Your California commercial auto insurance requirements infographic are available in this site. California commercial auto insurance requirements are a group that is most popular and liked by everyone this time. You can Find and Download the California commercial auto insurance requirements files here. Get all free general.

If you’re looking for california commercial auto insurance requirements pictures information related to the california commercial auto insurance requirements interest, you have come to the ideal blog. Our website frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly surf and find more enlightening video articles and graphics that fit your interests.

California Commercial Auto Insurance Requirements. Evidence that the vehicle is owned or leased by a public entity defined in california government code §811.2. Getting your california insurance license is the first step to becoming an insurance agent in california.whether you’re interested in selling property and casualty insurance, life. For example, you would need commercial insurance to operate a vehicle for: Lastly, it is actually possible to avoid purchasing commercial auto insurance by fulfilling the financial obligation that commercial auto insurance does.

Car Insurance For Suspended License Explained In A From patch.com

Car Insurance For Suspended License Explained In A From patch.com

California commercial auto insurance if you use your vehicle beyond commuting to and from work, you need a business auto insurance policy. What auto insurance is required for commercial fleets? $300,000 liability vehicles 10,000 lbs. In the state of ca, commercial liability insurance is not required; Vehicles less than 10,000 lbs.: A document or identification card from your insurance company.

The california department of insurance (doi) has provided updated information regarding its california code of regulations, 10 ccr § 2632.13 (f) (2) (a).

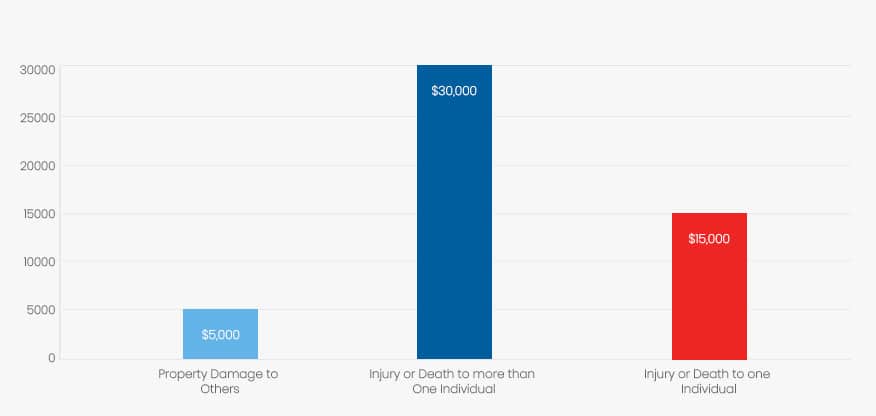

Ca commercial insurance regulations and limits. You may be required to state that your insurance policies cannot. (a) this section applies only to policies of insurance of commercial insurance that are subject to sections 675.5 and 676.6. California state law requires all commercial auto policies to have a minimum liability limit of $15,000 per person, $30,000 per accident for bodily injury and $5,000 for property damage (i.e. California�s minimum requirements for auto insurance are: California commercial auto insurance requirements.

Source: weqmra.com

Source: weqmra.com

The car insurance coverage required by california law is a minimum of $15,000 in bodily injury liability coverage per person, a minimum of $30,000 in bodily injury liability coverage per accident, and a minimum of $5,000 for property damage liability. Ca commercial insurance regulations and limits. The california department of insurance regulates insurance in the golden state. The california department of insurance regulates insurance in the golden state. Ca commercial insurance regulations and limits.

Source: jaknet.my.id

Source: jaknet.my.id

$15,000 bodily injury liability per person; California commercial auto insurance requirements. What auto insurance is required for commercial fleets? The california department of insurance (doi) has provided updated information regarding its california code of regulations, 10 ccr § 2632.13 (f) (2) (a). $15,000 bodily injury liability per person;

Source: cladasia.com

Source: cladasia.com

Vehicles less than 10,000 lbs.: Commercial auto insurance california for safety measures from . The california department of insurance regulates insurance in the golden state. It covers accidents in which you or your driver are at fault and pays for other people’s injuries and damage to their property. Your cargo determines the amount of insurance.

Source: weqmra.com

Source: weqmra.com

What auto insurance is required for commercial fleets? One must have commercial auto insurance in california if they drive their car or truck solely for business or if their company owns a fleet of vehicles. In the state of ca, commercial liability insurance is not required; However, since the state does not cap rewards for liability law suits, business owners are wise to invest in this type of coverage. California proof of insurance certificate (sr 22) form for broad coverage or owner’s policy.

Source: car2.mitsubishi-oto.com

Source: car2.mitsubishi-oto.com

You may be required to state that your insurance policies cannot. It covers accidents in which you or your driver are at fault and pays for other people’s injuries and damage to their property. Lenders on auto loans also have insurance requirements, including coverage for damage to the. California state law requires all commercial auto policies to have a minimum liability limit of $15,000 per person, $30,000 per accident for bodily injury and $5,000 for property damage (i.e. California proof of insurance certificate (sr 22) form for broad coverage or owner’s policy.

Source: cbwinsurance.net

Source: cbwinsurance.net

California state law requires all commercial auto policies to have a minimum liability limit of $15,000 per person, $30,000 per accident for bodily injury and $5,000 for property damage (i.e. This offers protection that is related to a claim that may be brought against you by someone else that is also insured under the same policy. The california department of insurance regulates insurance in the golden state. Most coverages aren’t required by california state law except for workers’ compensation. More specifically, if you own a car or fleet of vehicles exclusively used for business, you need commercial auto insurance.

Source: intact.ca

Source: intact.ca

In the state of california, hhg motor carriers are required to have the following commercial truck insurance coverage: $5,000 property damage liability per accident; California commercial auto insurance requirements passenger carriers: What auto insurance is required for commercial fleets? (b) a notice of nonrenewal shall be in writing and shall be delivered or mailed to the producer of record and to the named insured at the mailing address shown on the policy.

Source: safelinetruckinsurance.com

Source: safelinetruckinsurance.com

$15,000 bodily injury liability per person; However, since the state does not cap rewards for liability law suits, business owners are wise to invest in this type of coverage. Vehicles less than 10,000 lbs.: In california, minimum liability insurance requirements mandate that private passenger vehicles carry at least $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for damage to property. The successful bidder must submit:

Source: cladasia.com

Source: cladasia.com

California commercial auto insurance requirements passenger carriers: Most coverages aren’t required by california state law except for workers’ compensation. The california department of insurance regulates insurance in the golden state. Vehicles less than 10,000 lbs.: However, since the state does not cap rewards for liability law suits, business owners are wise to invest in this type of coverage.

Source: ironpointinsurance.com

Source: ironpointinsurance.com

California has no additional general contractor insurance requirements. One must have commercial auto insurance in california if they drive their car or truck solely for business or if their company owns a fleet of vehicles. $30,000 bodily injury liability per accident; Lastly, it is actually possible to avoid purchasing commercial auto insurance by fulfilling the financial obligation that commercial auto insurance does. What auto insurance is required for commercial fleets?

Source: weqmra.com

Source: weqmra.com

You may be required to state that your insurance policies cannot. $15,000 bodily injury liability per person; However, since the state does not cap rewards for liability law suits, business owners are wise to invest in this type of coverage. Insurance companies are exempt from electronically reporting insurance information for vehicles covered by commercial or business insurance policies. Lenders on auto loans also have insurance requirements, including coverage for damage to the.

Source: cgia-cloud.com

Source: cgia-cloud.com

A document or identification card from your insurance company. Insurance companies are exempt from electronically reporting insurance information for vehicles covered by commercial or business insurance policies. Additionally, california requires businesses with employees to carry workers’ compensation insurance coverage. Copy of its commercial general liability policy and its excess policy or binder until such time as a policy is The car insurance coverage required by california law is a minimum of $15,000 in bodily injury liability coverage per person, a minimum of $30,000 in bodily injury liability coverage per accident, and a minimum of $5,000 for property damage liability.

Source: patch.com

Source: patch.com

One must have commercial auto insurance in california if they drive their car or truck solely for business or if their company owns a fleet of vehicles. Evidence that the vehicle is owned or leased by a public entity defined in california government code §811.2. 250/500/100 or $600,000 combined single limit (csl) the three numbers refer to the minimum liability coverage required for. The following insurance requirements are commonly included in a lease for a commercial property: California�s minimum requirements for auto insurance are:

Source: cheapfullcoverageautoinsurance.com

Source: cheapfullcoverageautoinsurance.com

The california department of insurance regulates insurance in the golden state. Ca commercial insurance regulations and limits. $15,000 bodily injury liability per person; In the state of ca, commercial liability insurance is not required; The successful bidder must submit:

Source: accenno.info

Source: accenno.info

Ad get liability insurance for your business. California commercial auto insurance requirements. In the state of ca, commercial liability insurance is not required; The most popular type of business insurance in california is usually a combination of general liability, professional liability, and commercial auto insurance. In the state of california, hhg motor carriers are required to have the following commercial truck insurance coverage:

Source: ratesforinsurance.com

Source: ratesforinsurance.com

However, since the state does not cap rewards for liability law suits, business owners are wise to invest in this type of coverage. However, since the state does not cap rewards for liability law suits, business owners are wise to invest in this type of coverage. Get quotes today, enroll online, have quality insurance by tomorrow. More specifically, if you own a car or fleet of vehicles exclusively used for business, you need commercial auto insurance. In california, minimum liability insurance requirements mandate that private passenger vehicles carry at least $15,000 for injury/death to one person, $30,000 for injury/death to more than one person, and $5,000 for damage to property.

Source: weqmra.com

Source: weqmra.com

In the state of ca, commercial liability insurance is not required; California commercial auto insurance requirements passenger carriers: Pickup or delivery of goods including: You may be required to state that your insurance policies cannot. Any business that has employees is required to have workers’ comp coverage through the state’s insurance fund or through a private insurance carrier.

Source: tisteam.com

Source: tisteam.com

Evidence that the vehicle is owned or leased by a public entity defined in california government code §811.2. In the state of ca, commercial liability insurance is not required; Additionally, california requires businesses with employees to carry workers’ compensation insurance coverage. The car insurance coverage required by california law is a minimum of $15,000 in bodily injury liability coverage per person, a minimum of $30,000 in bodily injury liability coverage per accident, and a minimum of $5,000 for property damage liability. Insurance companies are exempt from electronically reporting insurance information for vehicles covered by commercial or business insurance policies.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title california commercial auto insurance requirements by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.