Your Anti rebating laws insurance banner are available. Anti rebating laws insurance are a property that is most popular and liked by everyone now. You can Get the Anti rebating laws insurance files here. News all free fire.

If you’re looking for anti rebating laws insurance images information related to the anti rebating laws insurance interest, you have visit the ideal blog. Our website frequently gives you hints for seeking the maximum quality video and image content, please kindly hunt and find more informative video articles and images that fit your interests.

Anti Rebating Laws Insurance. And this can land you a state insurance department fine regardless of whether your intent was innocent or not. • negotiating commission with clients outside of a broker agreement. Rebating began to threaten the solvency of life insurance companies and raised questions around unfair discriminatory practices. Rebating is a serious violation of insurance law that not only comes with legal penalties imposed by state regulators but also various sanctions from insurance companies.

In most cases of rebating, the insurer will terminate its relationship with the agent/broker and other companies may choose to refuse to establish a relationship with an agent/broker who. Rebating is a serious violation of insurance law that not only comes with legal penalties imposed by state regulators but also various sanctions from insurance companies. The alaska division of insurance has determined that the following are violations of the rebating laws: However, the fact that the statute only prohibits insurers from paying someone to refer them clients or procure clients for them is generally understood by the industry and the courts to allow an insurer to pay rebates directly to an insured or insurance applicant. Rebating began to threaten the solvency of life insurance companies and raised questions around unfair discriminatory practices. • negotiating commission with clients outside of a broker agreement.

The national association of insurance commissioners and the national council of insurance legislators, alongside some states, are providing guidance and model laws on the regulatory compliance of offering rebates for the sale of insurance.

At the fall 2020 national meeting of the. • negotiating commission with clients outside of a broker agreement. Law § 2324(a) (mckinney 1985). Rebating began to threaten the solvency of life insurance companies and raised questions around unfair discriminatory practices. Law § 4224(c)(mckinney 1985) similarly prohibits the use of inducements to foster the sale of insurance products. The national association of insurance commissioners and the national council of insurance legislators, alongside some states, are providing guidance and model laws on the regulatory compliance of offering rebates for the sale of insurance.

Source: content.naic.org

Source: content.naic.org

The alaska division of insurance has determined that the following are violations of the rebating laws: A few states prohibit an insured from taking a rebate from an agent or broker. Law § 4224(c)(mckinney 1985) similarly prohibits the use of inducements to foster the sale of insurance products. • a gift, service, or anything of value used as an inducement • a gift, service, or anything of value used as an inducement to

Source: kenyachambermines.com

Source: kenyachambermines.com

• a gift, service, or anything of value used as an inducement The most common types of Rebating is a serious violation of insurance law that not only comes with legal penalties imposed by state regulators but also various sanctions from insurance companies. Although you no doubt learned about rebating in compliance 101, it can’t hurt to review key concepts. Knowingly giving (directly or indirectly) a rebate as an inducement to purchase insurance is also an unfair trade practice in violation of rsa

Source: kenyachambermines.com

Source: kenyachambermines.com

• negotiating commission with clients outside of a broker agreement. The alaska division of insurance has determined that the following are violations of the rebating laws: The alaska division of insurance has determined that the following are violations of the rebating laws: However, the fact that the statute only prohibits insurers from paying someone to refer them clients or procure clients for them is generally understood by the industry and the courts to allow an insurer to pay rebates directly to an insured or insurance applicant. Nonetheless, regulators are catching up for better or worse.

Source: cladasia.com

Source: cladasia.com

The alaska division of insurance has determined that the following are violations of the rebating laws: Nonetheless, regulators are catching up for better or worse. In most cases of rebating, the insurer will terminate its relationship with the agent/broker and other companies may choose to refuse to establish a relationship with an agent/broker who. At the fall 2020 national meeting of the. However, the fact that the statute only prohibits insurers from paying someone to refer them clients or procure clients for them is generally understood by the industry and the courts to allow an insurer to pay rebates directly to an insured or insurance applicant.

Source: cladasia.com

Source: cladasia.com

Some states have passed a provision of the producer licensing model act. • a gift, service, or anything of value used as an inducement The national association of insurance commissioners and the national council of insurance legislators, alongside some states, are providing guidance and model laws on the regulatory compliance of offering rebates for the sale of insurance. With regard to life or accident and health insurance, n.y. The most common types of

Source: eoforless.com

Source: eoforless.com

At the fall 2020 national meeting of the. The reduction in commission would constitute either a rebate or an unlawful inducement to the making of insurance, which is prohibited by n.y. • negotiating commission with clients outside of a broker agreement. • negotiating commission with clients outside of a broker agreement. The national association of insurance commissioners and the national council of insurance legislators, alongside some states, are providing guidance and model laws on the regulatory compliance of offering rebates for the sale of insurance.

Source: insurancethoughtleadership.com

Source: insurancethoughtleadership.com

Rebating began to threaten the solvency of life insurance companies and raised questions around unfair discriminatory practices. However, the fact that the statute only prohibits insurers from paying someone to refer them clients or procure clients for them is generally understood by the industry and the courts to allow an insurer to pay rebates directly to an insured or insurance applicant. Although you no doubt learned about rebating in compliance 101, it can’t hurt to review key concepts. • a gift, service, or anything of value used as an inducement to • negotiating commission with clients outside of a broker agreement.

Source: insurancejournal.com

Source: insurancejournal.com

However, the fact that the statute only prohibits insurers from paying someone to refer them clients or procure clients for them is generally understood by the industry and the courts to allow an insurer to pay rebates directly to an insured or insurance applicant. Law § 2324(a) (mckinney 1985). • a gift, service, or anything of value used as an inducement to However, the fact that the statute only prohibits insurers from paying someone to refer them clients or procure clients for them is generally understood by the industry and the courts to allow an insurer to pay rebates directly to an insured or insurance applicant. The national association of insurance commissioners and the national council of insurance legislators, alongside some states, are providing guidance and model laws on the regulatory compliance of offering rebates for the sale of insurance.

Source: stonedeanlaw.com

Source: stonedeanlaw.com

In most cases of rebating, the insurer will terminate its relationship with the agent/broker and other companies may choose to refuse to establish a relationship with an agent/broker who. At the fall 2020 national meeting of the. • a gift, service, or anything of value used as an inducement Nonetheless, regulators are catching up for better or worse. The reduction in commission would constitute either a rebate or an unlawful inducement to the making of insurance, which is prohibited by n.y.

Source: shirdihotelsaisahavas.com

Source: shirdihotelsaisahavas.com

• a gift, service, or anything of value used as an inducement to Law § 4224(c)(mckinney 1985) similarly prohibits the use of inducements to foster the sale of insurance products. The alaska division of insurance has determined that the following are violations of the rebating laws: Knowingly giving (directly or indirectly) a rebate as an inducement to purchase insurance is also an unfair trade practice in violation of rsa A few states prohibit an insured from taking a rebate from an agent or broker.

Source: stonedeanlaw.com

Source: stonedeanlaw.com

Knowingly giving (directly or indirectly) a rebate as an inducement to purchase insurance is also an unfair trade practice in violation of rsa With regard to life or accident and health insurance, n.y. Rebating began to threaten the solvency of life insurance companies and raised questions around unfair discriminatory practices. The most common types of The alaska division of insurance has determined that the following are violations of the rebating laws:

Source: freundschaft-die-in-der-liebe-einge.blogspot.com

Source: freundschaft-die-in-der-liebe-einge.blogspot.com

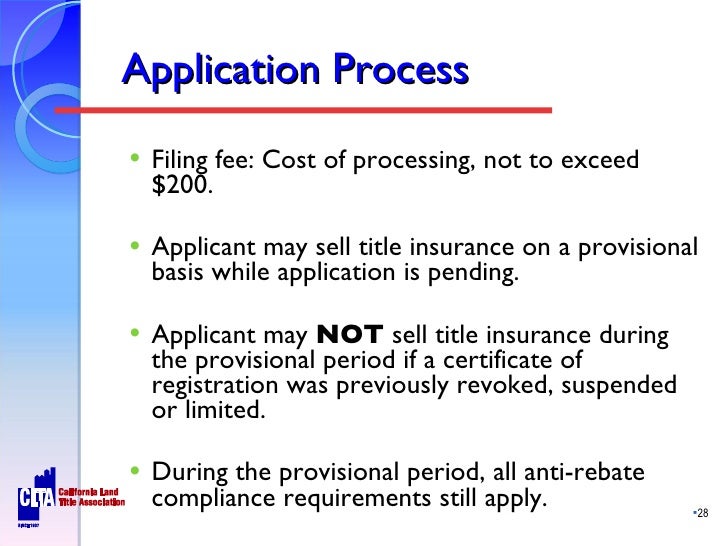

The alaska division of insurance has determined that the following are violations of the rebating laws: Some states have passed a provision of the producer licensing model act. A few states prohibit an insured from taking a rebate from an agent or broker. In most cases of rebating, the insurer will terminate its relationship with the agent/broker and other companies may choose to refuse to establish a relationship with an agent/broker who. (a) a title insurer may not make or issue a contract, policy, or guarantee of insurance except in accordance with filings approved as provided in this subtitle, except for special or unusual risks for which a filing has not yet been provided.

Source: insurancejournal.com

Source: insurancejournal.com

(a) a title insurer may not make or issue a contract, policy, or guarantee of insurance except in accordance with filings approved as provided in this subtitle, except for special or unusual risks for which a filing has not yet been provided. Law § 4224(c)(mckinney 1985) similarly prohibits the use of inducements to foster the sale of insurance products. Although you no doubt learned about rebating in compliance 101, it can’t hurt to review key concepts. The reduction in commission would constitute either a rebate or an unlawful inducement to the making of insurance, which is prohibited by n.y. Rebating is a serious violation of insurance law that not only comes with legal penalties imposed by state regulators but also various sanctions from insurance companies.

Source: eoforless.com

Source: eoforless.com

Some states have passed a provision of the producer licensing model act. Some states have passed a provision of the producer licensing model act. Rebating is a serious violation of insurance law that not only comes with legal penalties imposed by state regulators but also various sanctions from insurance companies. However, the fact that the statute only prohibits insurers from paying someone to refer them clients or procure clients for them is generally understood by the industry and the courts to allow an insurer to pay rebates directly to an insured or insurance applicant. • a gift, service, or anything of value used as an inducement

• a gift, service, or anything of value used as an inducement However, the fact that the statute only prohibits insurers from paying someone to refer them clients or procure clients for them is generally understood by the industry and the courts to allow an insurer to pay rebates directly to an insured or insurance applicant. Law § 2324(a) (mckinney 1985). The most common types of • a gift, service, or anything of value used as an inducement to

Source: cladasia.com

Source: cladasia.com

And this can land you a state insurance department fine regardless of whether your intent was innocent or not. • a gift, service, or anything of value used as an inducement The reduction in commission would constitute either a rebate or an unlawful inducement to the making of insurance, which is prohibited by n.y. And this can land you a state insurance department fine regardless of whether your intent was innocent or not. • negotiating commission with clients outside of a broker agreement.

Source: shirdihotelsaisahavas.com

Source: shirdihotelsaisahavas.com

A few states prohibit an insured from taking a rebate from an agent or broker. A few states prohibit an insured from taking a rebate from an agent or broker. At the fall 2020 national meeting of the. • negotiating commission with clients outside of a broker agreement. In most cases of rebating, the insurer will terminate its relationship with the agent/broker and other companies may choose to refuse to establish a relationship with an agent/broker who.

Source: propertyappraisalzone.com

Source: propertyappraisalzone.com

The alaska division of insurance has determined that the following are violations of the rebating laws: The alaska division of insurance has determined that the following are violations of the rebating laws: At the fall 2020 national meeting of the. (a) a title insurer may not make or issue a contract, policy, or guarantee of insurance except in accordance with filings approved as provided in this subtitle, except for special or unusual risks for which a filing has not yet been provided. Law § 4224(c)(mckinney 1985) similarly prohibits the use of inducements to foster the sale of insurance products.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title anti rebating laws insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.