Your Car insurance cheaper when car paid off health are available. Car insurance cheaper when car paid off are a money that is most popular and liked by everyone today. You can Get the Car insurance cheaper when car paid off files here. Get all free policy.

If you’re searching for car insurance cheaper when car paid off images information connected with to the car insurance cheaper when car paid off topic, you have visit the right blog. Our site frequently provides you with suggestions for viewing the maximum quality video and picture content, please kindly search and find more enlightening video articles and images that fit your interests.

Car Insurance Cheaper When Car Paid Off. Reducing your level of car insurance coverage. Paying off your vehicle does not change the cost to repair or replace your car. Older cars have lower value and will cost the insurance company less to pay off if damaged or stolen. Car insurance premiums don�t automatically go down when you pay off your car, but you can probably lower your premium by dropping coverage that�s no longer required.

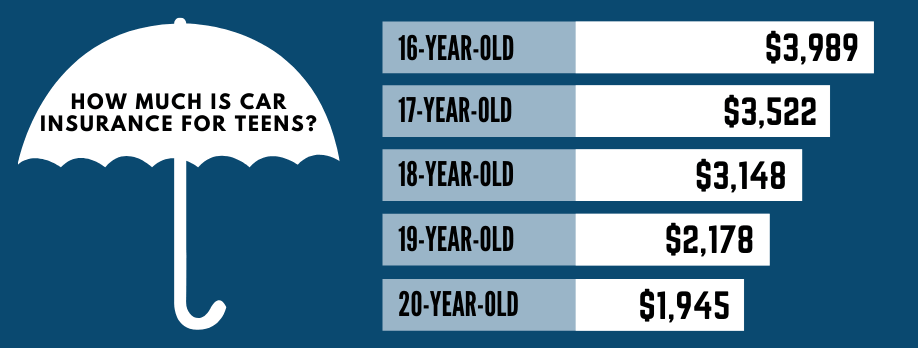

5 Reasons Why Car Insurance for Teenagers is Expensive From yourgreatcar.com

5 Reasons Why Car Insurance for Teenagers is Expensive From yourgreatcar.com

It might seem like your insurance rates just got cheaper after you finally paid off your loan. Paying off a vehicle when it has been leased or financed feels like a milestone. But paying your car off does not change this at all. Unlike when you have a loan or lease, owning your car means there�s no financing or leasing company requiring you to have comprehensive or collision coverage. Keep reading to find cheaper car insurance quotes. When you purchase a vehicle with your own money, you can make the cheaper choice to purchase only your state�s mandatory minimum coverage.

Insurance can be cheaper if you own the car, but that depends on how much coverage you need and the kind of car you drive.

Yes, let your car insurance company know: Car insurance premiums don�t automatically go down when you pay off your car, but you can probably lower your premium by dropping coverage that�s no longer required. Paying off your car may affect your insurance coverage requirements. So if you currently hold comprehensive car insurance, you could find cheaper car insurance by scaling back to a bare minimum policy. But paying your car off does not change this at all. The reduced value can potentially reduce your premium rates.

Source: pinterest.com

Source: pinterest.com

Insurance premium rates for older cars tend to be lower. Insurance companies will charge less to insure a car with a lower value. While owning your vehicle may mean more to you than being a borrower or a lessor, taking that leap to becoming a titleholder does not always affect the cost of your car insurance premiums. It might seem like your insurance rates just got cheaper after you finally paid off your loan. It is a good idea to notify your car insurance company of the loan payoff so that you can remove the lienholder from your policy.

Source: microcoms.net

Source: microcoms.net

Since car insurance is billed in advance then if you are willing to pay ahead for car insurance then you might just get the cheapest rates. Paying car insurance a month in advance is standard for most car insurance companies. As a newer car ages, the cost of insuring it goes down considerably. Older cars have lower value and will cost the insurance company less to pay off if damaged or stolen. Paying off your vehicle does not change the cost to repair or replace your car.

Source: saiki.justice-ci.org

Source: saiki.justice-ci.org

Reducing your level of car insurance coverage. You car insurance cost tends to decline a little bit at a time (unless your carrier gets a global rate increase through your state’s insurance commission) as your car gets older and less valuable and as you remain insured with them without an accident for an increasing amount of time. Car insurance premiums don�t automatically go down when you pay off your car, but you can probably lower your premium by dropping coverage that�s no longer required. Insurance on older cars is generally cheaper. In most cases, this is true.

Source: inipku.com

Source: inipku.com

A lower car insurance rate can equal significant savings. Once the loan is paid off, there is no entity imposing that requirement any more so you could remove those coverages form your policy and save premium. Can paying off your car decrease your car insurance rates. Discuss this decision with your insurance professional in order to best understand the potential premium savings vs the possible financial risk to you in any future loss. And different insurers work things out in their own way.

Source: un-insurance.com

Source: un-insurance.com

This can sometimes be obtained through loyalty to a company, or simply because of the type of car driven. Discuss this decision with your insurance professional in order to best understand the potential premium savings vs the possible financial risk to you in any future loss. Older cars have lower value and will cost the insurance company less to pay off if damaged or stolen. Car insurance premiums don�t automatically go down when you pay off your car, but you can probably lower your premium by dropping coverage that�s no longer required. Paying off your vehicle does not change the cost to repair or replace your car.

Source: canadacarstorage.ca

Source: canadacarstorage.ca

This means that if you maintain comprehensive and collision (full coverage) and your vehicle were to be totaled in an accident,. It is a good idea to notify your car insurance company of the loan payoff so that you can remove the lienholder from your policy. Reducing your level of car insurance coverage. If you’re not comfortable canceling your policy and you want to maintain a certain amount of protection, you may want to consider switching to a lower level of coverage. And different insurers work things out in their own way.

Source: ballengerinsurance.net

Source: ballengerinsurance.net

Paying car insurance a month in advance is standard for most car insurance companies. So, it can be confusing to know what you can do to get low car insurance costs. And different insurers work things out in their own way. In certain situations, the auto insurance rate reduction drops quite dramatically after the vehicle is paid off. The most common payment option offered by all insurers is to pay for your car insurance upfront for the full year.

Source: ojo.sprzatanie-lublin.com

Source: ojo.sprzatanie-lublin.com

Whether reducing coverage after paying off your car loan is a possibility or not depends on the value of the car and your personal financial situation. Yes, let your car insurance company know: Insurance companies will charge less to insure a car with a lower value. Does car insurance get cheaper once your car is paid off? Paying off your car may affect your insurance coverage requirements.

Source: pendletonyp.com

Source: pendletonyp.com

By the time you pay off the vehicle, it may have lost almost half its value. If you are not the owner, your lender may require certain types of coverage for the term of your loan. According to confused.com�s car insurance price index, at the end of 2021 motorists paid £539 for their car insurance, on average. Read this guide to determine how often. You car insurance cost tends to decline a little bit at a time (unless your carrier gets a global rate increase through your state’s insurance commission) as your car gets older and less valuable and as you remain insured with them without an accident for an increasing amount of time.

Source: cfpinsurance.com

Source: cfpinsurance.com

According to confused.com�s car insurance price index, at the end of 2021 motorists paid £539 for their car insurance, on average. It might seem like your insurance rates just got cheaper after you finally paid off your loan. Paying off your car is a huge accomplishment. In certain situations, the auto insurance rate reduction drops quite dramatically after the vehicle is paid off. Insurance on older cars is generally cheaper.

Source: insurancenewshubb.com

Source: insurancenewshubb.com

Paying off your car is a huge accomplishment. Insurance premiums for older cars tend to be lower, since it would cost an insurance company less to pay off the value of your vehicle if it�s stolen or damaged. Insurance premium rates for older cars tend to be lower. While owning your vehicle may mean more to you than being a borrower or a lessor, taking that leap to becoming a titleholder does not always affect the cost of your car insurance premiums. Paying off a vehicle when it has been leased or financed feels like a milestone.

Source: dedunumax.info

Source: dedunumax.info

Read this guide to determine how often. So, it can be confusing to know what you can do to get low car insurance costs. No, your insurance premium does not go down when you pay off your car. Insurance premium rates for older cars tend to be lower. Auto insurance policies offer multiple coverage types.

Source: bmw-cars-for-sale.com

Source: bmw-cars-for-sale.com

Does car insurance get cheaper once your car is paid off? Learn the details you need to know about pay as you drive insurance. Paying car insurance a month in advance is standard for most car insurance companies. According to confused.com�s car insurance price index, at the end of 2021 motorists paid £539 for their car insurance, on average. While owning your vehicle may mean more to you than being a borrower or a lessor, taking that leap to becoming a titleholder does not always affect the cost of your car insurance premiums.

Source: canadacarstorage.ca

Once the loan is paid off, there is no entity imposing that requirement any more so you could remove those coverages form your policy and save premium. You car insurance cost tends to decline a little bit at a time (unless your carrier gets a global rate increase through your state’s insurance commission) as your car gets older and less valuable and as you remain insured with them without an accident for an increasing amount of time. Wednesday, may 23, 2012 10:01:54 am. But can paying off a financed or leased vehicle also reduce the cost of insurance. Best cheap car insurance in 2016

Source: weqmra.com

Source: weqmra.com

It might seem like your insurance rates just got cheaper after you finally paid off your loan. As a newer car ages, the cost of insuring it goes down considerably. Keep reading to find cheaper car insurance quotes. Paying off your vehicle does not change the cost to repair or replace your car. It is a good idea to notify your car insurance company of the loan payoff so that you can remove the lienholder from your policy.

Source: siteweb-paris.com

Source: siteweb-paris.com

It might seem like your insurance rates just got cheaper after you finally paid off your loan. If you�re driving less and looking for cheaper car insurance, consider learning about pay per mile car insurance options and save as much as 40% off of standard auto insurance rates. Vehicles tend to dramatically decrease in value after the first couple years of their life. So if you currently hold comprehensive car insurance, you could find cheaper car insurance by scaling back to a bare minimum policy. Car insurance premiums don�t automatically go down when you pay off your car, but you can probably lower your premium by dropping coverage that�s no longer required.

Source: pinterest.com

Source: pinterest.com

Joan purchased a $20,000 car with $10,000 cash and a $10,000 loan, but didn�t want to pay for full coverage insurance because she felt the risk of damage was very low. Paying car insurance a month in advance is standard for most car insurance companies. Unlike when you have a loan or lease, owning your car means there�s no financing or leasing company requiring you to have comprehensive or collision coverage. So if you currently hold comprehensive car insurance, you could find cheaper car insurance by scaling back to a bare minimum policy. Insurance premiums for older cars tend to be lower, since it would cost an insurance company less to pay off the value of your vehicle if it�s stolen or damaged.

Source: yourgreatcar.com

Source: yourgreatcar.com

Check with your insurance company after settling the lien on your car. It might seem like your insurance rates just got cheaper after you finally paid off your loan. You car insurance cost tends to decline a little bit at a time (unless your carrier gets a global rate increase through your state’s insurance commission) as your car gets older and less valuable and as you remain insured with them without an accident for an increasing amount of time. When you purchase a vehicle with your own money, you can make the cheaper choice to purchase only your state�s mandatory minimum coverage. Keep reading to find cheaper car insurance quotes.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title car insurance cheaper when car paid off by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.