Your 529 plan or whole life insurance commercial are ready. 529 plan or whole life insurance are a general that is most popular and liked by everyone this time. You can Find and Download the 529 plan or whole life insurance files here. Get all royalty-free commercial.

If you’re searching for 529 plan or whole life insurance pictures information related to the 529 plan or whole life insurance interest, you have visit the ideal blog. Our site always gives you suggestions for viewing the highest quality video and image content, please kindly surf and find more enlightening video content and graphics that match your interests.

529 Plan Or Whole Life Insurance. Bottom line as investment products, 529 plans and life insurance policies have a long list of benefits. However, they offer no downside investment risk. 529 vs whole life posted by poule deau on 7/29/13 at 2:34 pm to iknowmorethanyou quote: 529 plans have restrictive contribution limits.

Ep. 243 529 Plans, Whole Life Insurance, & Market Timing From mullooly.net

Ep. 243 529 Plans, Whole Life Insurance, & Market Timing From mullooly.net

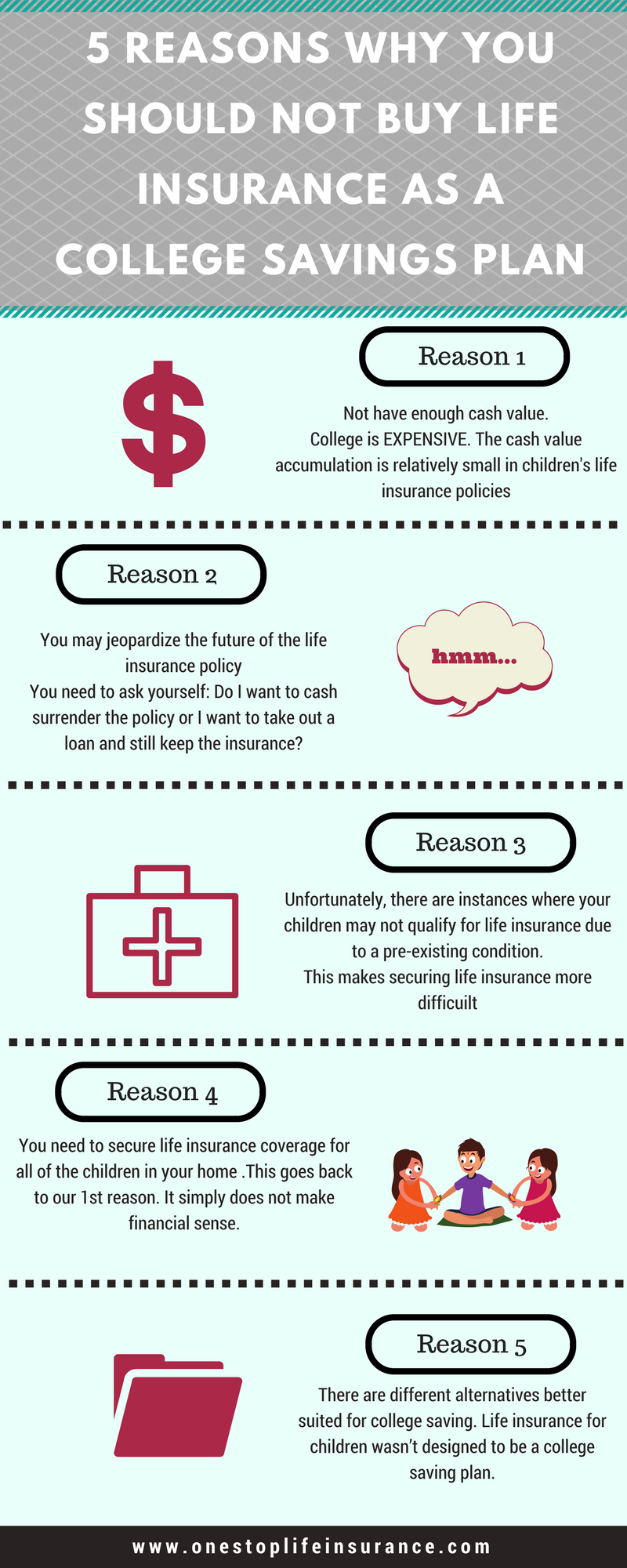

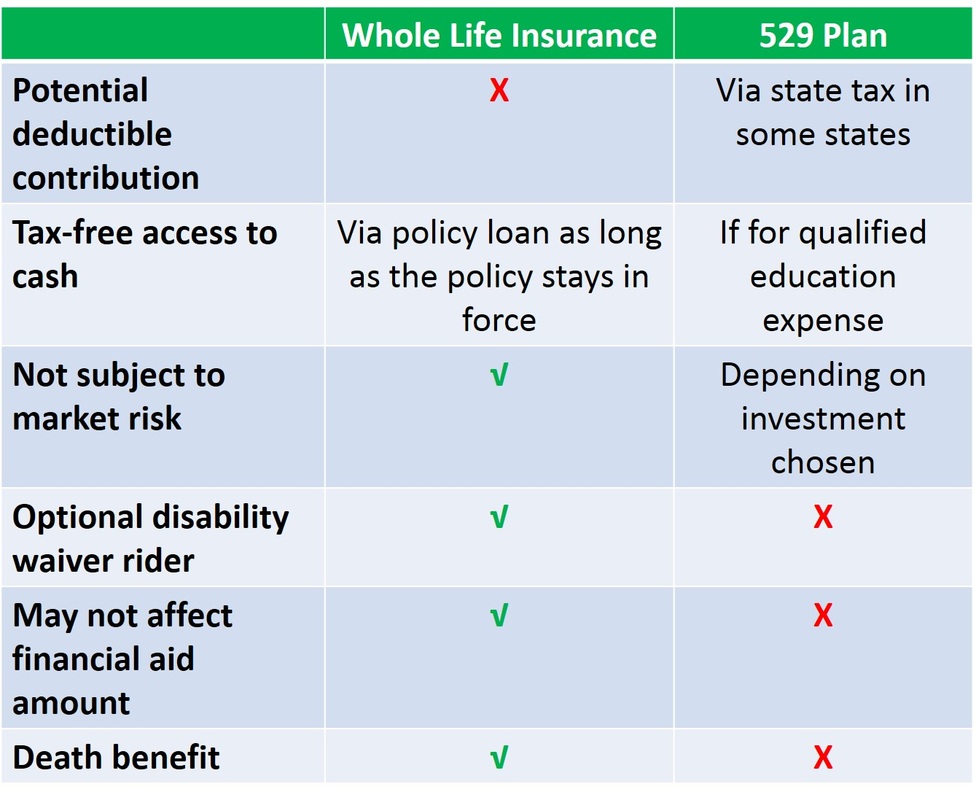

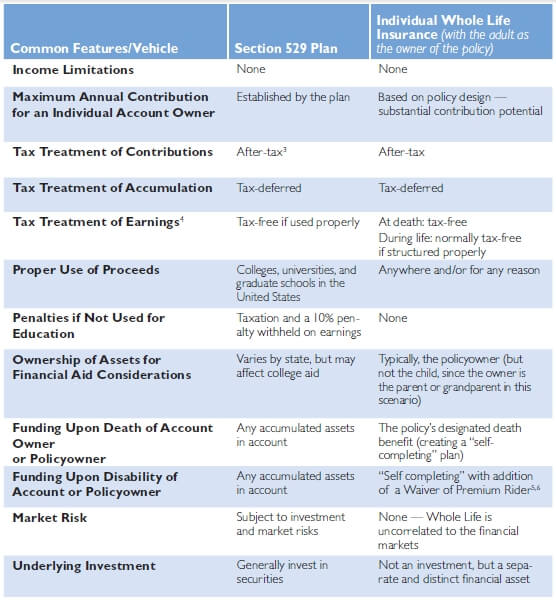

The other half suggest that whole life insurance is not ideal for the purpose of college savings and point to the 529 plan as the natural choice. Half of the resources love whole life insurance as a vehicle to save for college, and provide compelling arguments. Made it attractive by showing the cash value and death benefit many years from now with interest and dividends. If you need life insurance (and most people with young kids do) then buy a term policy—much more insurance for the dollar, and take your savings and invest it in a diversified portfolio of index mutual funds. The 529 plan also does not tax the money if it is used for education, but the money will be taxed if funds are. To maximize earnings, kuhner advises families to purchase a policy with a low death benefit and to contribute the maximum allowance.

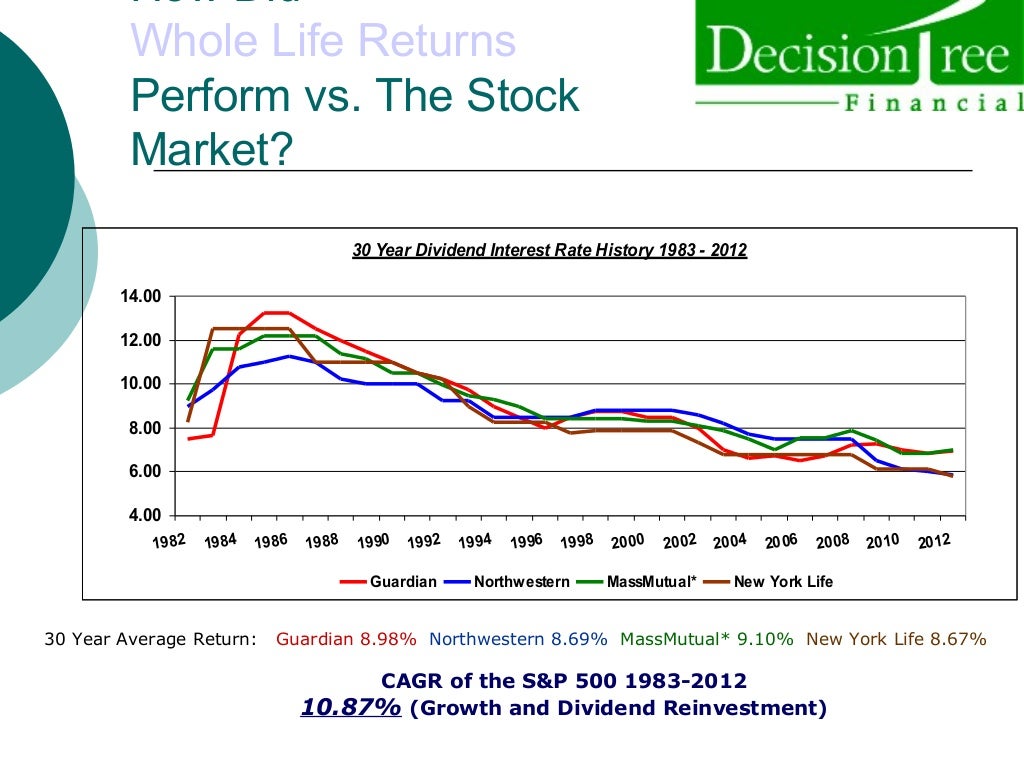

Section 529 college savings plans fluctuate with the market.

The agent i received my whole and term life policies with was trying to sell me a whole life policy for my 5 month old son for college and his future. 529 vs whole life posted by poule deau on 7/29/13 at 2:34 pm to iknowmorethanyou quote: These limits are assumed to be the maximum cost of attending college and are generally several hundred thousand dollars. Half of the resources love whole life insurance as a vehicle to save for college, and provide compelling arguments. Thus, the contract will have mortality and expense charges which are the charges to administer the policy and the costs to insure the insured. If you need life insurance (and most people with young kids do) then buy a term policy—much more insurance for the dollar, and take your savings and invest it in a diversified portfolio of index mutual funds.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

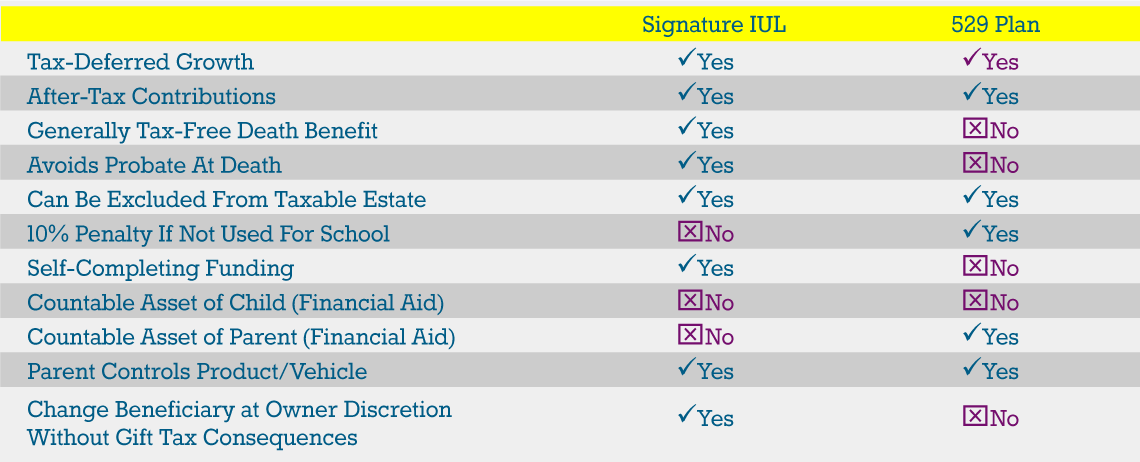

Unlike 529 plans, some life insurance policies use a tiered system when doling out returns. The more you invest, the better your return rate. The downside is that it counts as an asset when you apply for financial aid, while a life insurance policy doesn�t. If you need life insurance (and most people with young kids do) then buy a term policy—much more insurance for the dollar, and take your savings and invest it in a diversified portfolio of index mutual funds. Whole life insurance, on the other hand, has no limitations.

Source: kangqing-asdfghjkl.blogspot.com

Source: kangqing-asdfghjkl.blogspot.com

These will lower the potential returns that would otherwise be received in a 529 (hence the term “insurance drag”). Flexibility is a great asset regarding a life insurance plan. 529 plans for college savings, a 529 plan is much more likely to be a better option. 529 plans have restrictive contribution limits. There are maximum imposed limits to qualify as 529 plans.

Source: youtube.com

Source: youtube.com

These limits are assumed to be the maximum cost of attending college and are generally several hundred thousand dollars. If you need life insurance (and most people with young kids do) then buy a term policy—much more insurance for the dollar, and take your savings and invest it in a diversified portfolio of index mutual funds. 529 plans do not have “insurance drag”. Section 529 college savings plans fluctuate with the market. The agent i received my whole and term life policies with was trying to sell me a whole life policy for my 5 month old son for college and his future.

Source: westernsouthern.com

Source: westernsouthern.com

Whole life insurance, on the other hand, has no limitations. If you need life insurance (and most people with young kids do) then buy a term policy—much more insurance for the dollar, and take your savings and invest it in a diversified portfolio of index mutual funds. If a grandparent wants to make a generous. #2 whole life insurance has no contribution cap. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: slideshare.net

Source: slideshare.net

A 529 plan is a ta. Contributions you’ve made to a 529 plan. To maximize earnings, kuhner advises families to purchase a policy with a low death benefit and to contribute the maximum allowance. The downside is that it counts as an asset when you apply for financial aid, while a life insurance policy doesn�t. Half of the resources love whole life insurance as a vehicle to save for college, and provide compelling arguments.

Source: benzinga.com

Source: benzinga.com

In most circumstances, amounts paid into a whole life insurance policy will not provide as much available funds for college as the same amounts invested over the same time period in a 529 plan. The other half suggest that whole life insurance is not ideal for the purpose of college savings and point to the 529 plan as the natural choice. A whole life insurance policy is a small life insurance policy bundled with a mediocre savings plan. In this video i’m going to talk about what a 529 plan is, how 529 plans work and some alternatives to 529 plans like whole life insurance. These will lower the potential returns that would otherwise be received in a 529 (hence the term “insurance drag”).

Source: pinterest.com

Source: pinterest.com

In this video i’m going to talk about what a 529 plan is, how 529 plans work and some alternatives to 529 plans like whole life insurance. I�ve got a bushel of clients whose children got scholarships which have caused the 529 balances to remain in place. Currently, whole life insurance plans are sitting around 2% in yearly fees. 529 college saving plan vs whole life policy for my son. The agent i received my whole and term life policies with was trying to sell me a whole life policy for my 5 month old son for college and his future.

Source: mintcofinancial.com

Source: mintcofinancial.com

These limits are assumed to be the maximum cost of attending college and are generally several hundred thousand dollars. Unlike whole life insurance plans, you won’t be subject to hefty yearly fees on the accounts. Half of the resources love whole life insurance as a vehicle to save for college, and provide compelling arguments. 529 plans do not have “insurance drag”. Whole life insurance provides insurance for, you guessed it, your whole life.

I�ve got a bushel of clients whose children got scholarships which have caused the 529 balances to remain in place. Made it attractive by showing the cash value and death benefit many years from now with interest and dividends. Flexibility is a great asset regarding a life insurance plan. In most circumstances, amounts paid into a whole life insurance policy will not provide as much available funds for college as the same amounts invested over the same time period in a 529 plan. Your child can use the money to buy a home or pay for their wedding.

Source: liquidep.com

Source: liquidep.com

529 vs whole life posted by poule deau on 7/29/13 at 2:34 pm to iknowmorethanyou quote: However, they offer no downside investment risk. #2 whole life insurance has no contribution cap. Life insurance coverage or a 529 plan? Unlike whole life insurance plans, you won’t be subject to hefty yearly fees on the accounts.

Source: pinterest.com.au

Source: pinterest.com.au

The agent i received my whole and term life policies with was trying to sell me a whole life policy for my 5 month old son for college and his future. 529 plans for college savings, a 529 plan is much more likely to be a better option. A 529 plan is a ta. The 529 plan also does not tax the money if it is used for education, but the money will be taxed if funds are. These limits are assumed to be the maximum cost of attending college and are generally several hundred thousand dollars.

Source: financialresidency.com

Source: financialresidency.com

Your child can use the money to buy a home or pay for their wedding. I�ve got a bushel of clients whose children got scholarships which have caused the 529 balances to remain in place. In this video i’m going to talk about what a 529 plan is, how 529 plans work and some alternatives to 529 plans like whole life insurance. If you need life insurance (and most people with young kids do) then buy a term policy—much more insurance for the dollar, and take your savings and invest it in a diversified portfolio of index mutual funds. In most circumstances, amounts paid into a whole life insurance policy will not provide as much available funds for college as the same amounts invested over the same time period in a 529 plan.

Source: pfwise.com

Source: pfwise.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Unlike whole life insurance plans, you won’t be subject to hefty yearly fees on the accounts. When it comes to life insurance vs. These limits are assumed to be the maximum cost of attending college and are generally several hundred thousand dollars. Made it attractive by showing the cash value and death benefit many years from now with interest and dividends.

Source: legacyinsuranceagency.com

Source: legacyinsuranceagency.com

Whole life insurance, on the other hand, has no limitations. Whole life insurance provides insurance for, you guessed it, your whole life. Unlike 529 plans, some life insurance policies use a tiered system when doling out returns. One of which is a 529 plan. In this video i’m going to talk about what a 529 plan is, how 529 plans work and some alternatives to 529 plans like whole life insurance.

Source: navy-docs.blogspot.com

Source: navy-docs.blogspot.com

#2 whole life insurance has no contribution cap. 529 plans have restrictive contribution limits. 529 plans have restrictive contribution limits. Certainly, many clients are able to get more flexibility with life insurance than with a 529, whereas an insurance strategy can also offer many of the tax advantages of a 529 plan Whole life insurance provides insurance for, you guessed it, your whole life.

Source: slideshare.net

Source: slideshare.net

One of which is a 529 plan. In this video i’m going to talk about what a 529 plan is, how 529 plans work and some alternatives to 529 plans like whole life insurance. Most state plans are free each year. If you need life insurance (and most people with young kids do) then buy a term policy—much more insurance for the dollar, and take your savings and invest it in a diversified portfolio of index mutual funds. Your child can use the money to buy a home or pay for their wedding.

Source: leonardfinancialsolutions.com

Source: leonardfinancialsolutions.com

These limits are assumed to be the maximum cost of attending college and are generally several hundred thousand dollars. 529 vs whole life posted by poule deau on 7/29/13 at 2:34 pm to iknowmorethanyou quote: These will lower the potential returns that would otherwise be received in a 529 (hence the term “insurance drag”). Unlike whole life insurance plans, you won’t be subject to hefty yearly fees on the accounts. The more you invest, the better your return rate.

Source: careviva.com

Source: careviva.com

Whole life insurance, on the other hand, has no limitations. Life insurance coverage or a 529 plan? The 529 plan also does not tax the money if it is used for education, but the money will be taxed if funds are. A whole life insurance policy is a small life insurance policy bundled with a mediocre savings plan. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 529 plan or whole life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.