Your Cash payment settlement option insurance india are obtainable. Cash payment settlement option insurance are a india that is most popular and liked by everyone today. You can Download the Cash payment settlement option insurance files here. Find and Download all royalty-free premium.

If you’re looking for cash payment settlement option insurance pictures information connected with to the cash payment settlement option insurance keyword, you have visit the right site. Our website frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

Cash Payment Settlement Option Insurance. What is the other term for the cash payment settlement insurance option? This type of settlement does not allow you to replace what you�ve lost, at least not without some of the money to replace it coming out of your own pocket. Options 3, 4 and 5: Alternatively, you could surrender the policy and receive a lump payment from the insurer, but this will likely be significantly lower than the amount you paid in.

Cash Payment Settlement Option Insurance Group Life From ginewra-druella-rosier.blogspot.com

Cash Payment Settlement Option Insurance Group Life From ginewra-druella-rosier.blogspot.com

I.e., the payout that life insurance makes when the policyholder dies. This is the most common settlement option. This will be a direct transaction between the provider and yourself, the homeowner. The beneficiary is entitled to spend the money however they want, including investments, or rolling over the funds into their own life insurance policy. The settlement method you select may help your surviving family members have the necessary resources to continue making a comfortable living. Moreover, the value of the payout upon a brokerage settlement will be less than the face value of the policy.

A home insurance claim cash settlement means that your insurance company has accepted your claim, and they will give back an agreed sum of money.

In life settlements, the settlement amount will be more than the cash surrender value of the policy, but less than the death benefit. Settlement options are a beneficiary’s options for how to receive their payout from a life insurance company. In any case, the sale of a life insurance policy is an important decision. Alternatively, you could surrender the policy and receive a lump payment from the insurer, but this will likely be significantly lower than the amount you paid in. In lesser amounts for the remaining policy term of age 100 The settlement method you select may help your surviving family members have the necessary resources to continue making a comfortable living.

Source: debtfreeusa.com

Source: debtfreeusa.com

In life settlements, the settlement amount will be more than the cash surrender value of the policy, but less than the death benefit. This is the most common life insurance option, and is usually what comes to most people’s minds when thinking about the transaction. When a life insurance policy is cancelled and the insured has selected the extended term nonforfeiture option, the cash value will be used to purchase term insurance that has a face amount 1. Instead, plaintiffs and defendants negotiate compensation as a lump sum or a structured settlement , in which the plaintiff receives monthly payments for a specified period of time. The beneficiary is entitled to spend the money however they want, including investments, or rolling over the funds into their own life insurance policy.

Source: ginewra-druella-rosier.blogspot.com

Source: ginewra-druella-rosier.blogspot.com

Those who sell their policies receive more than their cash surrender value, which plays a crucial role if they are suddenly unwell or require additional income during retirement. Alternatively, you could sell your policy for cash to a third party in a transaction known as a life settlement, which usually pays more than surrendering the policy. Alternatively, you could surrender the policy and receive a lump payment from the insurer, but this will likely be significantly lower than the amount you paid in. Those who sell their policies receive more than their cash surrender value, which plays a crucial role if they are suddenly unwell or require additional income during retirement. Actual cash value (acv) is the depreciated value of an item of property at the time of the loss.

Source: diggyinsurance.com

Source: diggyinsurance.com

The premiums will then be paid by the buyer. If there is still money owing on the mortgage after the lender has received this money, you will still owe the balance. In life settlements, the settlement amount will be more than the cash surrender value of the policy, but less than the death benefit. In the case of a traditional policy, a licensed provider (the buyer) will pay the policy owner a cash amount above the surrender value, but below the death benefit. A life settlement is the sale of a life insurance policy in exchange for a lump sum cash payment.

Source: structuredsettlementquick.blogspot.com

Source: structuredsettlementquick.blogspot.com

A life settlement is the sale of a life insurance policy in exchange for a lump sum cash payment. Settlement options are a beneficiary’s options for how to receive their payout from a life insurance company. Depending on the extent of damage to your property, accepting a cash settlement may mark the end of your insurance policy, unless your insurer agrees to continue covering you. With this choice, the beneficiary receives the entirety of the settlement in one lump sum. There are two types of life insurance payouts:

Source: pinterest.com

Source: pinterest.com

In any case, the sale of a life insurance policy is an important decision. Moreover, the value of the payout upon a brokerage settlement will be less than the face value of the policy. Those who sell their policies receive more than their cash surrender value, which plays a crucial role if they are suddenly unwell or require additional income during retirement. This then functions like a. Options 3, 4 and 5:

Source: hypokhagneries.blogspot.com

Source: hypokhagneries.blogspot.com

With this choice, the beneficiary receives the entirety of the settlement in one lump sum. Even though a claim cash settlement seems good up to this point, there is something else you need to know. When a life insurance policy is cancelled and the insured has selected the extended term nonforfeiture option, the cash value will be used to purchase term insurance that has a face amount 1. Such a payout needs to be intimated to the insurer in advance by the insured. This type of settlement does not allow you to replace what you�ve lost, at least not without some of the money to replace it coming out of your own pocket.

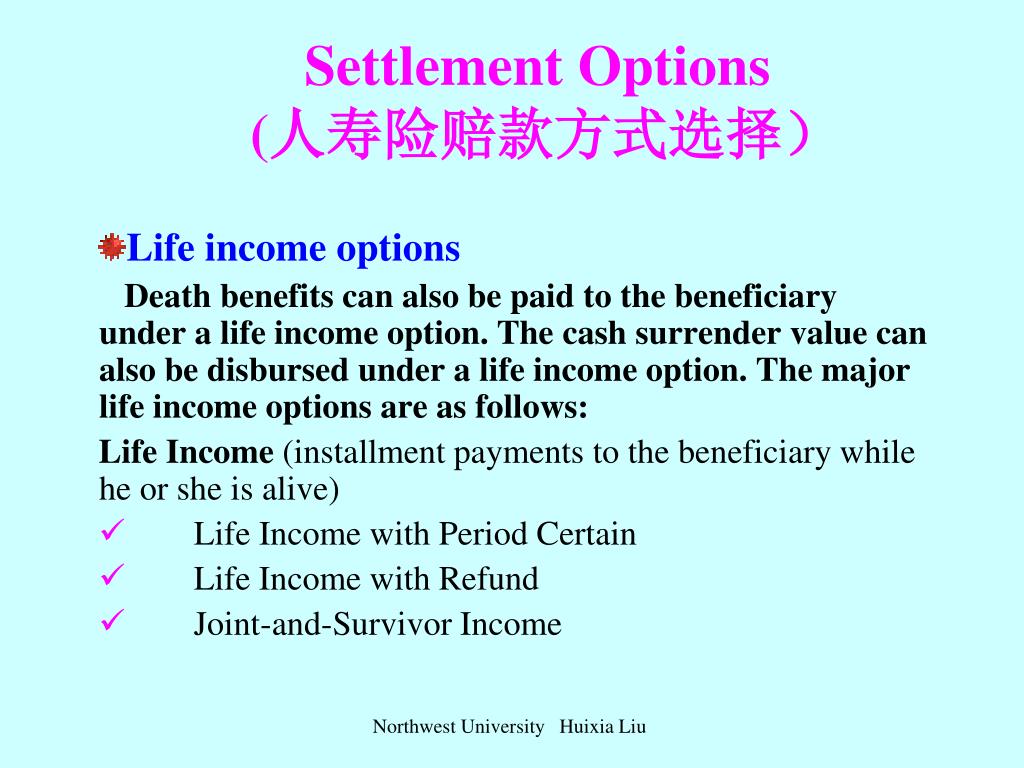

Source: slideserve.com

Source: slideserve.com

A home insurance cash settlement involves your insurer paying you, either in part or in full, your claim, rather than replacing or repairing damage to your building. Instead, plaintiffs and defendants negotiate compensation as a lump sum or a structured settlement , in which the plaintiff receives monthly payments for a specified period of time. With this choice, the beneficiary receives the entirety of the settlement in one lump sum. If you take a cash settlement for your loss rather than rebuilding, your mortgage lender will be entitled to receive the insurance money for the loss of the house, up to the balance of the mortgage. Such a payout needs to be intimated to the insurer in advance by the insured.

Source: firstquarterfinance.com

Source: firstquarterfinance.com

In any case, the sale of a life insurance policy is an important decision. What is the other term for the cash payment settlement insurance option? In life settlements, the settlement amount will be more than the cash surrender value of the policy, but less than the death benefit. Actual cash value (acv) is the depreciated value of an item of property at the time of the loss. Instead, plaintiffs and defendants negotiate compensation as a lump sum or a structured settlement , in which the plaintiff receives monthly payments for a specified period of time.

Source: apexlifesettlements.com

Source: apexlifesettlements.com

This type of settlement does not allow you to replace what you�ve lost, at least not without some of the money to replace it coming out of your own pocket. There are two types of life insurance payouts: The settlement method you select may help your surviving family members have the necessary resources to continue making a comfortable living. Those who sell their policies receive more than their cash surrender value, which plays a crucial role if they are suddenly unwell or require additional income during retirement. In lesser amounts for the remaining policy term of age 100

Source: angeladvocateslegal.com

Source: angeladvocateslegal.com

This is the most common settlement option. There are two types of life insurance payouts: Equal to the original policy as long as a period of time that the cash values will purchase 2. This type of settlement does not allow you to replace what you�ve lost, at least not without some of the money to replace it coming out of your own pocket. Depending on the extent of damage to your property, accepting a cash settlement may mark the end of your insurance policy, unless your insurer agrees to continue covering you.

Source: ginewra-druella-rosier.blogspot.com

Source: ginewra-druella-rosier.blogspot.com

I.e., the payout that life insurance makes when the policyholder dies. Options 3, 4 and 5: A home insurance cash settlement involves your insurer paying you, either in part or in full, your claim, rather than replacing or repairing damage to your building. With this choice, the beneficiary receives the entirety of the settlement in one lump sum. They also provide for reduced premiums in return for certain reductions to.

Source: ginewra-druella-rosier.blogspot.com

Source: ginewra-druella-rosier.blogspot.com

A home insurance claim cash settlement means that your insurance company has accepted your claim, and they will give back an agreed sum of money. This is the most common life insurance option, and is usually what comes to most people’s minds when thinking about the transaction. A cash payment through life settlement may be more important to some, while others might prefer to keep their policy. Some personal injury claims never make it to trial. With this choice, the beneficiary receives the entirety of the settlement in one lump sum.

Source: ginewra-druella-rosier.blogspot.com

Source: ginewra-druella-rosier.blogspot.com

This type of settlement does not allow you to replace what you�ve lost, at least not without some of the money to replace it coming out of your own pocket. Depending on the extent of damage to your property, accepting a cash settlement may mark the end of your insurance policy, unless your insurer agrees to continue covering you. Options 3, 4 and 5: Moreover, the value of the payout upon a brokerage settlement will be less than the face value of the policy. In lesser amounts for the remaining policy term of age 100

Source: ginewra-druella-rosier.blogspot.com

Source: ginewra-druella-rosier.blogspot.com

The premiums will then be paid by the buyer. If you take a cash settlement for your loss rather than rebuilding, your mortgage lender will be entitled to receive the insurance money for the loss of the house, up to the balance of the mortgage. This is the most common life insurance option, and is usually what comes to most people’s minds when thinking about the transaction. A cash payment through life settlement may be more important to some, while others might prefer to keep their policy. This then functions like a.

Source: ginewra-druella-rosier.blogspot.com

Source: ginewra-druella-rosier.blogspot.com

The first type is a death benefit payout from a life insurance policy. If you take a cash settlement for your loss rather than rebuilding, your mortgage lender will be entitled to receive the insurance money for the loss of the house, up to the balance of the mortgage. In life settlements, the settlement amount will be more than the cash surrender value of the policy, but less than the death benefit. They also provide for reduced premiums in return for certain reductions to. Such a payout needs to be intimated to the insurer in advance by the insured.

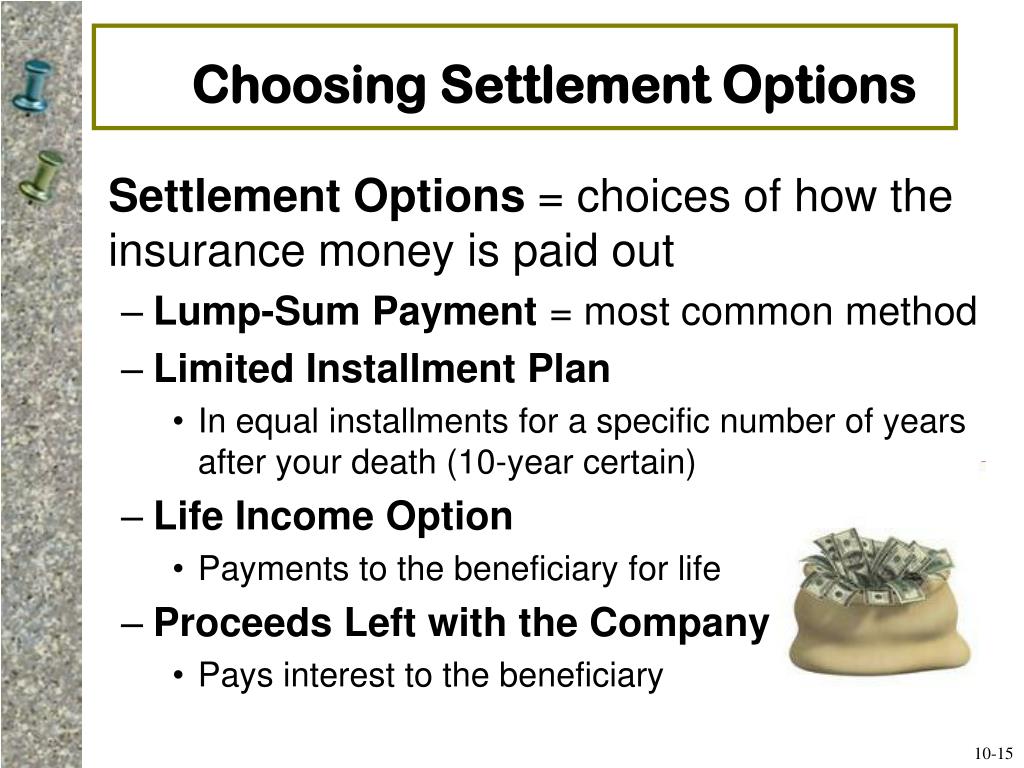

Source: slideserve.com

Source: slideserve.com

Such a payout needs to be intimated to the insurer in advance by the insured. When a life insurance policy is cancelled and the insured has selected the extended term nonforfeiture option, the cash value will be used to purchase term insurance that has a face amount 1. A structured settlement payout differs from cashing out an existing payment stream. There are two types of life insurance payouts: Actual cash value (acv) is the depreciated value of an item of property at the time of the loss.

Source: hypokhagneries.blogspot.com

Source: hypokhagneries.blogspot.com

Settlement options are a beneficiary’s options for how to receive their payout from a life insurance company. Depending on the extent of damage to your property, accepting a cash settlement may mark the end of your insurance policy, unless your insurer agrees to continue covering you. Those who sell their policies receive more than their cash surrender value, which plays a crucial role if they are suddenly unwell or require additional income during retirement. Even though a claim cash settlement seems good up to this point, there is something else you need to know. Instead, plaintiffs and defendants negotiate compensation as a lump sum or a structured settlement , in which the plaintiff receives monthly payments for a specified period of time.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title cash payment settlement option insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.