Your 1099 r life insurance surrender policy are available in this site. 1099 r life insurance surrender are a investment that is most popular and liked by everyone today. You can News the 1099 r life insurance surrender files here. News all free risk.

If you’re searching for 1099 r life insurance surrender pictures information linked to the 1099 r life insurance surrender topic, you have visit the right site. Our website always gives you suggestions for seeing the highest quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

1099 R Life Insurance Surrender. 1099r life insurance surrender life settlement advisors. At this point, the insurance company would issue a 1099r form. Any surrender of a policy that has a gain. Matured policies that have incurred a taxable gain.

Does An Insurance Company Get A 1099 Leah Beachum�s Template From lindeleafeanor.blogspot.com

Does An Insurance Company Get A 1099 Leah Beachum�s Template From lindeleafeanor.blogspot.com

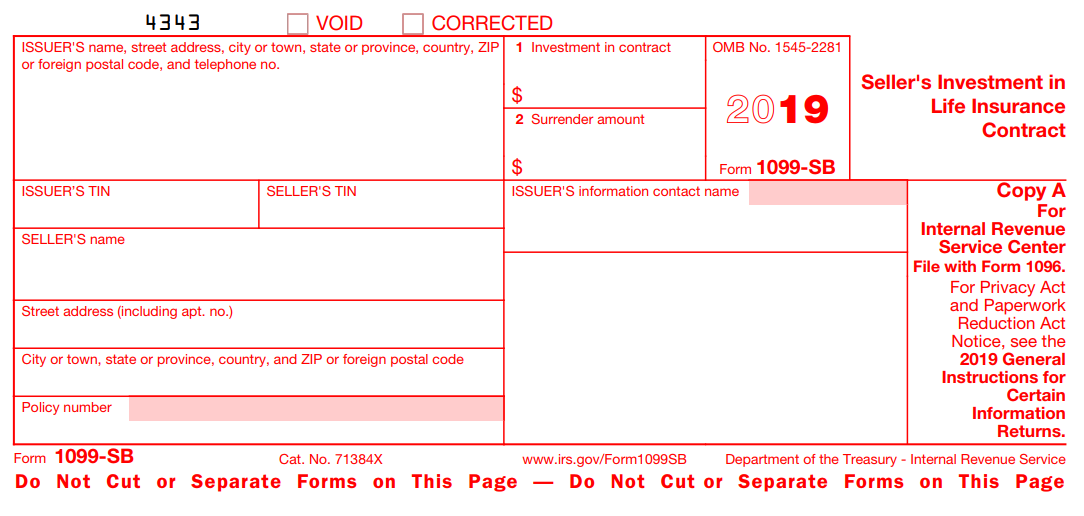

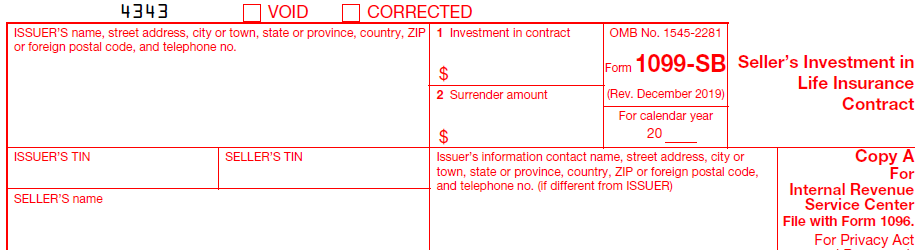

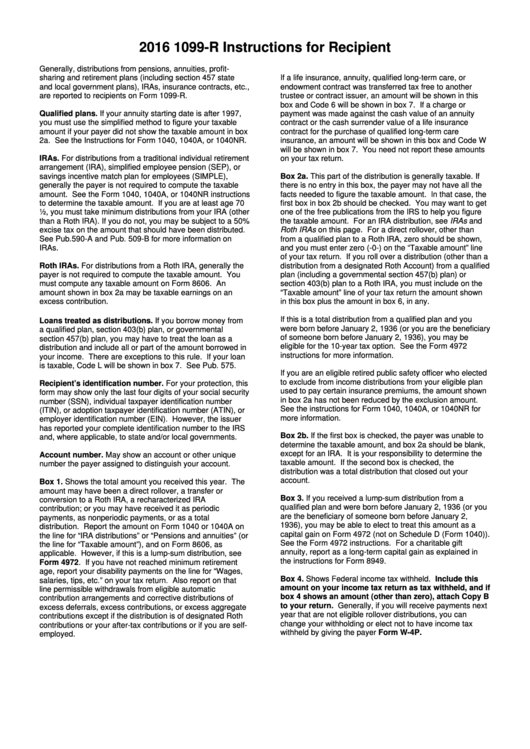

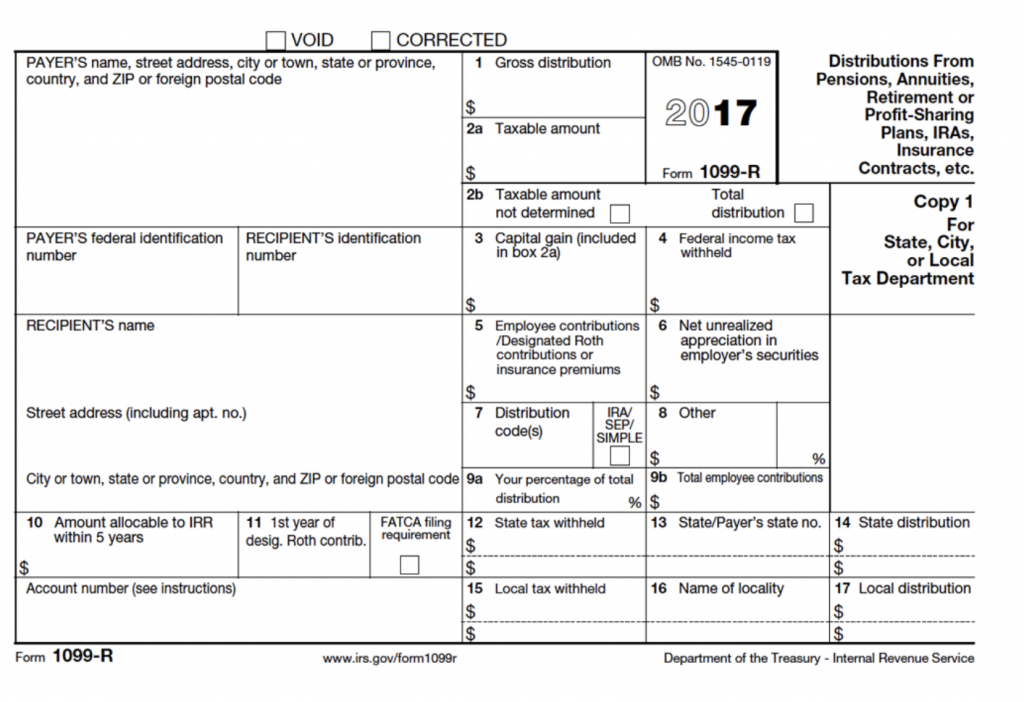

The gross amount of the distribution, taxable amount, employee contributions, tax withholding, and the distribution code are reported to the contract owner and the irs. If the cash value payout exceeds your contributions (what you paid in) the excess would be considered taxable and should be reported. From within your taxact® return (online or desktop), click federal. The only tax adviser that they paid, miller, suggested there would be a tax liability. Distributions may include (but are not limited to): If you are reporting the surrender of a life insurance contract, see code 7 , later.

If you have no gain on the payout, you don�t have.

1099r life insurance surrender life settlement advisors. Cost basis was difference in total premiums $10,000(paid by parents of taxpayer) and total dividends, $8,000. A partial surrender under a policy that has a gain, including surrenders attributable to a reduction in face amount. • surrenders • partial withdrawals If you are reporting the surrender of a life insurance contract, see code 7, later. Indicates a distribution was taken from your retirement plan, life insurance policy or annuity.

Source: keikaiookami.blogspot.com

Source: keikaiookami.blogspot.com

The taxpayer cashed out the policy in 2017 for If you cash in a life insurance policy, you must include in income any proceeds that are more than the cost of the life insurance policy. At this point, the insurance company would issue a 1099r form. If you are reporting the surrender of a life insurance contract, see code 7 , later. Life insurance policy (a mutual life ins.

Source: annuityfactor.blogspot.com

Source: annuityfactor.blogspot.com

If you surrender a life insurance policy for cash, you must include in income any proceeds that are more than the cost of the life insurance policy. Cost basis was difference in total premiums $10,000(paid by parents of taxpayer) and total dividends, $8,000. Co.) was cashed out in 2017. The gross amount of the distribution, taxable amount, employee contributions, tax withholding, and the distribution code are reported to the contract owner and the irs. If you are reporting the surrender of a life insurance contract, see code 7,.

Source: eagle-lifeco.com

If you have no gain on the payout, you don�t have. Lapse of a loaned policy that has a gain. Cost basis was difference in total premiums $10,000(paid by parents of taxpayer) and total dividends, $8,000. Box 1 shows the total amount you received from the insurance company ($250,000). Any surrender of a policy that has a gain.

Source: wiki.1099pro.com

Source: wiki.1099pro.com

If the cash value payout exceeds your contributions (what you paid in) the excess would be considered taxable and should be reported. A partial surrender under a policy that has a gain, including surrenders attributable to a reduction in face amount. From within your taxact® return (online or desktop), click federal. Cost basis was difference in total premiums $10,000(paid by parents of taxpayer) and total dividends, $8,000. Co.) was cashed out in 2017.

Source: sec.gov

Source: sec.gov

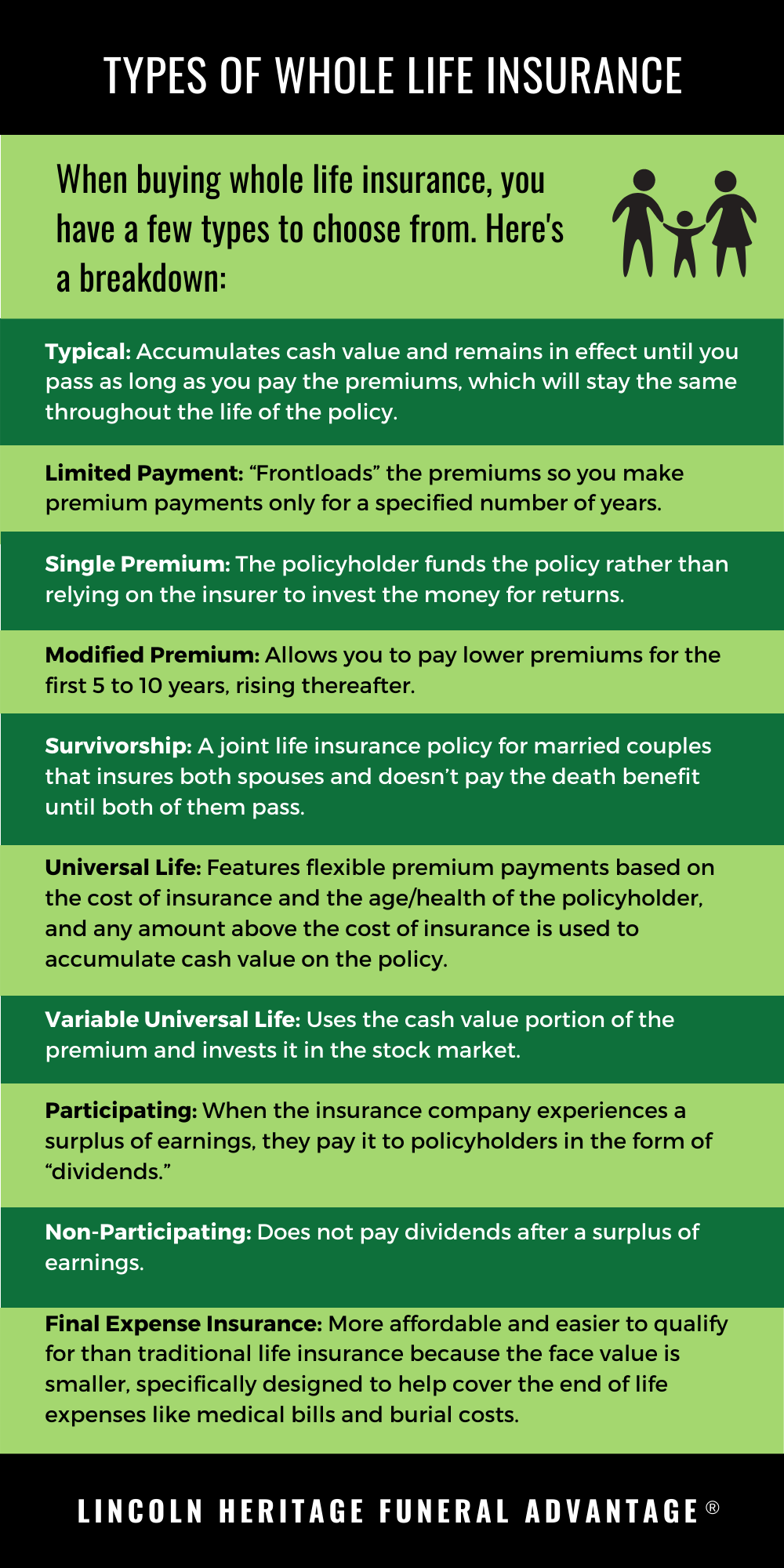

If the cash value payout exceeds your contributions (what you paid in) the excess would be considered taxable and should be reported. If you surrender a life insurance policy for cash, you must include in income any proceeds that are more than the cost of the life insurance policy. Lapse of a loaned policy that has a gain. If you cash in a life insurance policy, you must include in income any proceeds that are more than the cost of the life insurance policy. Life insurance policy surrendered for cash.

Source: chooseinsuranceonlinecom.com

Source: chooseinsuranceonlinecom.com

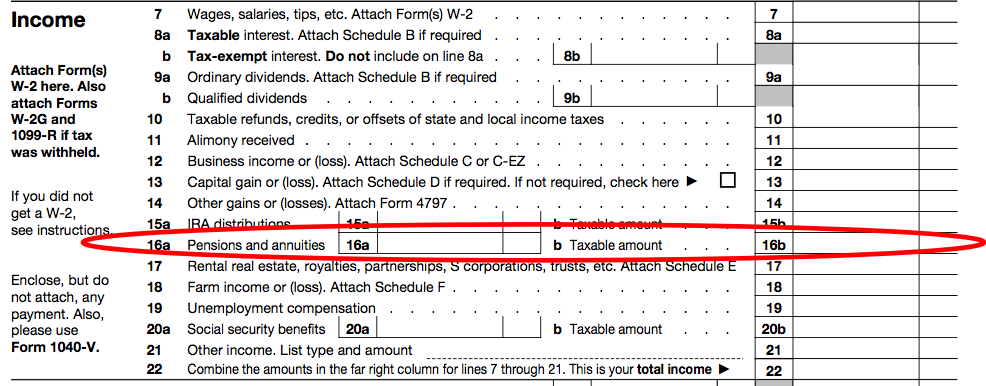

Report these amounts on lines 16a and 16b of form 1040 or on lines 12a and 12b. A partial surrender under a policy that has a gain, including surrenders attributable to a reduction in face amount. The taxpayer cashed out the policy in 2017 for If you have no gain on the payout, you don�t have. From within your taxact® return (online or desktop), click federal.

Source: 1099fire.com

Source: 1099fire.com

Report these amounts on lines 16a and 16b of form 1040 or on lines 12a and 12b. Life insurance policy surrendered for cash. Report these amounts on lines 4a and 4b of form 1040. Lapse of a loaned policy that has a gain. • surrenders • partial withdrawals

Source: annuitiestodays.blogspot.com

Source: annuitiestodays.blogspot.com

Lapse of a loaned policy that has a gain. Any surrender of a policy that has a gain. 1099r life insurance surrender life settlement advisors. If you are reporting the surrender of a life insurance contract, see code 7,. Life insurance policy (a mutual life ins.

Source: forbes.com

Source: forbes.com

If you have no gain on the payout, you don�t have. Indicates a distribution was taken from your retirement plan, life insurance policy or annuity. If you have no gain on the payout, you don�t have. To report the proceeds from a policy surrendered for cash: The taxpayer cashed out the policy in 2017 for

Source: formsbank.com

Source: formsbank.com

Cost basis was difference in total premiums $10,000(paid by parents of taxpayer) and total dividends, $8,000. Report these amounts on lines 4a and 4b of form 1040. If you cash in a life insurance policy, you must include in income any proceeds that are more than the cost of the life insurance policy. • surrenders • partial withdrawals Co.) was cashed out in 2017.

Source: lindeleafeanor.blogspot.com

Source: lindeleafeanor.blogspot.com

• surrenders • partial withdrawals Life insurance policy surrendered for cash. If you surrender a life insurance policy for cash, you must include in income any proceeds that are more than the cost of the life insurance policy. Matured policies that have incurred a taxable gain. 1099r life insurance surrender life settlement advisors.

Source: lsa-llc.com

Source: lsa-llc.com

Indicates a distribution was taken from your retirement plan, life insurance policy or annuity. Indicates a distribution was taken from your retirement plan, life insurance policy or annuity. Life insurance policy (a mutual life ins. Insurance companies are required to send these forms out whenever something happens to trigger it, like a full surrender of a life insurance. If you are reporting the surrender of a life insurance contract, see code 7, later.

Source: us.dujuz.com

Source: us.dujuz.com

If you cash in a life insurance policy, you must include in income any proceeds that are more than the cost of the life insurance policy. The only tax adviser that they paid, miller, suggested there would be a tax liability. Co.) was cashed out in 2017. If the cash value payout exceeds your contributions (what you paid in) the excess would be considered taxable and should be reported. Report these amounts on lines 4a and 4b of form 1040.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

To report the proceeds from a policy surrendered for cash: The gross amount of the distribution, taxable amount, employee contributions, tax withholding, and the distribution code are reported to the contract owner and the irs. Indicates a distribution was taken from your retirement plan, life insurance policy or annuity. Box 1 shows the total amount you received from the insurance company ($250,000). Life insurance policy surrendered for cash.

Source: kangrohman-agusmunawar.blogspot.com

Source: kangrohman-agusmunawar.blogspot.com

The gross amount of the distribution, taxable amount, employee contributions, tax withholding, and the distribution code are reported to the contract owner and the irs. If you are reporting the surrender of a life insurance contract, see code 7 , later. A partial surrender under a policy that has a gain, including surrenders attributable to a reduction in face amount. Report these amounts on lines 16a and 16b of form 1040 or on lines 12a and 12b. Life insurance policy surrendered for cash.

Source: everquote.com

Source: everquote.com

The only tax adviser that they paid, miller, suggested there would be a tax liability. Lapse of a loaned policy that has a gain. Report these amounts on lines 4a and 4b of form 1040. Life insurance policy (a mutual life ins. Co.) was cashed out in 2017.

Source: kikavagyok.blogspot.com

Source: kikavagyok.blogspot.com

Indicates a distribution was taken from your retirement plan, life insurance policy or annuity. If you are reporting the surrender of a life insurance contract, see code 7,. Report these amounts on lines 4a and 4b of form 1040. Report these amounts on lines 16a and 16b of form 1040 or on lines 12a and 12b. If you have no gain on the payout, you don�t have.

Source: lsa-llc.com

Source: lsa-llc.com

If the cash value payout exceeds your contributions (what you paid in) the excess would be considered taxable and should be reported. 1099r life insurance surrender life settlement advisors. Cost basis was difference in total premiums $10,000(paid by parents of taxpayer) and total dividends, $8,000. Co.) was cashed out in 2017. Report these amounts on lines 16a and 16b of form 1040 or on lines 12a and 12b.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 1099 r life insurance surrender by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.