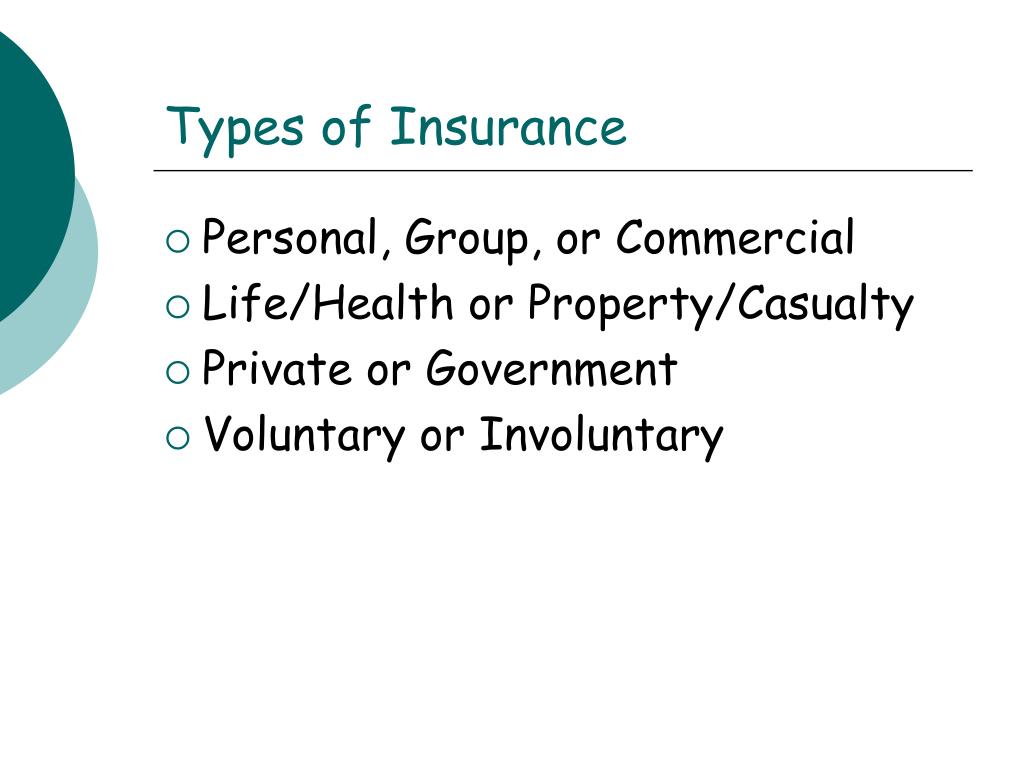

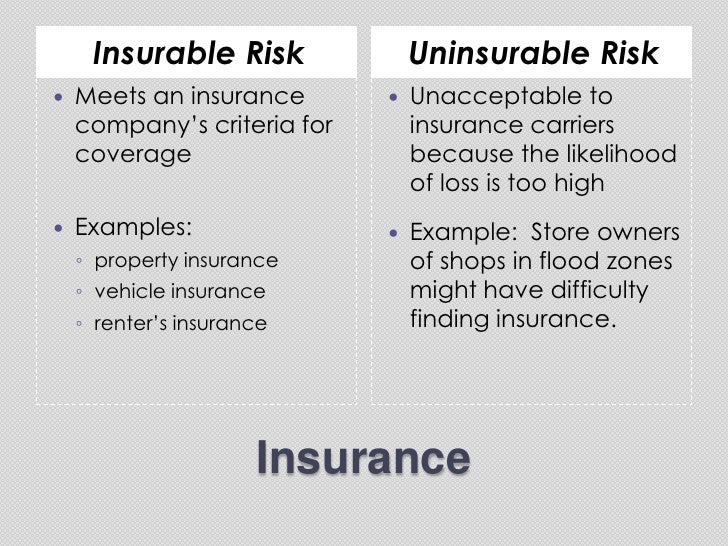

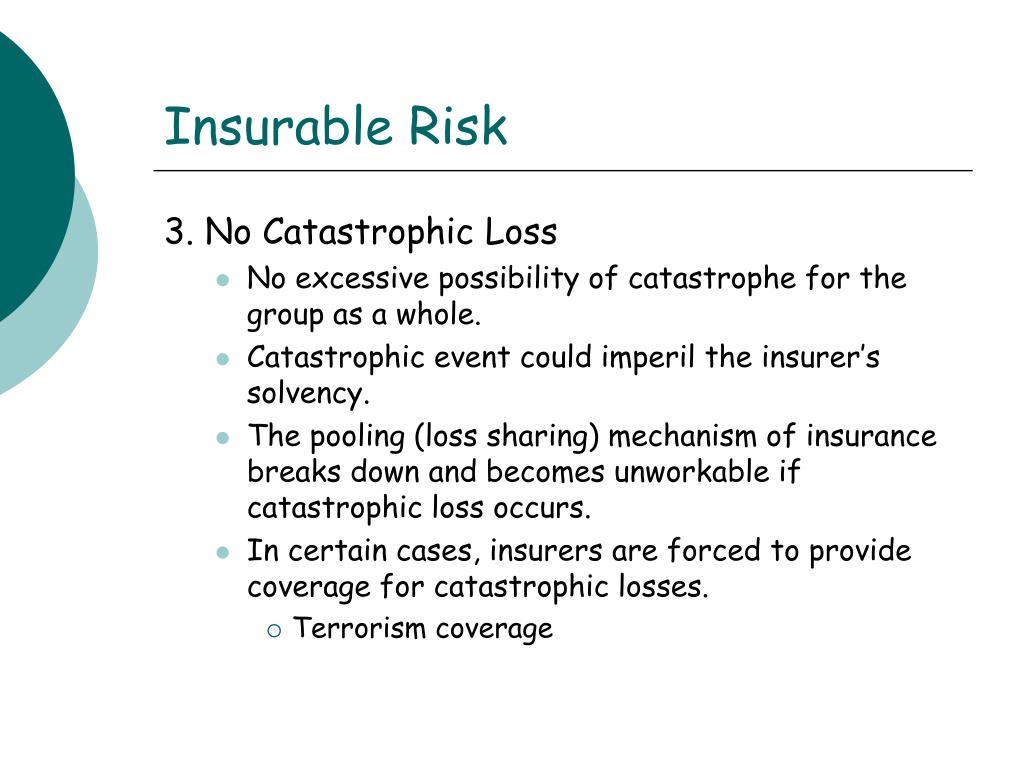

Characteristics Of Non Insurable Risk. The premium must be economically feasible. The uncertainty is more in respect of time of risk and its impact. An example for hoas is sinkholes. One of the criteria for an insurable risk is that it not be catastrophic.

Risk Management and Insurance From slideshare.net

Risk Management and Insurance From slideshare.net

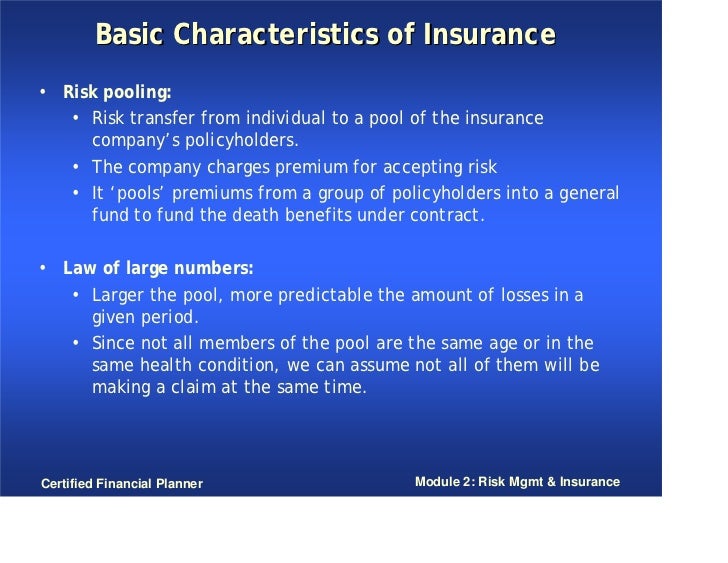

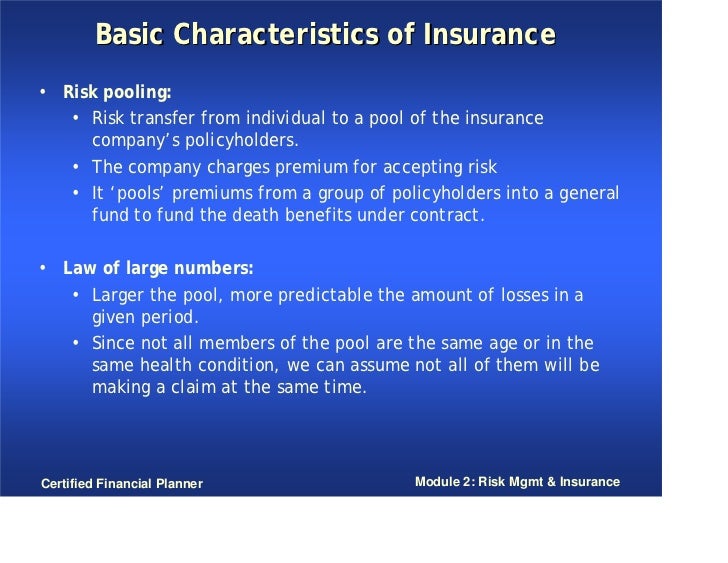

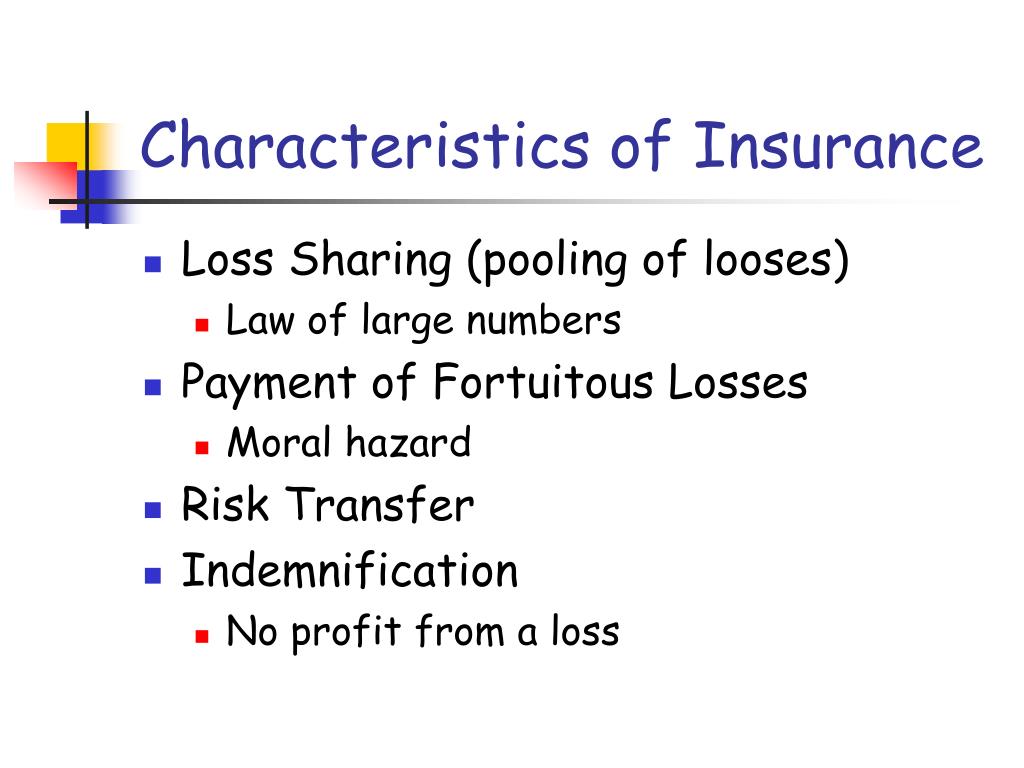

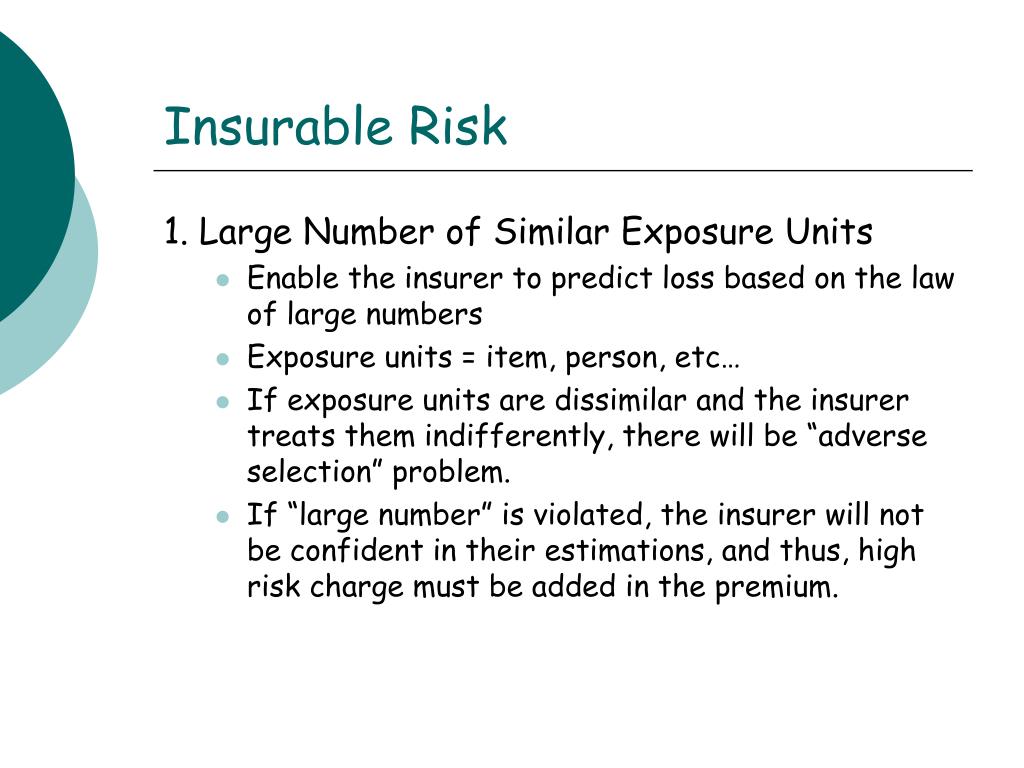

What is an insurable risk? The characteristics of insurable risk are as follows: There must be a large number of exposure units. The risk cannot be forecast and measured. The number of similar loss exposure unit must be large that is , there must be large number of exposure units ,to predict average loss based One of the criteria for an insurable risk is that it not be catastrophic.

Pure risks are risks that have no possibility of a positive outcome—something bad will happen or nothing at all will occur.

The consequences (loss) must be assessable, definite or can be measured in terms of time or money/financially measurable. The consequences (loss) must be assessable, definite or can be measured in terms of time or money/financially measurable. The risk is probabilistic and generic. An example for hoas is sinkholes. Study flashcards on characteristics of ideally insurable risk at cram.com. The characteristics of insurable risk are as follows:

Source: laudzakur.blogspot.com

Source: laudzakur.blogspot.com

The uncertainty is more in respect of time of risk and its impact. The chance of loss must be calculable. The number of similar loss exposure unit must be large that is , there must be large number of exposure units ,to predict average loss based Fair premiums this means that the insurer must be able to cover claims and expenses with premium income and thus if premiums must be set too high then the risk is not insurable. It holds the prospect of gain as well as loss.

Source: slideshare.net

Source: slideshare.net

What is an insurable risk? It is caused by some unfavourable or undesirable event. Quickly memorize the terms, phrases and much more. Insurable risks are risks that insurance companies will cover. Cram.com makes it easy to get the grade you want!

Source: 1investing.in

Source: 1investing.in

Acceptance characteristics of non insurable risk insurability of any risk for a risk that meets the ideal criteria for efficient insurance same peril similar. There are ideally six characteristics of an insurable risk: The premium must be economically feasible. A principle of insurance holds that only a small portion of a given group will experience loss at any one time. The loss should not be catastrophic.

Source: slideserve.com

Source: slideserve.com

There are ideally six characteristics of an insurable risk: The risks are related with certain factors like changes in consumer tastes and fashions, changes in methods of production, strike or lockout in the work place, increased competition in the. The answer, the requirements(characteristics ) that must generally be met if a risk is to be insurable in the private insurance market are: Ideally insurable risk is a pure, static and par ticular risk. Distinguish insurable from non insurable risks?

Source: researchgate.net

Source: researchgate.net

Thus, a potential loss cannot be calculated so a premium cannot be established. Fair premiums this means that the insurer must be able to cover claims and expenses with premium income and thus if premiums must be set too high then the risk is not insurable. The loss must be determinable and measurable. These risks are generally insurable. The number of similar loss exposure unit must be large that is , there must be large number of exposure units ,to predict average loss based

Source: ezraberdeen.blogspot.com

Source: ezraberdeen.blogspot.com

Litigation is the most common example of pure risk in liability. The most common examples are key property damage risks, such as floods, fires, earthquakes, and hurricanes. To assure randomness, because law of large number is based on the random The number of similar loss exposure unit must be large that is , there must be large number of exposure units ,to predict average loss based These include a wide range of losses, including those from fire, theft, or lawsuits.

Source: slideshare.net

Source: slideshare.net

When you buy commercial insurance, you pay premiums to your insurance company. Fair premiums this means that the insurer must be able to cover claims and expenses with premium income and thus if premiums must be set too high then the risk is not insurable. In order for a risk to be insurable, it must have these key characteristics. A principle of insurance holds that only a small portion of a given group will experience loss at any one time. It is caused by some unfavourable or undesirable event.

Source: slideserve.com

Source: slideserve.com

The answer, the requirements(characteristics ) that must generally be met if a risk is to be insurable in the private insurance market are: There are ideally six characteristics of an insurable risk: Distinguish insurable from non insurable risks? The chance of loss must be calculable. Pure risks are risks that have no possibility of a positive outcome—something bad will happen or nothing at all will occur.

Source: ezraberdeen.blogspot.com

Source: ezraberdeen.blogspot.com

The consequences (loss) must be assessable, definite or can be measured in terms of time or money/financially measurable. An example for hoas is sinkholes. The loss must be determinable and measurable. 1.4.4 elements of insurable risk. The number of similar loss exposure unit must be large that is , there must be large number of exposure units ,to predict average loss based

Source: slideshare.net

Source: slideshare.net

Cram.com makes it easy to get the grade you want! One of the criteria for an insurable risk is that it not be catastrophic. The number of similar loss exposure unit must be large that is , there must be large number of exposure units ,to predict average loss based Risks are of different types, but have certain common characteristics. In return, the company agrees to pay you in the event you suffer a covered loss.

Source: slideserve.com

Source: slideserve.com

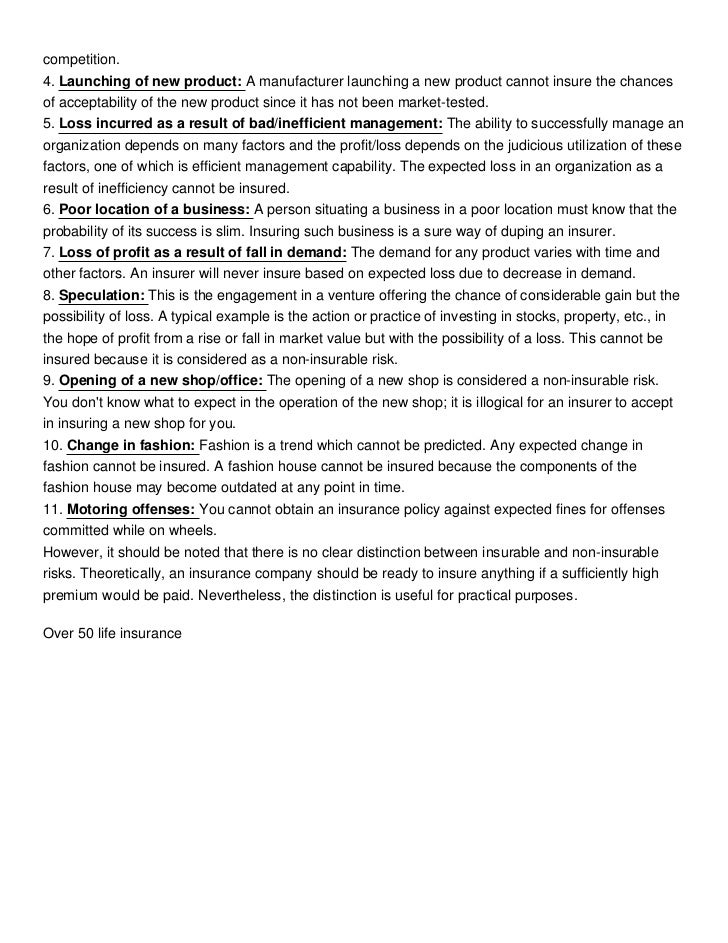

The risks are related with certain factors like changes in consumer tastes and fashions, changes in methods of production, strike or lockout in the work place, increased competition in the. Uninsurable risk is a condition that poses an unknowable or unacceptable risk of loss or a situation in which insuring would be against the. Insurable risks are risks that insurance companies will cover. It holds the prospect of gain as well as loss. Pure risks are risks that have no possibility of a positive outcome—something bad will happen or nothing at all will occur.

Source: dcnewsupdate.blogspot.com

Source: dcnewsupdate.blogspot.com

The loss must be accidental and unintentional. The characteristics of insurable risk are as follows: When you buy commercial insurance, you pay premiums to your insurance company. Fair premiums this means that the insurer must be able to cover claims and expenses with premium income and thus if premiums must be set too high then the risk is not insurable. There must be a large number of exposure units.

Source: slideshare.net

Source: slideshare.net

An example for hoas is sinkholes. In order for a risk to be insurable, it must have these key characteristics. Insurable risks are risks that insurance companies will cover. Uninsurable risk is a condition that poses an unknowable or unacceptable risk of loss or a situation in which insuring would be against the. There must be a large number of exposure units.

Source: slideserve.com

Source: slideserve.com

Cram.com makes it easy to get the grade you want! Study flashcards on characteristics of ideally insurable risk at cram.com. These risks are generally insurable. An example for hoas is sinkholes. The loss should not be catastrophic.

Source: slideserve.com

Source: slideserve.com

Study flashcards on characteristics of ideally insurable risk at cram.com. It is caused by some unfavourable or undesirable event. The risks are related with certain factors like changes in consumer tastes and fashions, changes in methods of production, strike or lockout in the work place, increased competition in the. The most common examples are key property damage risks, such as floods, fires, earthquakes, and hurricanes. These risks are generally insurable.

Source: academia.edu

Source: academia.edu

What is an insurable risk? Distinguish insurable from non insurable risks? Ideally insurable risk is a pure, static and par ticular risk. Study flashcards on characteristics of ideally insurable risk at cram.com. The premium must be economically feasible.

Source: iedunote.com

Source: iedunote.com

Normally, the risks involved in business are fairly known. To assure randomness, because law of large number is based on the random It holds the prospect of gain as well as loss. The answer, the requirements(characteristics ) that must generally be met if a risk is to be insurable in the private insurance market are: These include a wide range of losses, including those from fire, theft, or lawsuits.

Source: slideserve.com

Source: slideserve.com

The risks are related with certain factors like changes in consumer tastes and fashions, changes in methods of production, strike or lockout in the work place, increased competition in the. Pure risks are risks that have no possibility of a positive outcome—something bad will happen or nothing at all will occur. It is caused by some unfavourable or undesirable event. What is an insurable risk? A principle of insurance holds that only a small portion of a given group will experience loss at any one time.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title characteristics of non insurable risk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.